Online retail sales growth slowed in May following a fairly strong April

Insight

The uplift in US bond yields continued overnight, supporting the US dollar but not hurting equities

Overnight focus has been on incoming bank earnings, where Charles Schwab and regional bank M&T have seen their share prices up following an absence of horror stories on deposit outflows in Q1 (no worse than expected) while State Street’s share price is off 10% after reporting a 5% deposit outflow in the quarter to $224bn and expectations for another $4-5bn drain in the current quarter. The financial sub-sector of the S&P 500 is up 1.1% ahead of the 0.3% overall market rise. This has provided a little more support for the back-up in US Treasury yields in recent days, but with a much bigger kicker from the much stronger than expected Empire (New York State) manufacturing survey. This, the first of the April regional manufacturing PMIs – jumped to 10.8 from -24.6 and an expected -18.0. the USD has extended Friday’s gains with indices +0.4-0.5% though AUD/USD is steady near Monday’s local closing levels, currently at 0.6702.

The Financial Times at the moment has as its lead headline ‘Depositors pull nearly $60bn from three US banks as Apple raises pressure’, which as well as highlighting the deposit losses of 5% (Charles Schwab) 3% (M&T Bank) and 5% (State Street) notes that Apple and Goldman Sachs on Monday announced the launch of new savings accounts in the US that will pay a market-leading 4.15% interest a year (with, presumably, implications for net interest margins). Goldman reports tonight prior to the NYSE open.

Suffice to say that the focus on the hundreds of regional banks reporting in coming days will be firmly on the extent of deposit outflows relative to street expectations, before turning in early May to system-wide lending standards/credit conditions when the Fed’s Senior Loan Officers Opinion Survey (SLOOS) will be published (not until after the May 3 Fed decision, but presumably to which FOMC members will be privy beforehand).

To the data and Empire State survey is the first whose survey period post-dates SVB Bank’s failure. It shows no ill-effects either in the headline business conditions reading at 10.8 from -24.6 or some of key sub-indices where both new orders new orders and shipments hit their highest levels in 12 months. The index of six-month capital spending intentions, which rose, by 3.2 points to 16.5, might just be noise after a 7.2-point drop in April – indeed the small size of the Empire State survey makes it prone to greater volatility than other regional surveys – though a headline, again in the Financial Times, which caught our eye yesterday was that ‘US manufacturing commitments double after Biden subsidies launched’. The report notes that companies have committed more than $200bn to US manufacturing projects since Congress passed the Inflation Reduction Act last August – President Joe Biden’s effort to spark a new industrial revolution. The investment in semiconductor and clean tech investments is almost double the commitments made in the same sectors in the whole of 2021, and nearly twenty times the amount in 2019, according to data compiled by the Financial Times. Whether New York State is a beneficiary of any of this we don’t yet know.

Separately, the NAHB homebuilder sentiment index rose for the fourth straight month to 45 from 44, as expected, still low after a deep downturn (the index is up from a low of around 30 during the early stage of the pandemic and in December last year, but relative to post pandemic highs of 90. The commentary said that although credit conditions were tight, there was no evidence that the pressure on the regional bank system had worsened the lending environment for builders and developers.

Central bank speaker overnight includes Richmond Fed President Thomas Barkin who says he wants to see more evidence inflation is easing back to the Fed’s 2% goal and that the ‘economy works just fine with rates at this level’. ECB President Christine Lagarde has also been speaking at a Council on Foreign Relations event in New York where she notes that “If global value chains fragment along geopolitical lines, the increase in the global level of consumer prices could range between around 5 per cent in the short run and roughly 1 per cent in the long run.” On the currently topical issue of potential shifts towards a more multi-polar currency landscape, Lagarde said that “So far, the data do not show substantial changes in the use of international currencies…but they do suggest that international currency status should no longer be taken for granted.”

In Markets, the S&P500, Nasdaq and Dow Jones have all closed with gains of 0.3%, the former led by a 2.2% gains for Real Estate followed by the aforementioned 1.1% rise for Financials. Communications Services (-1.3%) an Energy (also -1.3%) are the laggards, where in the case of Energy both WTI and Brent crudes are off about $1.50. The stronger US dollar is being mentioned in dispatches as one culprit and too a short term overbought technical condition (including the failure to break above the 200-day moving average last week). Gold is down about 0.5% or $9 to $1,995 while non-ferrous base metals and iron ore are narrowly mixed.

