Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

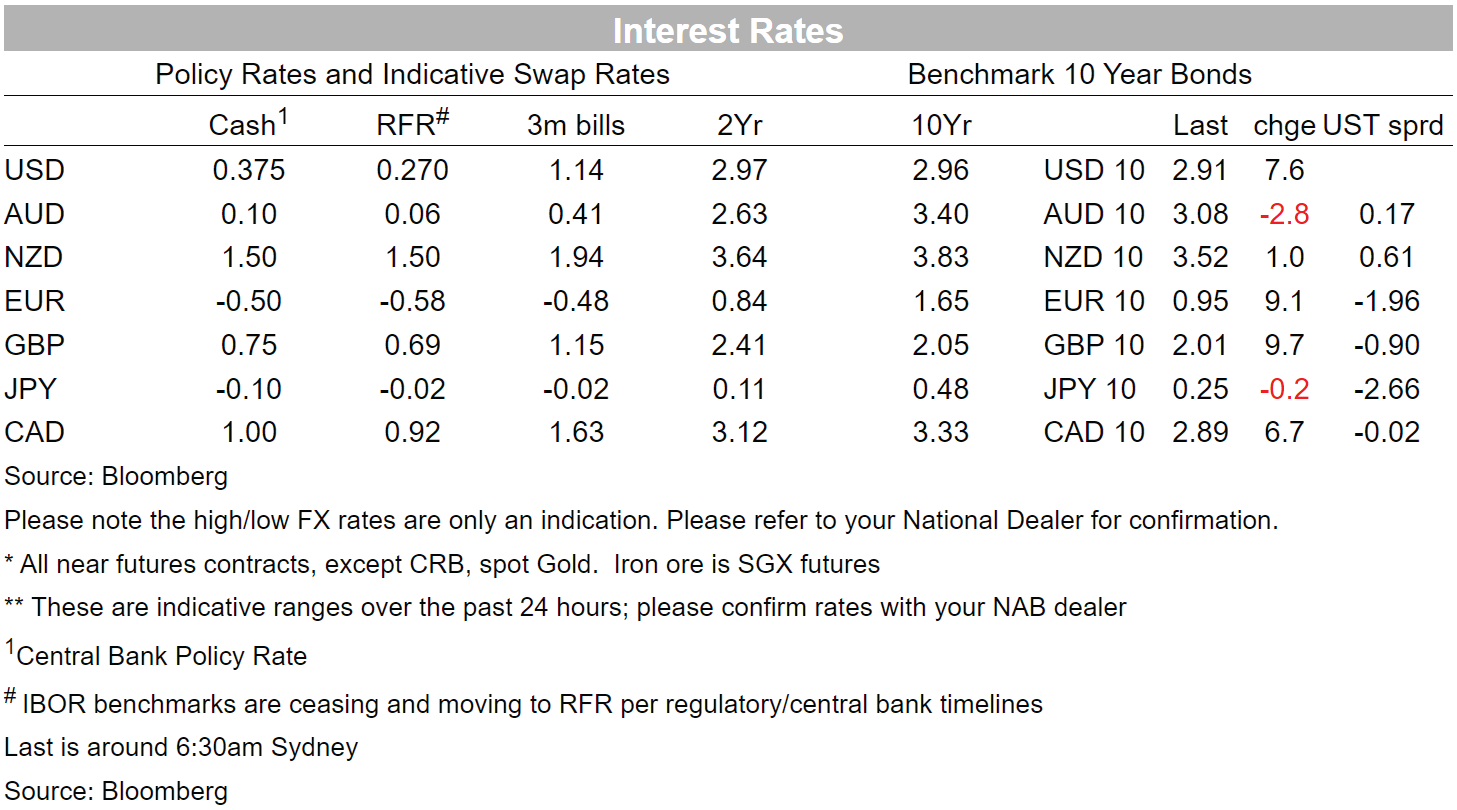

Markets are a little easier to understand today. Bond yields are back on the rise, given inflation expectations and more hawkish rhetoric from central banks.

