We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Risk appetite improves despite hawkish Fed talk

Events Round-Up

NZ: Card spending total (m/m%), Aug: 0.9 vs. -0.2

CH: PPI (y/y%), Aug: 2.3 vs. 3.2 exp.

CH: CPI (y/y%), Aug: 2.5 vs. 2.8 exp.

CH: Aggregate financing (CNYb), Aug: 2430 vs. 2075 exp.

CH: New loans (CNYb), Aug: 1250 vs. 1500 exp.

CA: Unemployment rate (%), Aug: 5.4 vs. 5.0 exp.

Price action on Friday was a classic case of equity investors not seeing eye to eye with bond investors. The latter increasing expectations of a US recession via renewed UST curve flattening while the former enjoyed a risk positive night, not only helping both the S&P 500 and NASDAQ record solid gains on the day, but also end a three-week losing streak. Technicals and short covering appear to have boosted equity moves while hawkish rhetoric from Fed speakers backing Fed Chair Powell message on Thursday was the main US Treasury driver. After losing altitude during our trading session on Friday, the USD range traded during the overnight session. AUD was Friday’s outperformer, starting the new week at 0.6828. Ukraine news over the weekend sees the euro lead gains against the USD early this morning.

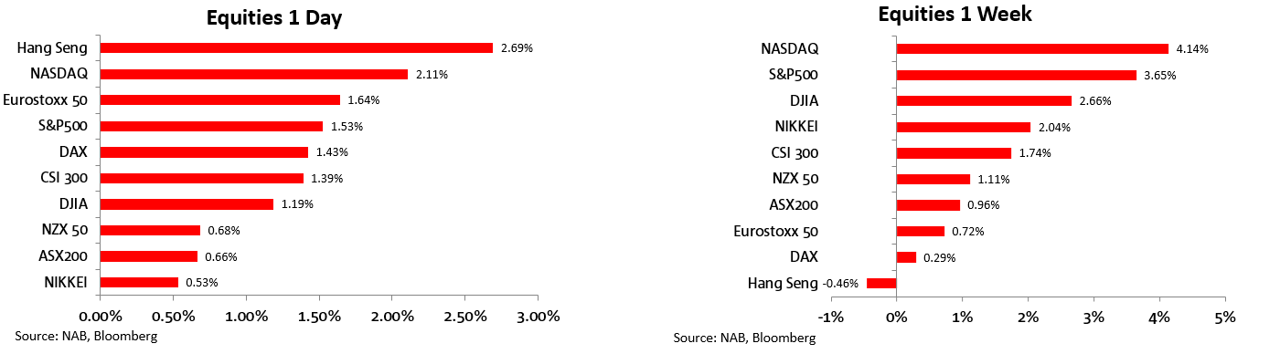

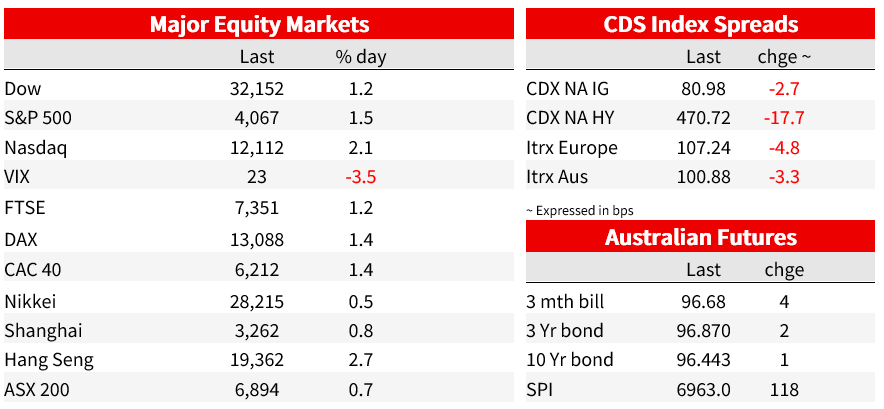

The S&P 500 Index climbed 1.5% with all 11 major industry groups in the green. Energy and communication led the gains (up over 2%) while the tech heavy NASDAQ gained 2.2% with both indices ending a 3-week losing streak, up 3.65% and 4.14% on the week respectively. The VIX index ended the week at 23, after reaching a high of 28 earlier in the week.

