A private sector improvement to support growth

Insight

China vaccination push sees Hang Seng gains extended to 5%+ by the close

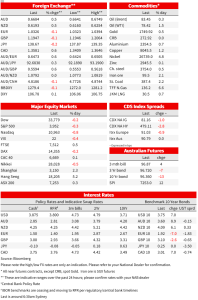

Not a particularly big night across markets, the standout being a significantly re-pricing (lower) in December ECB meeting rates expectations, after both German and Spanish November CPI surprised to the downside ahead of tonight’s pan-Eurozone figurers. This hasn’t harmed the Euro though amid a very flat overall USD performance. AUD and NZD are still the two best performing G10 FX pairs, albeit well back from their highs, earlier gains coming alongside significant re-strengthening in the RMB and the 5%+ close for the Hang Seng index. This is on hopes that weekend protests and the economic harm being caused by current restrictions will hasten not harm prospects for a transition away from China’s zero covid policy in coming months. The announcement yesterday evening our time of a new push to persuade elderly Chinese citizens to get their covid booster shots is seen to be validating this view, as too Beijing reportedly blaming local authorities for excessive covid restrictions. These currently see more of China’s GDP impacted by lockdowns and travel restrictions than was the case earlier this year during the Shanghai (and elsewhere) covid infection surge – 25% now versus 21% then, according to one report in the FT.

The news during our day yesterday of a 3pm Beijing time press briefing from China’s health authorities prompted a strong intra-day turnround in the AUD (from sub-0.6650 to above 0.67), a move which was validated by the announcement of a push to persuade more of China’s elderly populace to get their covid booster shots . To date, only 69% of those over 60 have reportedly had boosters, and only about 40% of those over 80. How successful the push will be remains to be seen given a known high vaccine hesitancy rate among the elderly. But a shift in the official narrative about vaccinations (as well – still to come perhaps – about the severity of the health risks posed by covid itself, especially for those that are vaccinated) was always going to be a significant staging post along the route to a ’living with covid’ state in China. Hopes that this can be achieved no later than next Spring have been bolstered by these latest announcements, hence the closing gain of 5.25% in the Hang Seng.

In FX the big G10 underperformer overnight has been the CAD, off more than 1%at one point (seeing AUD/CAD back above 0.91 and to its best levels since mid-June). This after its October GDP data showed growth stagnating (0.0%) in October according to StatsCan, alongside (better than expected) 2.9% annualised growth in Q3. The bigger story though is CNH extending its local session gains, USD/CNH now sub-7.14, and while AUD and NZD are well back from their European session highs of 0.6749 and 0.6254, they are still the two top performing G10 currencies of the last 24 hours, both currently +0.6% on Tuesday’s NY close.

The EUR was little impacted by significant downside CPI surprises in German and Spanish CPI, unlike the Euro rates market where pricing for the ECB’s Refi rate out of the 15 December meeting came in from 66bps to 56bps. As flagged by earlier state figures, Germany’s November CPI came in at -0.5% against the -0.2% consensus for a fall in the annual rate to 10.0% from 10.4% (10.4% expected). Spain printed an even bigger downside surprise , at 6.8% down from 7.3% and a rise to 7.4% expected. This should mean today’s pan-Eurozone figures print well south of the 10.4% earlier consensus.

In contrast to the reduction in ECB December rate hike pricing, BoE pricing has lifted from 57bps to nearer 60bps for the 15 December meeting. This after (now routinely) hawkish comments from MPC member Catherine Mann, who said she is worrying increasingly about “increasingly embedded” inflation expectations that she says are drifting towards 4% and double the 2% target. Governor Bailey was also testifying Tuesday, noting that the labour market is much more constrained than it had expected and different to other countries (a clarion call for the need to increase immigration if ever there was one). GBP is little changed against the USD, but over 0.5% softer against the AUD.

The main US data release was the Conference Board’s Consumer Confidence index, which at 100.2 from 102.2 was trivially different from the 100.0 expected, the decline led both the Present Situation sub-index (137.4 from 138.7) and Expectations (75.4 from 77.9). Also released, the S&P Case Shiller September (20-City) House price index showed a 1.24% monthly fall, though prices are still up 10.4% on a year ago (but down from 13% in August).

Bond markets are showing contrasting fortunes, benchmark Eurozone yields down 6-7bps at 10 years post the CPI data (gilts a lesser 2.5bps) while US treasures are up 4bps at 2-years and 7bps at 10s – this ahead of a keenly awaited speech from Fed chair Powell early tomorrow morning our time.

Coming into the last hour of NYSE trade, US stocks are showing modest losses (S&P500 -0.4%, NASDAQ-0.7%). This after the aforementioned 5.25% gain for the Hang Seng Tuesday and a narrowly mixed performance from European equities.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.