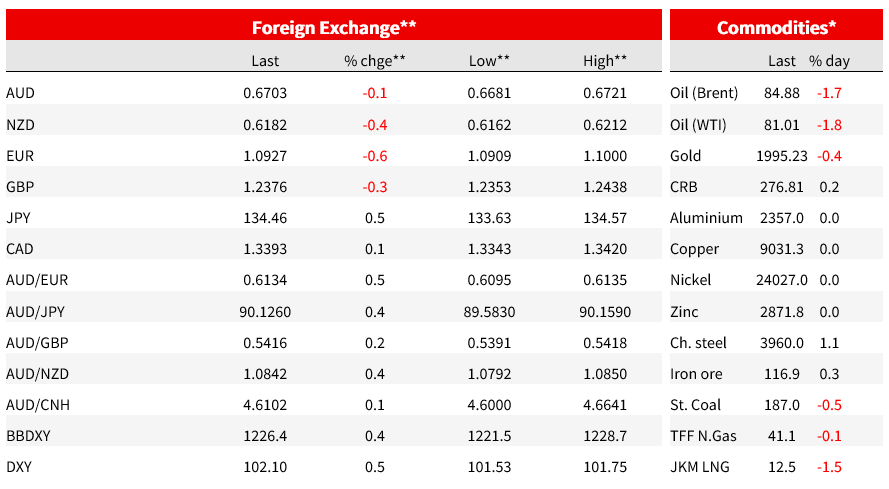

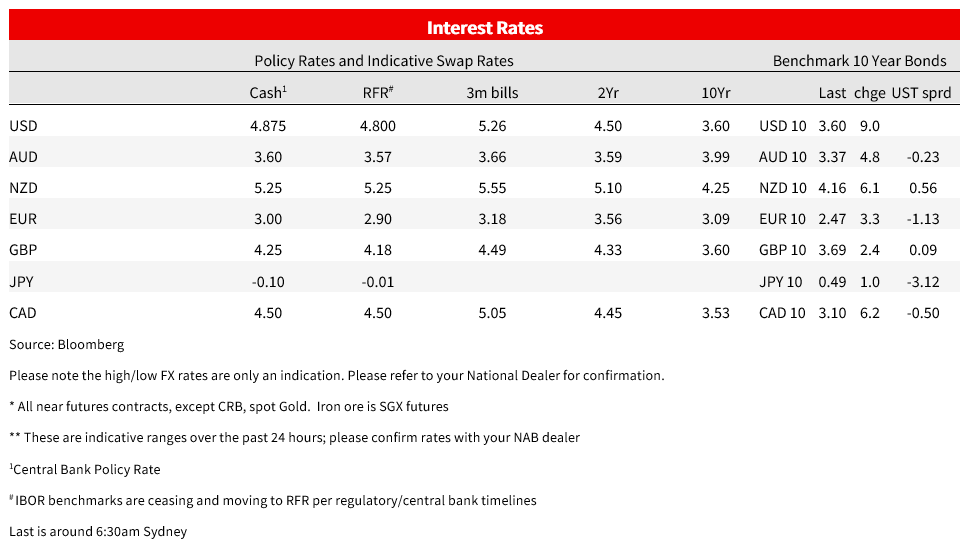

Bonds are ending the New York day with a fairly level shift up in the Treasury yield curve (2s +9bps to 4.19%, 10s +8bps to 3.60%) and which follows earlier rises of 1-3bps for 10-year benchmarks in Europe. In FX, the USD’s recovery after last Friday morning’s flirtation with new 1-year lows in DXY index terms is continuing, aided by the rise in Treasury yields, DXY +0.5% and the broader BBDXY +0.4%. NOK is faring worst in G10 with the oil prices drop (-0.9%) and AUD the best (off just 0.06% and holding on to the 0.67 handle). The AUD/NZD move up off its April 5 post RBNZ/RBA meeting lows is continuing, up another 0.3% in the last 24 hours to 1.0840. GBP, NZD, JPY and EUR are all off by between 0.3% and 0.6%.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.