There were no fundamental drivers propelling the improvement in risk appetite, either from economic data releases or company specific news. Instead, it seems technical drivers were the main driver. Some commentators noted evidence of short covering with the most-shorted stocks performing the best. Bullish signals were also evident with the S&P 500 rising above its 100 moving day average and looking more comfortable above the 4000 mark while the likes of Citigroup noted oversold positioning from extremely pessimistic levels, as evident by -16 level in the Levkovich Index ( -17 defines panic) with Bank of America highlighting their bull-and-bear indicator had reached “maximum bearish” level — often seen as a contrarian buy signal.

The positive equity vibes were also evident in Europe, the Stoxx 600 Index closed 1.5% higher and posted its first weekly gain in a month. Basic resources, banks and technology stocks were all up in excess of 2%.

Looking at the weekly performance, US equity indices led the gains followed by Japan and China while the Hang-Seng was the notable underperformer, down -0.46% over the past five days.

In what is probably turning out to be the most anticipated recessions (Europe first and next year the US), equity investors are seemingly pricing in the recovery before we have endured the downturn. Here is where we struggle with the recent equity rebound, history tells us that equities tend to struggle when activity readings head south and as the northern hemisphere approaches winter with major central banks still on tightening mode, further declines in activity readings look like a good bet.

In contrast the positive vibes coming from the equity market, the UST curve flattened by 3 bps to – 23, reversing some of the steeping that had been in place earlier last week with curve reaching a level of -13.7 on Wednesday. An inverted curve has been a reliable US recession leading indicator.

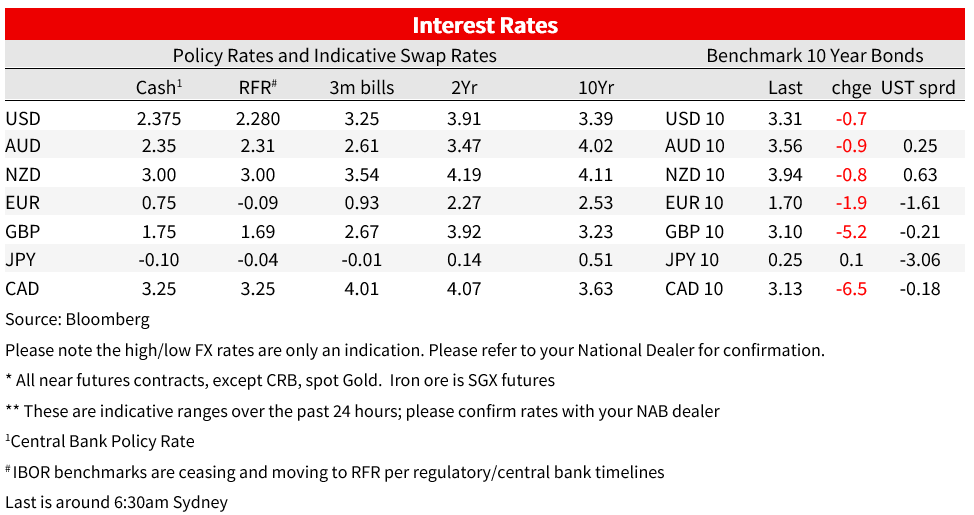

The flattening of the curve was led by a 5.3bps rise in the 2y rate, to 3.56% while the 10y Note was little changed, down 0.6bps to 3.313%. But looking at the week, the move up in yields was fairly aggressive with the 2y rate up 17bps while 10y gained 12bps.

The move up in front end UST yields was supported by Fed speakers backing Fed Chair Powel’s hawkish message from the previous day. Fed Bullard (voter, hawkish), said he supports a third 75bps rate hike this month, adding that he expects the Fed will hold rates at higher levels next year . As for this week’s CPI data, Bullard said the data may show “progress”, but then added “I wouldn’t let one data point sort of dictate what we are going to do at this (September) meeting, so I am leaning strong towards 75 at this point”.

