Online retail sales growth slowed in May following a fairly strong April

Insight

The Bank of Canada rose 50bps, the sixth consecutive increase, and took the target rate to 4.25%.

US yields are lower across the curve and the DXY weaker. US unit labour costs helped the case for easing inflation pressures at the margin, while comments from Russian President Putin noting the country will defend itself and its allies with ‘all means necessary’ added some haven demand. The Bank of Canada opted for 50bp, raising he target rate to 4.25%, but opened the door to a potential pause in January. There was further movement away from zero Covid in China, with more limits on local officials’ discretion to lockdown areas and more at-home quarantine, while Chinese trade data was weaker than expected.

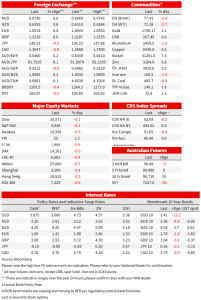

US yields were lower across the curve. The 2yr yields was down 11bp to 4.25% to be back below levels at the end of last week, while the 10yr was 12bp lower 3.41% as investors continued to weigh concern around the activity outlook and firming confidence inflation is past its peak against the policy makers stated intention of higher for longer policy rates. Fed pricing for a peak in May was 5bp lower at 4.92, while end 2023 pricing fell further, down 13bp to 4.41%. Adding some support was US Q3 unit labour costs rising 2.4%, significantly lower than the 3.1% increase expected and a material slowing from the 6.7% gain recorded in Q2. In Europe, German 10yr bunds were 2bps lower at 1.78%. Adding to the risk off tone and some haven demand for bonds was Russian President Putin noting the country will defend itself and its allies with ‘all means necessary’ and stopping short of pledging not to use atomic weapons first in a conflict.

Equities, in contrast had a choppy session, moving in and out of gains through the day and currently little changed. The S&P500 0.1% lower, while the Nasdaq so far further in the red at -0.5%. In Europe, the Euro Stoxx 50 was 0.5% lower.

The Bank of Canada rose 50bps, the pick of a very slim majority of analysts, with expectations split between 25 and 50bps. In the event, the 50bp from the BoC was the sixth consecutive increase and took the target rate to 4.25%. Although opting for the larger move, the statement said that “Governing Council will be considering whether the policy rate needs to rise further to bring supply and demand back into balance and return inflation to target. ” That was the first major change to language on future hikes since the BoC began lifting rates as the Council opened the door to a pause at its next meeting. The Bank said upward price pressure may be losing momentum even though inflation ‘is still too high and short-term inflation expectations remain elevated.’ There are two monthly inflation prints before the next decision on 25 January. The 2yr yield in Canada was lower ahead of the decision on the lead from US rates, but jumped higher on the announcement and was just 2bp lower at 3.77. The more dovish communication another factor weighing despite market pricing putting more weight on a smaller 25bp move ahead of the decision.

The US dollar was softer overnight, down 0.5% on the DXY and softer against all G10 currencies. The AUD and NZD were towards the top of the pack, each gaining 0.6%. The AUD is back up to 0.6730 around its highs for the day. The EUR was 0.4% higher to 1.0514, while the dollar lost 0.5% against the yen to 136.22. German industrial production fell just 0.1% in October , less than the -0.6% expected and with upward revisions to prior data further evidence of a smaller hit from the energy shock than feared. Final Q3 estimates for EU GDP and employment both came out a touch better than initial estimates.

The flow of headlines on China reopening continues. The latest shift taking the form of 20 new guidelines including limits to local officials’ power to shut down entire city blocks and allowing cases with mild or no symptoms and close contacts to isolate at home instead of in a quarantine facility. Bloomberg reported that officials are debating an economic growth target for next year of around 5%, with some seeing a higher target as helpful in shifting the focus away from covid controls towards boosting the economy.

There was a knee-jerk move higher in Chinese stocks on the news, with the Hang Seng up as much as 1.5% intraday and the CSI 300 close to 1%, but the initial reaction reversed with the Hang Seng down 3.2% on the day and the CSI 300 down 0.25%. Further easing of Covid restrictions had been priced in over recent weeks, while the speed of adjustments to policy settings raises concerns about disruptions from the first wave of infections and ongoing containment measures. While reported covid cases have been falling since late November, that could be attributable to reduced mass testing. The WSJ reports more than 2m people remain in quarantine and that 42,000 areas are now designated ‘high risk’ according to the People’s Daily, up from 32,000.

Also weighing on the activity outlook was weaker than expected China trade data. Chinese exports fall a sharp 8.7% y/y, down from -0.3% y/y against -3.9% expected. While the virus disruptions play a role, the drop in exports also reflects softer global demand as export demand for Chinese exports turns from a support to a headwind for Chinese activity. Import growth also dropped from -0.7% to -10.6%, lower than consensus for -7.1% y/y.

Australian GDP data yesterday rose 0.6% q/q and 5.9% y/y, slightly below consensus for a 0.7% gain. The detail confirmed strong activity and broad-based inflation pressures in the third quarter with growth in the quarter led by household consumption growth, up 1.1% and supported by recovering services activity. GDP is now 6.5% above pre-pandemic levels – stronger than most major economies. The income side of the accounts is in greater-than-usual focus with the RBA closely watching the evolution of labour costs and earnings. Compensation of employees was 3.2% higher in the quarter and most of that came through earnings, with average earnings per hour up 2.6% q/q, well outpacing the RBA’s expectations.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.