Total spending grew 0.9% in June.

There’s been a strong risk-off sentiment to the start of the week.

A risk-off environment has intervened since our last note on Friday. Concerns over further Chinese lockdowns compounded the risk off dynamic that took hold late last week on concerns over the implications of a front-loaded Fed tightening cycle. Asian and European equities were lower, though early declines were pared later in the US session. Commodity markets overnight. Beijing began testing millions of residents on Monday and some business districts and residential areas entered lockdown.

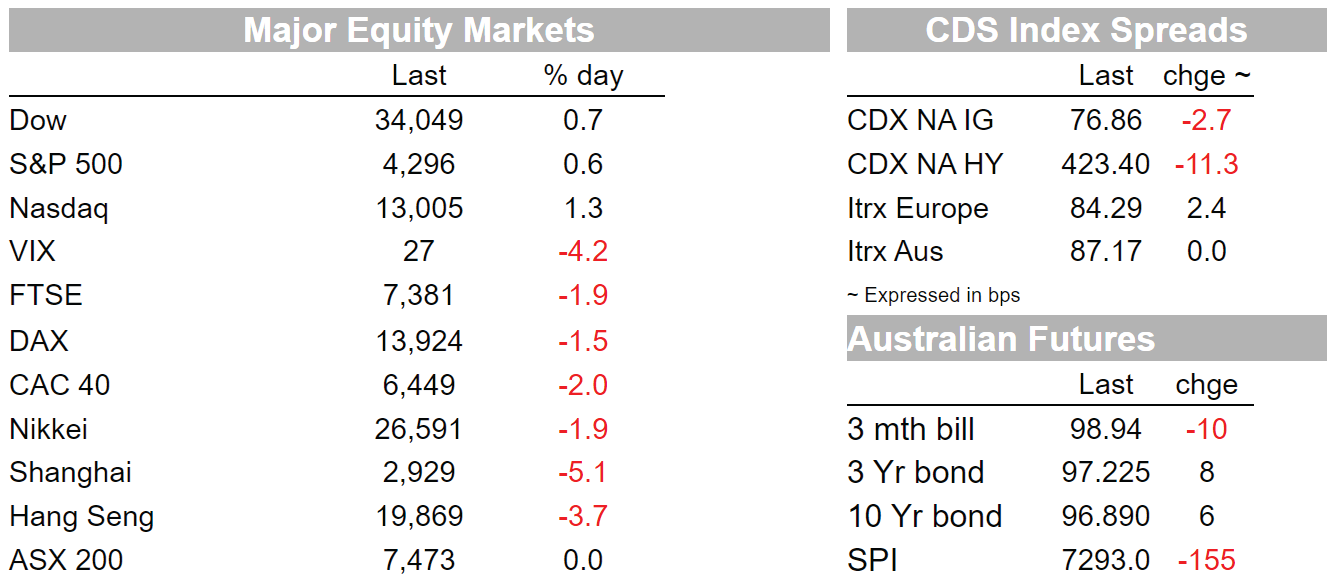

Lockdowns could be spreading to more Chinese cities as panic buying was seen in Beijing. The Chinese capital recorded 41 cases of covid over weekend, but officials saw evidence of community spread and several neighbourhoods were sent into lockdown on Monday, though a city-wide lockdown has not yet been imposed. Several other provinces have also seen a rise in cases recently. The CSI 300 was down 4.9% to its weakest close since April 2020. The yuan weakened further, moving briefly above 6.60 for the first time since November 2020, though pared some of the losses after the PBoC cut the FX reserve ratio, adding dollar liquidity in what can be interpreted as some discomfort with the pace of depreciation. Offshore renminbi now 0.9% lower at 6.5704.

