A private sector improvement to support growth

Insight

Friday’s offshore markets produced as many fireworks as we have seen on just about any day this year with the mere suggestion of the Fed stepping down from 75bps to a 50bps incremental rate hike in December producing a fierce rally in US equities.

Friday’s offshore markets produced as many fireworks as we have seen on just about any day this year. The mere suggestion of the Fed stepping down from 75bps to a 50bps incremental rate hike in December produced a fierce rally in US equities, partial reversal of the recent surge in US Treasury yields and smart about-turn in the US dollar, the latter entailing an almost two cents jump in AUD/USD. The BoJ was summoned into action, producing a more than ¥5 intra-day reversal in USD/JPY. Earlier Friday, UK markets were evidently unsettled by the prospect of a phoenix-like return of Boris Johnson to the UK prime ministership, and too a prospective delay to the hitherto promised October 31 Budget because of the (latest) Tory party leadership contest. After the NY close, Moody’s joined the fray (after S&P, Fitch) in putting the UK sovereign credit rating on negative outlook.

At midnight Sydney time (9am NY), ‘in the know’ WSJ Fed watcher Nick Timiraos tweeted, “Some officials are more eager to calibrate their rate setting to reduce the risk of overtightening. But they won’t want to dramatically loosen financial conditions if and when they hike by 50 bps (instead of 75). This meeting could allow officials to get aligned on next steps”.

In his subsequent WSJ column Timiraos wrote, “Federal Reserve officials are barrelling toward another interest-rate rise of 0.75 percentage point at their meeting Nov. 1-2 and are likely to debate then whether and how to signal plans to approve a smaller increase in December. “We will have a very thoughtful discussion about the pace of tightening at our next meeting,” Fed governor Christopher Waller said in a speech earlier this month. If officials are entertaining a half-point rate rise in December, they would want to prepare investors for that decision in the weeks after their Nov. 1-2 meeting without prompting another sustained rally. One possible solution would be for Fed officials to approve a half-point increase in December, while using their new economic projections to show they might lift rates somewhat higher in 2023 than they projected last month.”

In between Timiraos’ Tweet and his subsequent WSJ column, San Francisco Fed President Mary Daly was quoted Friday, during a talk at the University of California, Berkeley, saying, “The time is now to start planning for stepping down”.

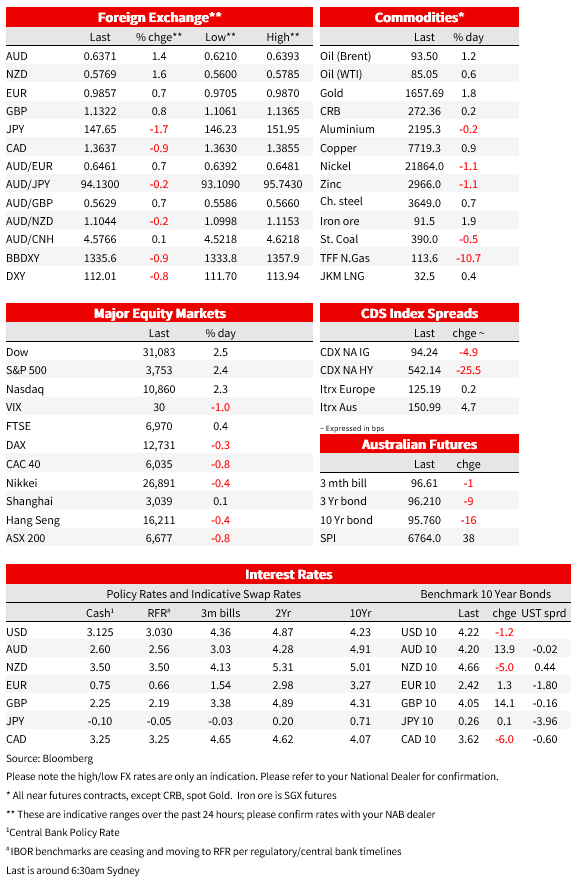

The upshot was that market pricing for Fed rate hikes over the combined November and December meetings reduced from 144bp to 136bps, SPI futures jumped over 1%, before extending intra-day gains to more than 3.5% by the close, while 2-year US Treasury yields fell back from a high of 4.63% to as low as 4.45% by midday NY time (ending the session at 4.47%, 14bps down on the day). US 10s fell from a new cycle high of 4.335% to 4.215% (down a mere 1bps on Thursday’s NY close, such was the speed and extent of Friday’s earlier sell-off). On the week, US 10s are 20bps higher vs -2.2bps for 2s, with the 30yr up over 34bps, which will of course feed directly into a similar sized rise in 30-year mortgage rates.

Adding to the excitement was the inevitable instruction from Japan’s MoF for the BoJ to step in against USD/JPY , after the pair had almost hit ¥152 (high of ¥151.91). This saw USD/JPY fall in the space of 3+ hours to a low of ¥146.23 – a similar sized fall as when the BoJ last intervened on 22 Sep (¥145.90 to ¥140.26). We might get some indication of the scale of BoJ USD sales when they release their provisional estimate of Tuesday’s money market settlements at 6pm JT on Monday. Chances are it was at least as big/bigger than on 22 Sep (~$19bn). Precise amounts won’t be known until MoF releases its monthly statement at the end of October).

Earlier Friday – indeed during our day – came the news that Boris Johnson was contemplating an attempt at resurrecting his prime ministership (ended ignominiously in July by the furore surrounding his covid restriction-related misdemeanours). Together with a UK Times’ report than the promised October 31 Budget from current Chancellor Jeremy Hunt night need to be delayed due to the Tory party leadership contest, GBP was independently weak on Friday morning in London, GBP/USD dropping from above $1.12 to below $1.11 (low of $1.1061). Its subsequent recovery to above $1.13 was entirely a function of USD weakness, GBP matching the CHF as the ‘least strong’ G10 currency Friday in the context of a roughly 0.8% drop in USD indices.

Ahead of the (currently still scheduled) October 31 budget statement, the UK’s Telegraph on Saturday reported Chancellor Jeremy Hunt is considering up to £20 billion of tax rises. The report, which did not cite sources, said Hunt could seek to reform capital gains rules and ditch a two-year government-funded removal of green levies from energy bills.

Also in the UK, after Friday’s NY close, Moody’s joined earlier actions by S&P and Fitch in revising its outlook on the British sovereign to negative from its hitherto stable Aa3 rating, reflecting, “Heightened unpredictability in policymaking amid weaker growth prospects and high inflation … and risks to the UK’s debt affordability from likely higher borrowing and risk of a sustained weakening in policy credibility”.

In contrast to the modest GBP rally, gains of 2.4% for the S&P500 and 2.3% for the NASDAQ, attributed largely to the WSJ’s Timiraos report, saw the AUD rally almost a such as the BoJ-supported JPY, up just over 1.5% on the day to a high of 0.6393 before closing in NY at $1.6379, its best level since 10 October. Proof positive that as and when risk sentiment does find a floor, AUD stands to be amongst the biggest beneficiaries of the subsequent USD sell-off. The Aussie outdid the kiwi on Friday (latter +1.25%) but on the week NZD was the best performing G10 currency, up 3.4% against 2.9% for AUD.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.