Economic and financial market update

Insight

Economic news flow overnight has been relatively light, though playing with the grain of the suggestion from last week’s US data (ISM Services) that the US is in process of losing its global growth leadership position.

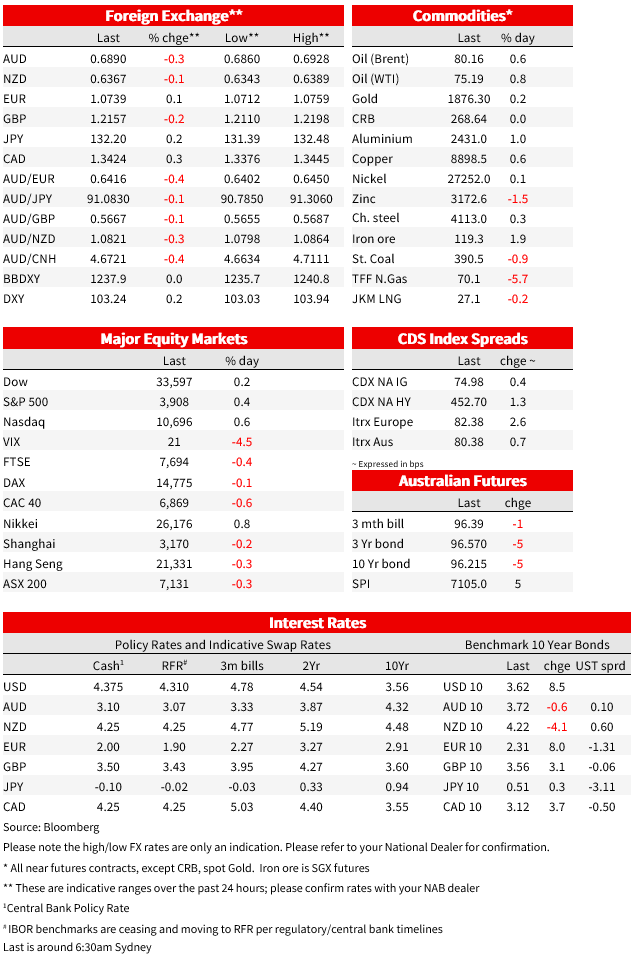

Ahead of tomorrow night’s all-important US CPI release, which comes against the backdrop of a US money market now much better positioned for a 25bps rather than 50bps Fed Funds rate rise on February 1, bond and currency markets have retraced a little of their hitherto year to date moves, though US equities are having another (modest) up day with an hour or so of the NYSE trade still to go. AUD/USD is back sub-0.69 having been a high as 0.6950 on Monday.

Economic new flow overnight has been relatively light, though playing with the grain of the suggestion from last week’s US data (ISM Services) that the US is in process of losing its global growth leadership position (or perhaps more pertinent, will be weakening just as much, or more, than most other developed economies in the first half of 2023).

The NFIB Small Business Optimism survey fell to 89.8 from 91.9, below the expected 91.5, and wholesale trade sales fell by 0.6% against a rise of 0.2% expected. On the other side of the data ledger, French industrial production rose by a much stronger than expected 2.0% and manufacturing output an even stronger 2.4% (both expected 0.8%) though Finnish and Dutch data was weaker. Overall industrial production for the Eurozone reported on Monday, was +0.2% on the month.

China published its December credit and money supply data after last night’s APAC session close, with mixed results. New Yuan (bank) loans expanded by a slightly stronger than expected ¥1.4tn. last month (¥1.2tn. expected) but Aggregate Financing was much weaker than expected at ¥1.3tn. (1.85tn expected) while M2 money supply growth slipped back to 11.8% from 12.4% in November and below the 12.3% consensus. The data highlights the dependence on (largely state owned) banks for the economic recovery the Chinese authorities are furiously intent on securing, having abandoned most of the zero covid strictures since late November amid rising social discontent.

On the central bank front, yesterday’s Riksbank symposium on central bank independence featured a star-studded cast of central banks including Fed chair Powell, in which he said that “What the Fed is doing to bring down inflation won’t be politically popular, and we know that, and that’s why we have this institutional arrangement that provides more autonomy to do our job”. The ECB’s Schnabel, speaking t the same event, said that (ECB) rate must still rise significantly and that policy must turn restrictive to fight inflation. Eurozone money markets are very well priced for +50bps on 2 February (48.5bps) while the Fed meeting the data before is currently priced for just 31bps. BoE on 2 Feb. is at 44bps and RBA on 7 February at 16bps.

In political news, US Treasury Secretary Janet Yellen has announced that she will stay in her post through the remainder of President Biden’s current term (at his request). This as the early exchanges in the newly elected House of Representative make clear that the debt ceiling issue – that the US will need to confront by mid-year – is seen as the main point of leverage Republicans have in their quest to overturn chunks of policy measures put in place by the Biden administration in the last year or so. The House has already voted to repeal ~$80tn of additional funding for the Internal Revenue Service, but which of course won’t get through Senate, at this stage at least.

Market wise, in FX the USD is some 0.2% firmer in DXY terms relative to Monday’s NY close, led by losses of 0.2-0.3% for GBP, CHF, CAD, and JPY (EUR/USD is virtually unchanged). AUD/USD, which made a high of 0.6950 on Monday in the context of a fall in USD/CNY down through 6.80 and bringing its year -to-date fall to some 3%, is down 0.4% alongside NOK, but remains the best performing G20 currency year to date (+1.1%).

In bonds, the 2-year note received a small fillip from a well-received 2-year note action, which cleared 2bps through the 4.0% when issued yield just prior to the sale. 2s are currently still 5bps up on the day, 10s by 9bps, reducing their YTD falls to 17bps and 25bps respectively. European benchmark 10s earlier closed between 3bps (Gilts) and 7.5bps (Bunds) firmer.

US equities come into the last hour showing gains of 0.5% for the S&P500 and 0.6% for the NASDAQ4, led by gains of close to 1% in Consumer Discretionary and Communication Services stocks. European stocks earlier close with losses of 0.3-0.6%. The Hang Seng, which fell by 0.3% yesterday, remain the best performing stock market year to date, up 8%.

For further FX, Interest rate and Commodities information visit Financial markets, loans, foreign exchange, commodities – NAB. Read our NAB Markets Research Disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.