Meanwhile Fed Governor Waller said that “until I see a meaningful and persistent moderation of the rise in core prices, I will support taking significant further steps to tighten monetary policy”. Sounding a little bit less hawkish, Fed George said the she prefers steady rate hikes over speedy rate hikes as the pace of policy tightening leads to market volatility that could be important as the balance sheet runs off.

Earlier in the session, German Bund yields eased a little with the 10y tenor down 2bps to 1.70% while Italian BTPS gained 4bps to 4.02%. ECB hiking expectations have continued to edge higher with money markets are now pricing 126bps of hike by December with a deposit rate seen at 1.813%, last Monday the rate was seen at 1.598%. The move up ECB pricing expectations was supported by hawkish comments by policy makers, including Knot who urges more hikes and Kazimir who says resolute hikes will continue. Over the weekend Bundesbank President Nagel said “Thursday’s step was a clear sign and if the inflation picture stays the same, further clear steps must follow”.

As expected, the EU Energy Ministers meeting didn’t conclude with any specific outcomes. There was broad agreement on the need for urgent action but stopped short of calling for a mandatory reduction in energy demand while the idea of a broader gas price cap — on all imports, not just Russia’s – was discussed without any agreement . Now the European Commission will have to do the hard work in devising new measures, getting agreement and the eventual delivery of concrete legislation. Separately, the bloc is working on a broader plan to adjust the structure of Europe’s electricity market, which Energy Commissioner Kadri Simson said she hopes will be “ready early next year.”

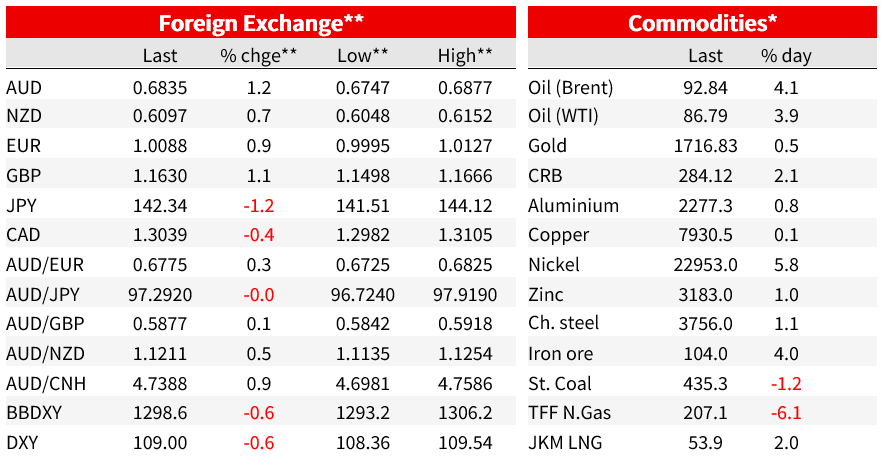

The USD came under pressure during our APAC session on Friday but Fed hawkish rhetoric during the NY session provided the greenback with some support. The AUD was on the vanguard against the USD on Friday during our day aided by smart falls in USD/CNH either side of the CNY fix, which came in almost 4 big figures beneath market-implied consensus (6.9098 vs 6.9484 BBG consensus). JPY was also a notable performer following news BoJ Governor Kuroda was meeting with PM Kishida. Kuroda then fronted reporters to say that a rapid weakening of the yen is undesirable, recent weakening is rapid and that moving by 2-3 yen a day is ‘very sudden’.

Talks of JPY intervention continued over the weekend with deputy chief cabinet secretary Seiji Kihara saying on Sunday Japan’s government must take steps as needed against excessive declines in the yen. History tells us that any unilateral intervention is unlikely to prove effective, a coordinated effort is needed and right now with major central banks fighting inflation through tighter policy, global official support for JPY seems unlikely. If the BoJ really wants to stop JPY’s decline, then they need to make changes to their ultra-easy policy, the pressure is building.

