We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

There were no significant market moves overnight.

https://soundcloud.com/user-291029717/consolidating-and-vaccinating?in=user-291029717/sets/the-morning-call

“I will run for shelter; Endless summer lift the curse; It feels like nothing matters; In our private universe”, Crowded House 1993

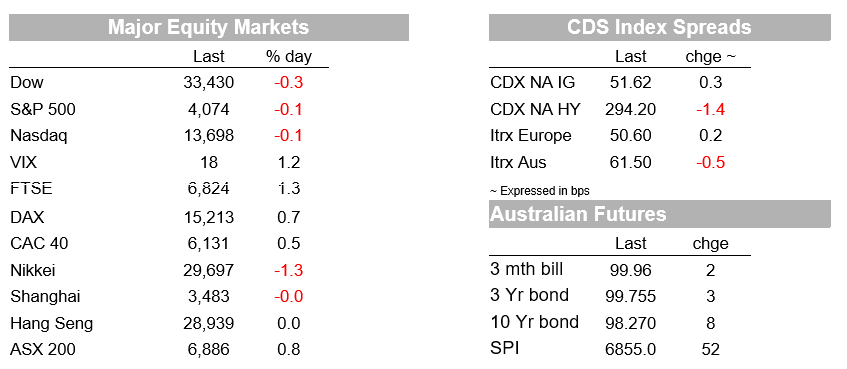

The Australia-NZ travel bubble got airline stocks racing yesterday with QANTAS +3.2% and Air NZ +5.8%. The moves down under also helped lift airline stocks globally as equity markets continue to tilt towards cyclicals with the FTSE airline sub-index +2.5% and the S&P500 airline sub-index +1.6%. Outside of those moves there has been little news overnight and US equities overall consolidated near their recent highs (S&P500 -0.1%), while European equities played catchup from their Easter holidays with the EuroStoxx 600 +0.7% to a record high.

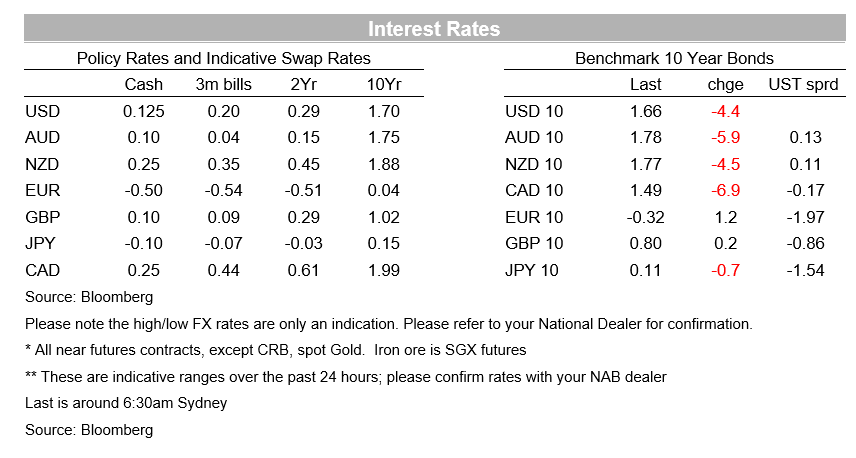

Yields have mostly drifted lower led by the belly with US 5yr yields -5.1bps to 0.87%; 10yr yields -4.6bps to 1.65%. There was no news behind the moves so positioning could be the driver, though it could also signal the recent bond selloff has run out of puff given yields have tracked lower following a trifecta of strong data over recent days – namely US employment and the ISM Manufacturing and Services Indices. Interest-rate swaps have also pared back their pricing for Fed hikes, now around 20bps is priced for the December 2022 FOMC meeting vs 28bps on Monday.

Data flow was light with the IMF upgrading its global growth forecasts from three months ago as largely expected. The IMF now expects global growth of 6.0% this year (previously 5.5%) and 4.4% next year (previously 4.2%) (see IMF WEO for details ). The IMF was particularly bullish on the US, with growth driven by massive fiscal stimulus. It was noted that next year the US will be the only large economy to surpass the level of output it would have had in the absence of the pandemic. The IMF also noted that most advanced economies will emerge from the pandemic with little lasting damage, thanks to the rapid rollout of vaccines and governments’ willingness to increase sharply public spending and borrowing.