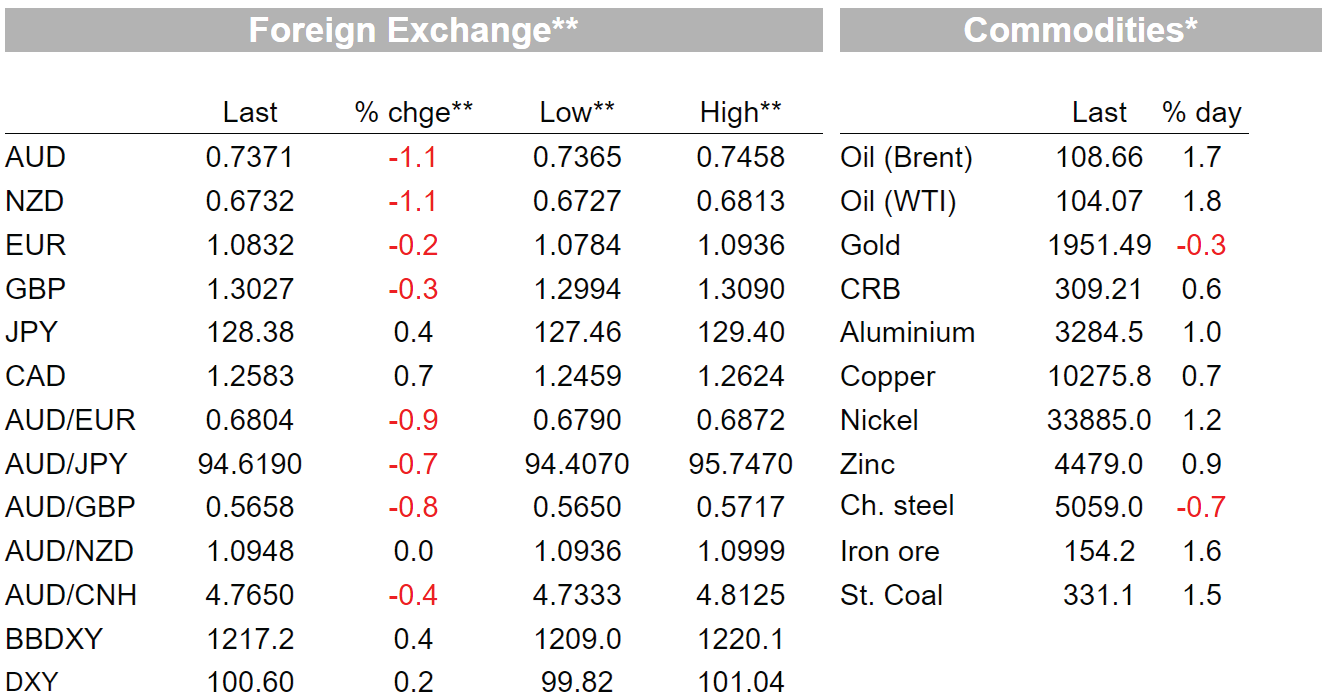

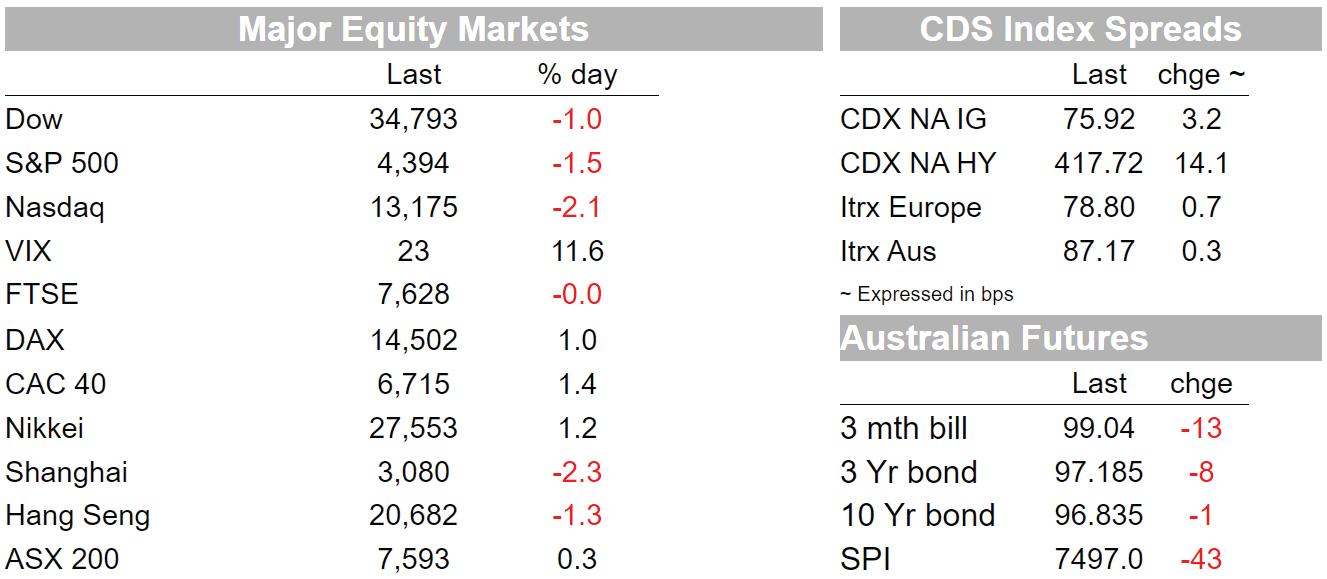

Just when it looked like 3% was a bridge too far for US Treasury yields, the 5-year Note has cracked 3% for the first time in this cycle, higher bond yields globally driven not by the Fed but this time the ECB where the hawkish chorus – calling for rates to start rising from July and be at or above zero by year-end – has suddenly grown louder. Whether for this reason or otherwise, US stock markets aren’t happy, the NASDAQ in particular (-2%) and where Netflix is still on the rack (-3.5%) even after Wednesday’s 35% fall. Communication Services, which includes Netflix, is the second worse performing S&P500 sub-sector after Energy (-2.4% and -3.1% respectively). Together with higher yields, this sees the DXY USD index comfortably back above 100 after dropping below late in our day yesterday. AUD/USD is off 1% against this backdrop, higher commodity prices getting short shrift just at the moment.

It is ECB not Fed officials that have garnered the most attention in the last 16 hours or so, Fed officials – including Fed chair Powell speaking overnight – no longer able to make any impression on the US rates market with calls for 50bps rate rise at the upcoming May and likely too June meetings (for the record, Powell said at the IMF that in his view it is appropriate to move a little more quickly and a 50bps hike will be on the table for the May FOMC). It was the ECB Governing Council member Pierre Wunsch who got the ball rolling on higher Eurozone yields yesterday afternoon our time, saying that “without any really bad news coming from that [Ukraine] front, hiking by the end of this year to zero or slightly positive territory for me would be a no brainer…what’s priced in by the markets today to me is on the low side of what might be required to get inflation under control”.

Not long thereafter, ECB vice-President Luis de Guindos said that he saw “no reason why we should not discontinue our Asset Purchase Programme in July”, and that a rate hike as soon as July was possible (though he also said September – or later – was also a possibility). ECB President Lagarde , speaking alongside Powell at the IMF overnight, was her usual more circumspect self, saying inflation “must be addressed in a gradual way and that ECB policy is about normalization not tightening”, but these comments are fully compatible with the ECB getting away from its negative (-50bps) policy rate setting in the second half of the year.