The AUD was the outperformer on Friday, gaining 1.3% and this morning it has opened a little bit stronger still at 0.6828. USD/JPY ended the week around ¥142.50 and has started the new week at ¥142.136. Meanwhile the NZD appreciated to 0.6150, having traded below 0.60 just 48 hours earlier. The kiwi opens the new week at 0.6086.

The USD has come under a little bit of pressure this morning with the euro gaining around 1 big figure to 1.0108. This on back on Ukraine news over the weekend. So far, the consensus view has been that Russia would most likely determine the end of the war, once it had reached its objective of annexing the Donbas region. But news of significant territory gains by Ukraine forces over the weekend are potentially increasing the probability of a different outcome, assuming the Ukraine can push Russia further away and end the war in its own terms. Is a cautiously optimistic case, Putin can be unpredictable, Russia is a nuclear power and it also has powerful friends. And imminent end to the war, seems like a long shot, but the market is embracing the good news at the start of the new week.

Moving onto some economic news on Friday China CPI eased to2.5%y/y from 2.7% vs 2.8% expected PPI 2.3% from 4.2% and 3.2% expected. Food +6.1% y/y, non-food +1.7%. Inflation (including at producer price level) continues to impose zero constraint on efforts to ease financial conditions in China, despite some mumblings to this effect after last month’s numbers. Late on Friday, China’s credit data revealed further deceleration in credit growth last month Chinese banks extended a net RMB1250bn in new local currency loans in August (the Bloomberg median was RMB1,500bn and our forecast was RMB 1,235bn). Aggregate financing (AFRE), the PBOC’s measure of broad credit, saw a net increase of RMB2430bn (Bloomberg: RMB2,075bn, CE: RMB1835bn). Overall however, bank loan growth dropped back from 11.0% y/y to 10.9%, the 20-year low that was touched in April.

Canada’s labour market data was weak for third consecutive month and the August unemployment rate rose 0.5% to 5.4% (it was flat in Jul). The weak report saw the market pare back rate hike expectations and Canada’s 2-year rate fell 6bps, going against the grain of higher short rates in the US and Euro area.

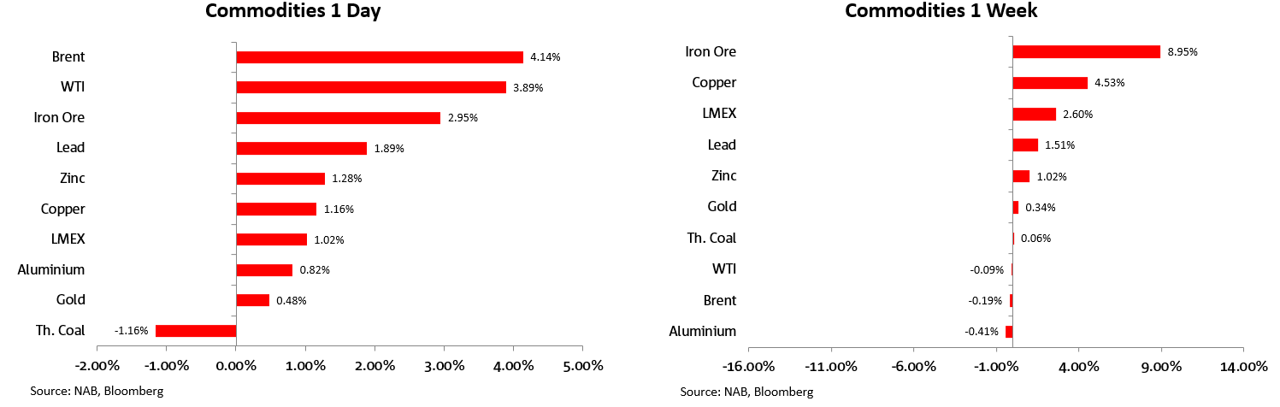

Lastly commodities had a solid Friday with gains in oil (~4%) leading the move up. Iron ore gained 2.95% and it was the outperformer on the week, up 9% to $102.98. Nickel on the London Metal Exchange jumped 12% this week, marking the biggest weekly gain since July. Copper and aluminium also rebounded from lows set at the start of September to unchanged for the week.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.