The US also had JOLTS data out which was better than expected at 7.367m against 6.900m expected. Although not market moving, it is worth noting the level of job openings is the highest since November 2018. The ratio of job openings to unemployed is now at 74%. Also in US news the vaccine rollout continues to progress with President Biden re-stating he wants all American adults to be eligible for a vaccine by April 2019. Many US states are also announcing dates when they expect to fully re-open with California the latest and flagging by 15 June.

Earlier and getting some airplay in China yesterday was an article published in the FT over the Easter break which reported that “China’s central bank has asked lenders to rein in credit supply, as the surge of lending that sustained the country’s debt-fuelled coronavirus recovery renewed concerns about asset bubbles and financial stability. ” Sources suggested that after the 16% growth in new loans in January/February, the PBoC had instructed banks to keep new loans in Q1 at the same level or lower than last year. Acting as some counter to this yesterday was the better than expected Caixin Services PMI which rose to 54.3 against 52.1 expected. However, since then are reports the US may boycott the Winter Olympics that are due to be held in Beijing in February 2022.

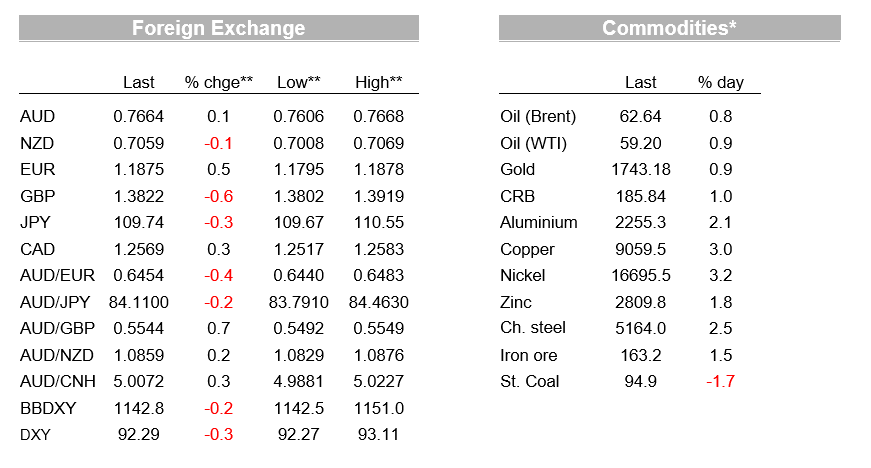

In FX, the USD fell with DXY -0.3% with EUR +0.5% and outperforming, while GBP (-0.6%) has underperformed. There haven’t been any obvious fundamental causes of this move, so it could well be flow driven as the new month starts. There has also been mixed performance by commodity currencies, with CAD (USD/CAD +0.3%) and NZD (-0.1%) falling, while AUD (+0.2%) has pushed higher.

Finally in Australia, the RBA Meeting yesterday gave little further guidance on the outlook with the post-meeting Statement repeating the familiar lines that the Board does not expect the conditions for a rate hike “…to be met until 2024 at the earliest ”. These conditions are that actual inflation is sustainably within the 2-3% target, which requires materially faster wages growth. There was also no comment on whether to extend the 3yr YCC target from the April 2024 bond to the November 2024 with the RBA again repeating that a decision will be made “later in the year”. On QE, the Bank reiterated that it was prepared to do more (QE) after the second $100bn round ends in September, while the language around this was a bit more definitive, flagging the willingness to do more if it “would assist with progress towards the goals of full employment and inflation”.

As for references to recent house price dynamics, the Statement reinforced the RBA/APRA view of not targeting house prices, but rather their focus being on lending standards (“monitoring trends in housing borrowing carefully and it is important that lending standards are maintained”). APRA Chair Byers last week noted that “at an aggregate level, lending statistics do not show major signs of a return to higher risk lending ”, which suggest no near-term tightening in macro-prudential regulations despite extensive media speculation. We may learn more on the RBA’s thinking on housing in Friday’s semi-annual Financial Stability Review.

A quiet day for Australia with only a smattering of second-tier data. It is also quiet offshore with only final versions of the Markit Services PMIs, while the US has the FOMC Minutes and a few Fed speakers. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.