A private sector improvement to support growth

Insight

AUD approaches 0.68, buoyed by China stimulus news and RMB gains

Overnight data summary:

Markets continue to display a great deal of intra-day sensitivity to the incoming global economic calendar. Hence US yields (and equities) have been supported by a much stronger than expected US consumer confidence survey while Eurozone yields have lagged the US and the EUR has fallen on a weak German IFO survey and more importantly the ECB’s Q2 bank lending survey showing further weakness in demand and tighter lending standards. The AUD meanwhile has built on local session gains to be the strongest G10 currency and coming within kissing distance of 0.68, in response to yesterday’s take on Monday’s Politburo announcements and decent gains in the Renminbi. Today it’s all about Q2 CPI in our time zone and tonight/tomorrow morning the messaging out of the latest FOMC meeting.

During our time zone yesterday, AUD was the best performing G10 currency, buoyed by a stronger CNY at the China market open. This following a daily USD/CNY fixing that came more than 500 pips stronger than implied by Monday’s closing levels and digestion of the statements issued following Monday’s Politburo meeting. The latter contained the strongest indication to date of meaningful policy stimulus in the works aimed at boosting economic activity following the dour (by Chinese standards) 0.8% Q2 GDP outcome. In particular, the Politburo pledged to increase the intensity of macro policy support, dropped prior references to housing being ‘for living not speculation’, replaced by reference to adapting to shifts in the ‘supply and demand’ characteristics of the property market and to ‘optimise property policies.’ There was also explicit reference to exchange rate stability, something that has not been evident for a couple of years. The upshot was a 0.7% drop in USD/CNY and, as of NY close, a 0.8% rally in AUD/USD to a high of 0.6795, alongside a gain of more than 4%+ for the Hang Seng, encompassing 10% jump for property sector stocks.

Also supporting AUD gains if for much the same reason, has been an across-the-board lift in commodity prices, including gains of more than 1% for copper, aluminium and iron ore and headed by a 4.7% jump in nickel. Oil meanwhile continues to build on recent gains, WTI and Brent crudes both up another 1% or so in the last 4 hours.

In sharp contrast to AUD (and other commodity linked currency) gains, EUR/USD has been the worst performing major currency, off about 0.25% at one point, losses since pared to -0.1% or so. Here, as well as a German IFO survey that modestly underperformed expectations to be below its long-term average, albeit not unexpected after Monday’s very weak German PMIs, the ECB’s Q2 lending survey showed a further weakening in loan demand. The ECB notes:

“Euro area firms’ net demand for loans decreased strongly in the second quarter of 2023 (net percentage of -42%, after -38% in the previous quarter; dropping to an all-time low since the start of the survey in 2003. The decline was again substantially stronger than expected by banks in the previous quarter. The net decrease in loan demand was the strongest since the start of the survey in 2003 for SMEs (net percentage of -40%) while the net decrease in demand for loans to large firms (net percentage of -34%) remained slightly more limited than during the global financial crisis”.

To what extent this increases the likelihood of the ECB being ‘one and done after it lifts rates by 25bps to 3.75% on Thursday remains to be seen. It may well, but in truth this is almost wholly contingent on what happens to underlying inflation developments between now and September, remembering that the ECB is not, in contrast to many other, a central bank with a dual mandate. Incidentally, the latest IMF forecasts, published overnight, show a small lift to its 2023 global growth forecast (3% from 2.8%) but contain a downward revision for Germany in contrast to upward revisions for every other G7 nation. Germany is the only G7 country now seen contracting over the whole of 2023.

In contrast to the poor German news, GBP is one of the better performing currencies after AUD, and whether a cause or not, the latest CBI trends survey showed some improvement, in both new orders and business optimism (as well as higher selling prices).

US data has resonated more in the bond and equity market than currencies, with the Conference Board’s Consumer Confidence index up by much more than expected at 117 from 110.1 (112 expected) with strong gains for both the ‘Present Situation’ (160 from 155.3) and Expectations (88.3 from 80.0). US Treasury yields were 3-4bps higher for 2s and 10s earlier in the US session but have peeled back a little late in the day, 2s currently up just 2bps to 4.88% and too 10s, to 3.89% (latter off a low of 3.73% last week). In contrast 10-year Bunds ended their day just 0.5bps up (gilts +1.3bps).

