On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

Latest flurry ahead of January 25-26 FOMC suggests March rates lift off expected.

When the FOMC sits down on tha Ides of March (15th), the last flurry of Fed speak on Friday, ahead of FOMC official entering the cone of silence in front of their January 25-26 meeting, makes March 16th rates ‘lift-off’ as close to a slam dunk for markets as it’s possible to imagine (currently 90% priced). Pershing Square’s Bill Ackman on Saturday was out tweeting that the Fed’s first move should be a ‘shock and awe’ 50bps rise to restore its credibility. That wasn’t a forecast though, and we doubt that this view will gain serious traction in the run up to next week’s Fed meet or the more crucial March 15-16 affair. But we also had JP Morgan chief Jamie Dimon on Friday suggesting the Fed could raise rates ‘6 or 7 times’ this year, recalling the Carter/Reagan/Volcker era.

To sum up latest Fed speak, Cleveland Fed President Loretta Mester on Friday said she believes that it’s “a compelling case” for the central bank to raise the federal funds rate at its March 15-16 meeting or “as soon as asset purchases are terminated”. Philly Fed President Patrick Harker last Thursday and Friday said “My forecast is that we would have a 25 basis-point increase in March, barring any changes in the data”. And without being explicit on timing, San Francisco Fed President Mary Daly on Friday said officials are “going to have to adjust policy” because there aren’t a lot of signs that inflation — running at the hottest rate in almost four decades — is going to remedy itself, while influential NY Fed President John Williams says “The next step in reducing monetary accommodation to the economy will be to gradually bring the target range for the federal funds rate from its current very-low level back to more normal levels….given the clear signs of a very strong labor market, we are approaching a decision to get that process underway.”

Also Friday, ECB President Christine Lagarde is still not blinking, saying “We expect the drivers of inflation to ease over the course of this year,” though did add that, “We will take any measures necessary to ensure that we deliver on our inflation target of 2% over the medium term” (its currently 2.6% in core terms, 4.9% headline).

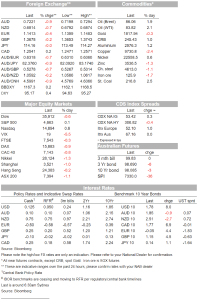

Incoming Fed speak was among the factor seeing US bond yields rise (again) and across the curve on Friday, by 7-9bps between 2 and 30 years, while over the week the curve has (bear) flattened significantly (e.g.2s 10s by some 8bps).

Latest bond market moves came in the face of incoming US data that on another day could have been expected to produce exactly the opposite reaction. Thus December Retail Sales fell by 1.9% against -0.1% expected with the core ‘ex autos and gas’ and ‘control’ measures by even more (-2.5% and -3.1%) respectively. Clear evidence of the hit to spending in the latter half of the month as Omicron took hold across the country.

This also showed up in a renewed slump in consumer confidence, the University of Michigan’s preliminary January Consumer Sentiment Index slipped to 68.8 from 70.6, still up a bit on the 67.4 November decade-long low but below the 70.0 expected,. Both Current Conditions and Expectations sub-series fell. Alongside, 1-year inflation expectations lifted to 4.9% from 4.8%and the more widely watched – at least by the Fed – 5-10yr reading lifted to a new post March 2011 high of 3.1% from 2.9%. Finally, December Industrial Production fell by 0.1% (consensus +0.2%) with manufacturing output -0.3% against 0.3% expected.

Over the weekend, China reported December home prices, which Reuters calculates fell by 0.2% after -0.3% in November, meaning annual growth down to 2.6% from 3.0%. Incidentally. In front of today’s Q4 GDP and December activity readings (see Coming Up below) Beijing reported its first Omicron case on Saturday – three weeks out from the Winter Olympics.

The US data appeared to be responsible for the early-day hit to US equities at Friday’s NYSE open, from which they struggled to recover as the session progressed and in the face of the latest rise in bond yields. That said, the NASDAQ ended up eking out a gain of 0.6% while the S&P finished up 0.1%. On the week, stocks were down everywhere, including modest weakness for US indices, expect Hong Kong (+3.8%). Shanghai the weakest with the CSI 300 down 2%.

Rotation from growth to value, driven in large part by the sharp rise in US risk-free rates, has been the dominant feature of equity market thus far in 2022, most evident in the 4.8% fall for the NASDAQ.

Whether because of the latest rise in bond yields or otherwise, the USD recouped almost half of its earlier week losses, the DXY index picking up from a low of 94.60 to 95.20, meaning that on the week DXY, and the broader BBDXY are both off by 0.6% having been down about 1.25% at Friday morning’s worst. AUD/USD was the worst performing G10 pair, off over 1% and spending time sub-0.72 having spent time above 0.73 just last Thursday. So a choppy trading environment for AUD looks to be the current order of the day.

In contrast to AUD, JPY was Friday’s best performing major currencies, flat versus the USD but up on all the crosses, and the strongest on the week (+1.2%). Contributing to the JPY Friday outperformance was a Reuters report, citing five different sources, saying that Bank of Japan policymakers are debating how soon they can start telegraphing an eventual interest rate hike (from the current -0.1%), which could come even before inflation hits the bank’s 2% target, emboldened by broadening price rises and a more hawkish Fed. GBP was also a G10 outperformer Friday albeit -0.25% on the USD, helped by GDP for the 3 months to November printing 1.1%, better than the 0.8% expected. GBP is the strongest G10 currency year to date, currently +1.0%.

Finally a lively week for commodities – fossil fuels in particular – saw oil and steaming coal up another 2% or so Friday for a rise of more than 10% on the week for coal and more than 5% for both Brent and WTI crudes. YTD, Brent crude is now up over 10%, and thermal coal by a cool (or rather hot) 28%. The oil price rise in particular is testament to optimism toward the demand side of the equation improving sooner rather than later premised on the Omicron covid subsiding in many countries very soon and following the trend already evident in the likes of the UK and South Africa.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.