We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Yields are generally lower globally as the earlier run up in expectations for central bank tightening are pared a little further. A hike of ‘only’ 50bp from the BoC helping that sentiment.

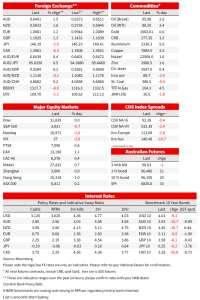

Yields are generally lower globally as the earlier run up in expectations for central bank tightening are pared a little further. A hike of ‘only’ 50bp from the BoC helping that sentiment. The US dollar is softer against all G10 currencies, losing 1.1% on the DXY and tech stocks are lower after disappointing earnings from Microsoft and Alphabet late Tuesday. Meta, reporting after the bell, also disappointed expectations. The S&P500 is 0.7% despite mixed results elsewhere and after spending some time in positive territory after the BoC decision.

First to the Bank of Canada, which raised rates by 50bp to 3.75%, disappointing market pricing and most economists’ predictions for a 75bp move. The move followed 100bp in and 75bp in the previous two meeting and means the BoC has hiked 350bp in 7 months. The statement reiterated that “we are resolute in our commitment to restore price stability” and that inflation remains broad based, with data showing no “meaningful evidence” that underlying price pressures are easing. That said, Governor Macklem noted that “this tightening phase will draw to a close. We are getting closer, but we aren’t there yet. ” Updated forecasts see the economy slowing sharply in coming months and inflation falling sharply to below 3% by the end of next year. Yields in Canada were sharply lower. The Canadian 2yr yield fell 27bp to 3.88% and the 10yr was 19bp lower at 3.29%. Yields were also generally lower globally. The US 10yr is down 9bp to 4.01%, while the German 10yr yields is 6bp lower at 2.11%.

The downshift at the Bank of Canada has further fanned the winds of a similar move by the Fed come December and comes after the RBA slowed the pace of hikes to 25bps at its October meeting. In Australia’s case and following an upside surprise in Q3 CPI data yesterday, the AFR’s Kehoe writes that “with the benefit of hindsight on the latest quarterly inflation figure, the RBA board may feel some regret about slowing the pace of hikes. ” The data flow at the time seemed to be making a compelling case for at least one more larger hike. Higher than expected inflation data yesterday hasn’t seen much additional risk of a reacceleration to 50bp, with 29bps priced for Tuesday’s meeting, up from 27bp. Articles from the AFR’s Kehoe and WSJ’s Glynn also note it is unlikely the RBA will step back up to 50. (Australia inflation: Shock 7.3pc CPI will push the Reserve Bank to send interest rates higher (afr.com); Glynn’s Take: RBA Unlikely to Revert to Blockbuster Rate Hikes (wsj.com))

As for the Q3 CPI data, it surprised higher on the headline measure at 1.8%q/q and 7.3%y/y (consensus 1.6/7.0) and more so on the closely watched trimmed mean measure coming in at 1.8%q/q and 6.1%y/y (consensus 1.5/5.5). The detail showed the inflation drivers broadening from the earlier consumer goods and construction pick up into high and accelerating market services inflation, parts of the basket that tend to be more persistent and sensitive to domestic conditions. Higher food and utilities inflation were large contributors in the quarter. The data suggest the RBA will be upgrading its near-term inflation forecasts next week and while 50bp is likely to be discussed, 25bp looks more likely. A number of economists pushed rate forecasts higher, though towards where markets were already pricing and there was relatively little reaction in markets. Futures pricing still implies a peak cash rate of around 4.2% by mid next year.

In equity markets, the S&P500 lost 0.7%, while the Dow Jones was flat and the Nasdaq was 2.0% lower. Losses led by tech after Alphabet and Microsoft reported results on Tuesday after markets closed. Alphabet shares were 9.1% lower, their biggest daily drop since March 2020 after slowing revenue growth and the first drop in YouTube advertising sales. Microsoft shares declined 7.7% after the company reported its weakest revenue growth in more than five years and said it expects a sharp decline in personal computer sales. But declines were not broad-based, with 6 of 11 sectors in the S&P500 in the green. The Euro Stoxx 50 was 0.6% higher and Asian bourses were also up.

In currencies the US dollar continued its pull back. The DXY lost 1.1% to 109.70, its lowest level in over a month. USD depreciation was against all G10 currencies, led by NZD and AUD. The CAD, under pressure from the larger fall in Canadian yields, was just 0.3% higher against the dollar. The AUD rose 1.5% to 0.6491, briefly touching an intraday high above 65c at 0.6511.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.