Online retail sales growth slowed in May following a fairly strong April

Insight

If non-farm payrolls gave markets a Goldilocks moment on Friday then maybe markets are already starting to question whether it was exactly what was needed.

https://soundcloud.com/user-291029717/goldilocks-loses-a-little-of-her-shine?in=user-291029717/sets/the-morning-call

Oh, the price you pay, oh, the price you pay, Now you can’t walk away from the price you pay – Bruce Springsteen

It’s only Tuesday, but with no real follow-through to Friday’s post-US payrolls fireworks, it’s hard to avoid the sense the global markets are for the most part now simply lurching from one big event risk to the next with not a lot to see in-between. That next big event risk of course being Thursday’s US CPI figures – hence I’ve gone early with today’s song title – and which then lead us into next week’s FOMC meeting.

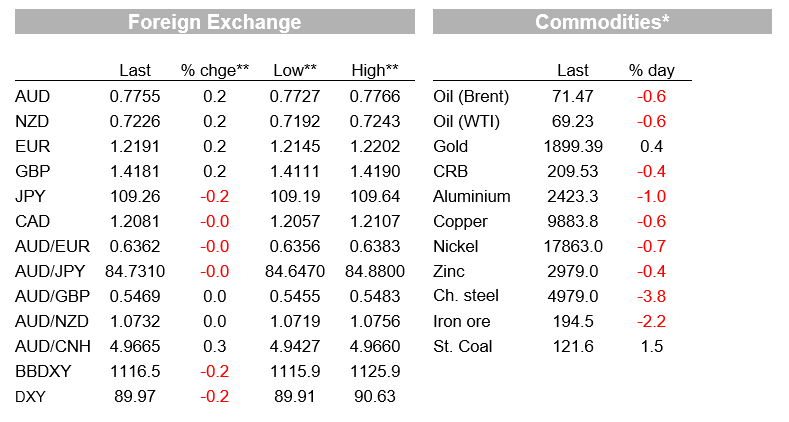

Efforts by journalists to hype the significance of the weekend ‘historic’ G7 agreement, endorsing a global minimum corporate tax rate of at least 15%, have failed to match the equity price action and where the NASDAQ has just finished with a gain of 0.5% against small losses for the S&P and Dow. Bond yields have retraced about 2bp of Friday’s move lower, but to no benefit to the USD even though real yields are higher. USD indices are off about 0.2% and AUD and NZD have extended Friday’s recovery, both up about 0.25%. The NAB business survey is out this morning

The start of a new week has not seen much by way of price action across all asset classes, despite the best effort of the business news commentariat to attribute the negative New York morning and early afternoon performance to the agreement reached on Saturday morning in London to an ‘at least 15%’ global minimum corporate tax rate. The reality is that this was well flagged as much as fortnight ago (soon after President Biden publicly endorsed the 15% figure). Plus there is awareness there is still a long way to go before a deal is inked at the broader G20 – or much broader OECD – levels and where the likes of Ireland with its 10% tax rate may yet prove to be a thorn in the side of securing a global agreement.

There is no argument that the multinationals standing to suffer the most from a 15% or higher global tax are the big US tech. companies, but the NASDAQ has just ended as the best performing US index today (+0.5% against -0.1% for the S&P and -0.4% for the Dow) and scoring a bigger gain that most European bourses (the Eurostoxx 50 finished up just 0.2%). An alternative view here, with which we have some sympathy, is that a 15% tax regime for big tech. will be deemed a ‘result’, especially if it means President Biden’s proposed lift to the US corporate tax rate from 21% to 28% never sees the light of day. We’d also note the NASDAQ had been an underperformer relative to the S&P and European bourses in April and May, perhaps in part because investors have been discounting the risk of a higher tax regime for many firms in this sector (albeit it’s hard to distinguish this from the ‘rotation’ trade out of growth to value as (most) economies more fully open up).

Bond markets have seen a partial retracement of Friday’s big drop in yields, with 10-year Treasuries up 1.4bps to 1.567% after European benchmarks ended mostly .5-2.0bps higher (Italy an outlier +4.1bps). Alongside, US 10-year break evens fell away in the New York afternoon to end 2bps lower, so real yields are 3-5bps higher, but not to any benefit for the US dollar where both the DXY and BBDXY indices have ended in New York about 0.2% softer, extending Friday’s losses.

NOK has topped the G10 leader board (+0.6%) on a day when oil prices have fallen back by half a percent (go figure) but after that it’s AUD and NZD which have fared best, both up 0.25% and leaving both pairs sitting more comfortably inside the ranges that were briefly shattered in the hours leading up to last Friday’s US employment report. AUD gains have come on a day when all commodities bar precious metals are softer, which seems fair given how many days of late have seen Aussie studiously ignoring the almost daily occurrence of higher commodity prices.

There were no US economic releases overnight but we did have German factory goods orders, which while weaker than expected at -0.5% (consensus estimate +0.2%) was driven by a fall in domestic orders (-4.3%) against a 2.7% rise in foreign orders. The former are still up on almost 4% on their (seasonally adjusted) Q1 average while foreign orders sits above their January ‘18 (pre-US-China trade war) peak.

So while there are hints that global goods demand could be slowing, evidenced by monthly volume falls in yesterday’s China export data and where annual growth in both export and import values fell a little shy of expectations, this may just be to do with ongoing supply chain issues, plus possibly some loss of intra-Asia trade given the various enforced lockdowns across the region from covid outbreaks. In truth, a bit too early to tell.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

Read our NAB Markets Research disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.