The net impact of the ECB commentary has been a 15bps rise in 2-year benchmark Eurozone yields , a 12bps rise in 5s and 9bps lift to the 10-year Bund. In US Treasuries, it is the belly of the curve that has shown the biggest rise – led by not leading the Eurozone – with the 5-year Note at one point in the night up 15bps and cracking 3% (high of 3.01%) before settling back nearer 2.95% coming into the New York close. 10-year Note yields, which on Wednesday had dropped back from a high of 2.98% to 2.82%, have been back up to as high as 2.95% but have since drifted back below 2.90%.

In FX, the Euro initially got a decent boost from the ECB-speak, EUR/USD rising by over a cent to above 1.0930, but USD strength has seen all of these gains evaporate, the single currency now back down at 1.0840 to be 0.1% weaker over the past 24 hours. It is the AUD that has suffered the most from the higher rates/weaker risk sentiment combo, joining the NZD with a loss of just over 1%, the Kiwi’s fall extending an earlier hit from the slightly weaker than expected headline Q1 NZ CPI print (6.9% against 7.1% expected). NZD losses held during the day even though the detail of the release were far from comforting. Indeed, as our BNZ colleagues notes, the RBNZ’s preferred Sectoral Factor Model estimate of 4.2% y/y, with Q4 revised up from 3.2% to 3.8% – was in many ways ever scarier than the headline CPI result.

AUD weakness, to a low of 0.7365 but which keeps it just above Monday’s intra-week low of 0.7346 – has come even though oil prices have lifted by the best part of $2, and copper, aluminium and nickel prices are all higher, as too (just) are iron ore futures. USD/JPY has – and a rarity by recent standards – been one of the least volatile G10 pairs in the last 24 hours, and where a note of caution is evident regarding FX intervention risks coming out of this week’s IMF/G20 meetings. A very low risk though in our view, in which respect a senior IMF official said yesterday that “We do not see disorderly market conditions in FX market”, when asked whether yen-buying currency intervention by Japan would be justified, and that the Yen’s recent declines are driven by fundamentals and that they saw no need for BoJ to change its accommodative monetary policy stance.

Also to note in FX is that USD/CNH has climbed further overnight, to 6.48 and bringing the rise on the week to more than 1.5%. – a move that clearly has the blessing of the Chinese authorities, evident from the lack of ‘protest’ at any of this week’s daily CNY fixings.

Finally in overnight economic news, the Philadelphia Fed index was slightly softer than expected at 17.6. The delivery times component fell sharply from 39.7 to 17.9, the lowest reading in over a year, a possible sign of easing supply-chain issues, although pricing indicators remained very strong. Initial jobless claims last week remained little changed at 184k, continuing to track around a historically low level.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.