US equities were having a good day even before Alphabet’s post close results , the S&P500 finishing 0.3% and the NASDAQ 0.6%, gains for the former led by materials (1.8%) and IT (1.2%), seemingly liking the potentially ‘no landing’ message from Consumer Confidence. Post close, Alphabet’s share price is up by more than 7% after its Q2 earnings came in at $62.07bn against a $60.27bn street consensus. In contrast, Microsoft’s shares have slipped despite reporting higher than expected revenue of $56.19bn versus $55.49bn expected, investors and analysts now keenly awaiting earnings guidance on the post-results earnings call.

Coming Up

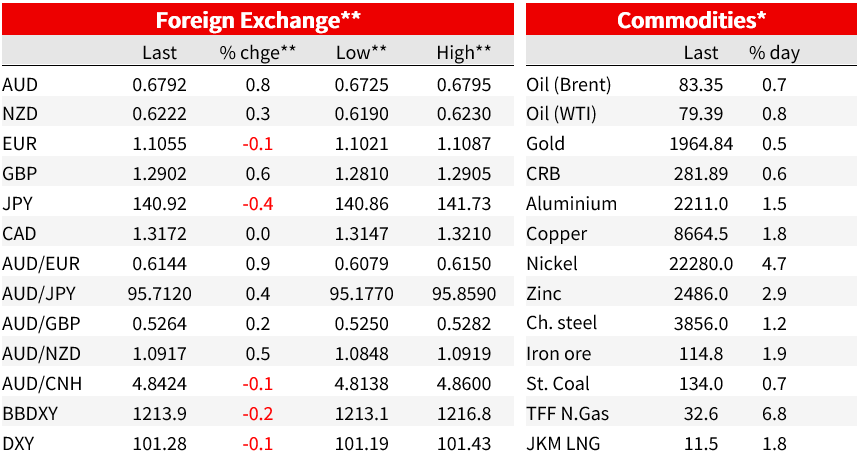

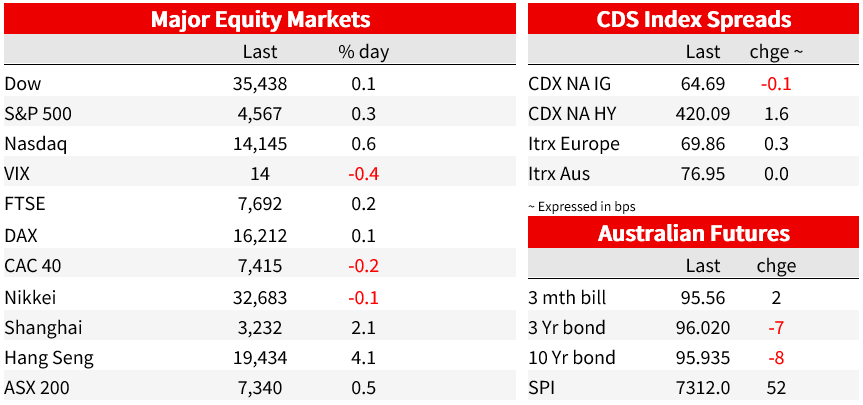

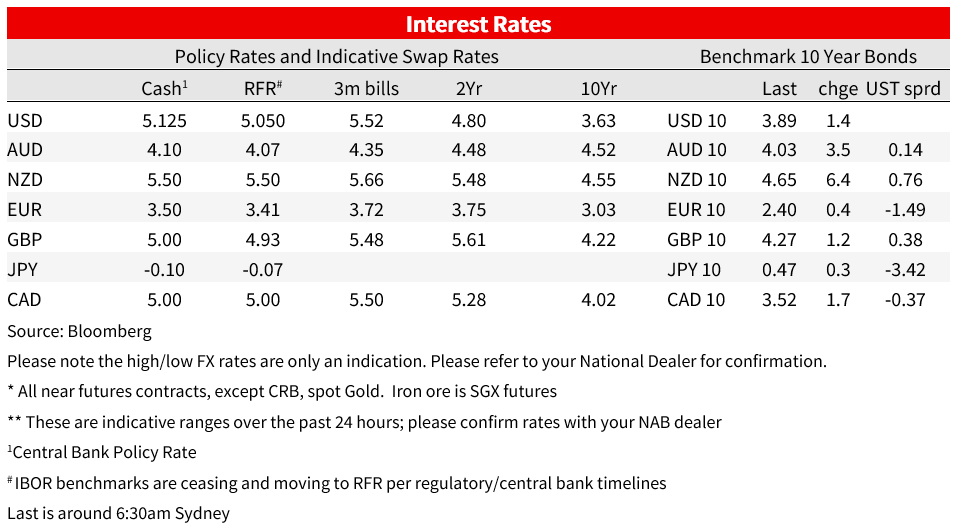

Market prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.