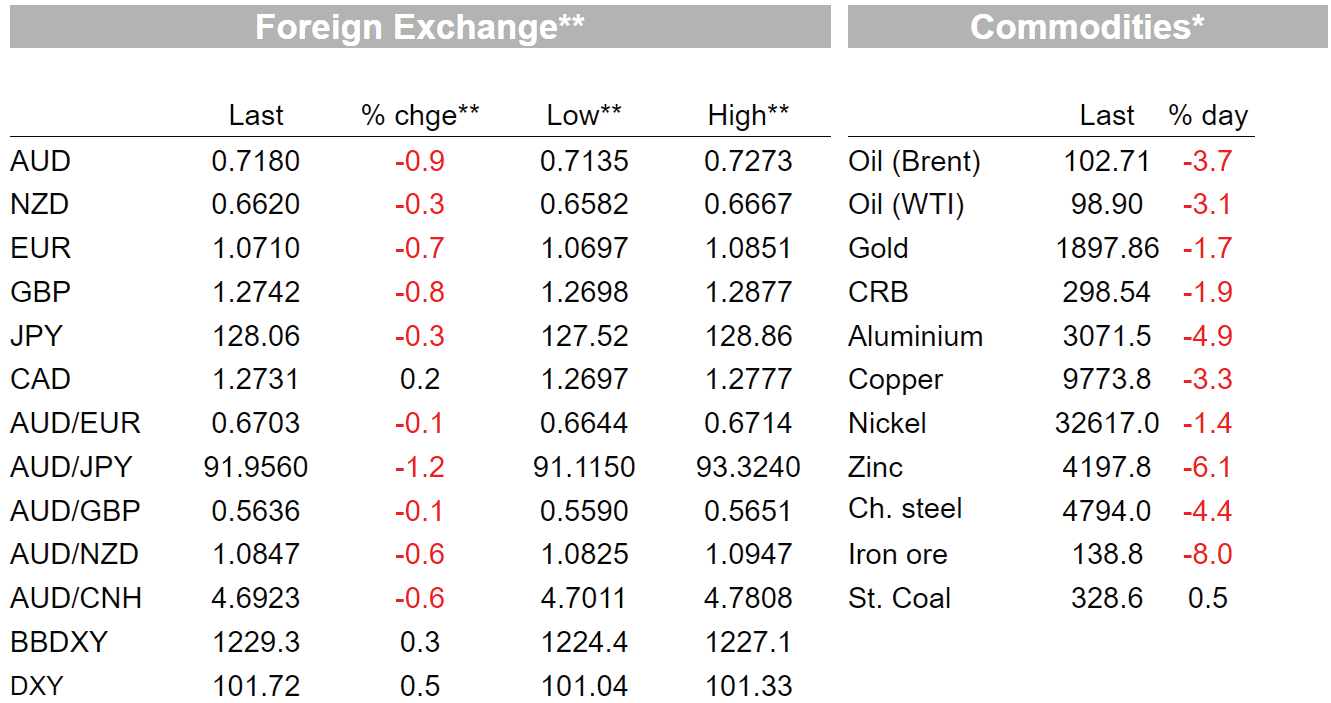

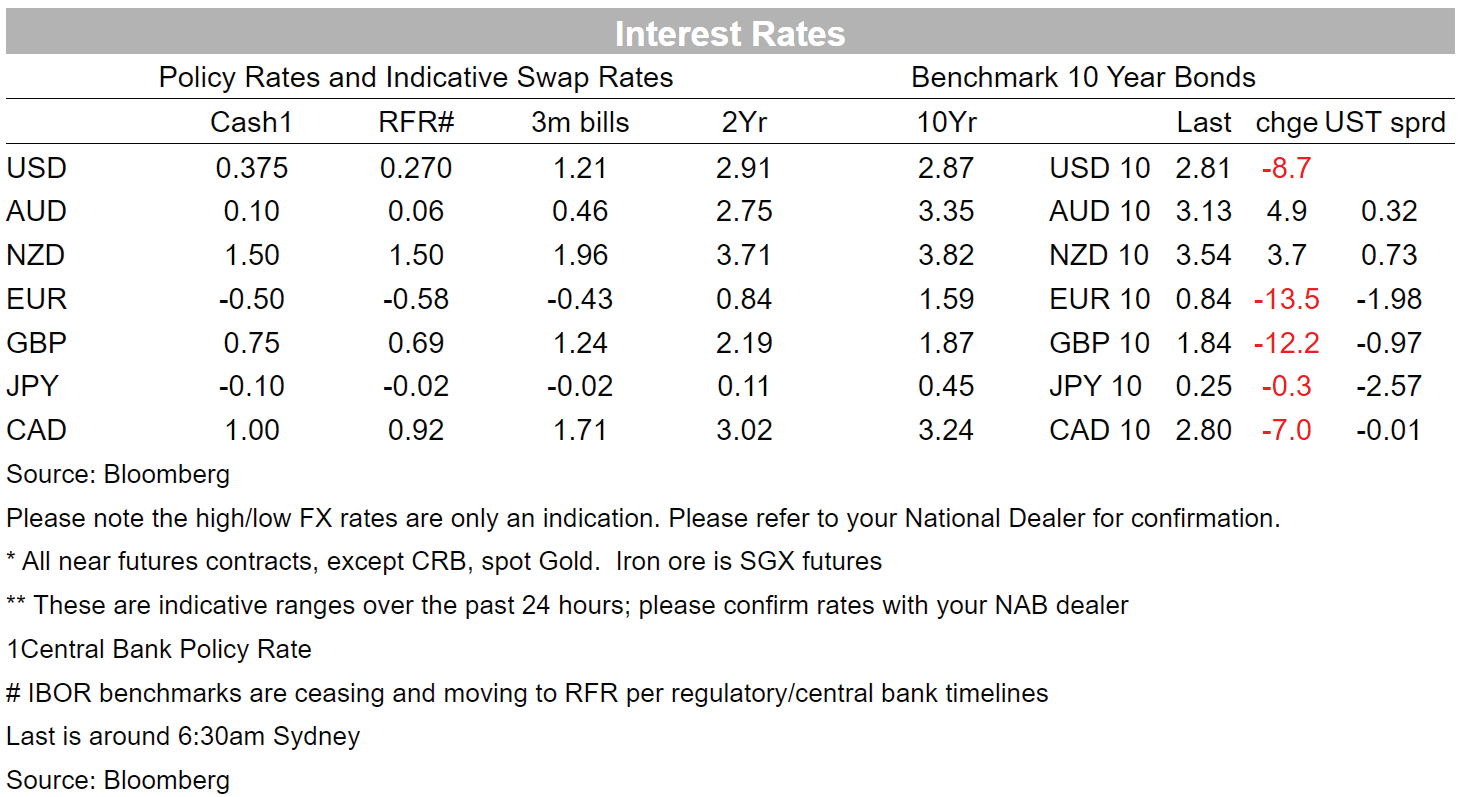

Currency and bond markets reflected the risk off dynamic. US 10yr yields were down 9bps to 2.81% on Monday, recovering off their intraday lows of 2.76. 10yr Breakeven inflation spent time above 3% on Thursday and Friday but fell back to mid-April levels of 2.92%. The rally in US rates was seen across the curve, with 2yr yields, down 8bps to 2.63. In Europe, benchmark 10yr yields were sharply lower, down 13.5bps to 0.84%.

The US dollar rose on the DXY, up 0.5% and the highest it’s been since spiking higher in March 2020 . The euro softened 0.7% to 107.12, the lowest since 2017 apart from a brief stint down to 1.0638 in March 2020. The yen was the only G10 currency to strengthen against the dollar, gaining 0.3% against the dollar, sitting around 128.06. The yen has been caught in recent days between safe-haven demand and safe haven demand and re-affirmed commitment to easy monetary policy from BoJ Governor Kuroda, who underscored the divergence between BoJ and Fed policy and making no mention of the recent depreciation in the yuan. Speaking in New York, Kuroda pointed to still-weak demand pull-inflationary factors, saying “there is still a long way to go to achieve the 2% target in a stable manner. ” Japanese CPI data on Friday showed inflation at 1.2% y/y, a 3-year high, but excluding food an energy still mired in deflation at -0.7% y/y.

The AUD lost another 0.9%, adding to the grind lower from Thursday’s intraday higher of 0.7458. The currency declined 1.8% on Friday to 0.7244. That continued Monday, the AUD falling as low as 0.7135, its lowest since 24 February as the clouded China outlook and hit to commodity prices set the tone. Brent was down 3.7% to US$102.7, while iron ore fell 8.0% amid concerns about China demand.

Equity markets staged a late recovery in the US. The S&P 500 ended up 0.6% in a volatile session, erasing an earlier decline of 1.7%. The VIX index hovered around 30 for most of the day, at one point reaching as high as 31.6, but moved lower late in the session as equities recovered. The Dow ended up 0.7% and the Nasdaq added 1.3%. Twitter shares rose 5.6% after the social-media company accepted Elon Musk’s $44 billion takeover deal. US equities had initially taken their lead from European and Asian markets, opening lower amid concerns about China lockdowns and extending losses from Friday, when the S&P 500 lost 2.8% to cap a third consecutive week of declines greater than 1%. The Euro Stoxx 50 was off 2.2%, while the Nikkei was 1.9% lower.

The pound has been another underperformer since our last note on Friday as weak retail sales and consumer confidence numbers highlighted that elevated inflation is biting for the consumer. Retail sales volumes declined 1.4% in March, against expectations for a fall of just 0.3%. That came after consumer confidence plunged 7 points to -38, its lowest since the -39 plumbed during the GFC. Signs of a weakening economy combined with an FT report that “ the UK government is preparing legislation that will give ministers sweeping powers to tear up the post-Brexit deal governing trade in Northern Ireland” helped the pound lower, down 2.2% against the USD from Thursday, compared to the euro’s 1.1% decline. The news underscored earlier comments by BoE Governor Bailey on the fine line being tread between “tackling inflation and the output effects of the real income shock, and the risk that could create a recession.”

In other data news, European PMI’s painted a surprisingly resilient picture on Friday, most notably in a 1.8 point rise in the German services PMI. Last night’s German IFO was also stronger than expected, with both the current assessment and expectations components rising. Services PMI’s in the US were weaker, offsetting a rise in the manufacturing index.

The French presidential runoff election yesterday saw Macron re-elected, defeating his far-right opponent Marine Le Pen. The margin, 58.5 to 41.5, was narrower than his 2017 victory, but more comfortable than recent polling might have predicted. That was worth only a brief relief rally in the euro before the broader risk off tone and safe-haven demand moved to the fore.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.