Online retail sales growth slowed in May following a fairly strong April

Insight

The Canadian dollar has been boosted by the Bank of Canada markedly increasing their growth forecasts for this year

https://soundcloud.com/user-291029717/hawkish-boc-boosts-canadian-dollar?in=user-291029717/sets/the-morning-call

“You’re the voice, try and understand it; Make a noise and make it clear; Oh, whoa; We’re not gonna sit in silence”, John Farnham 1986

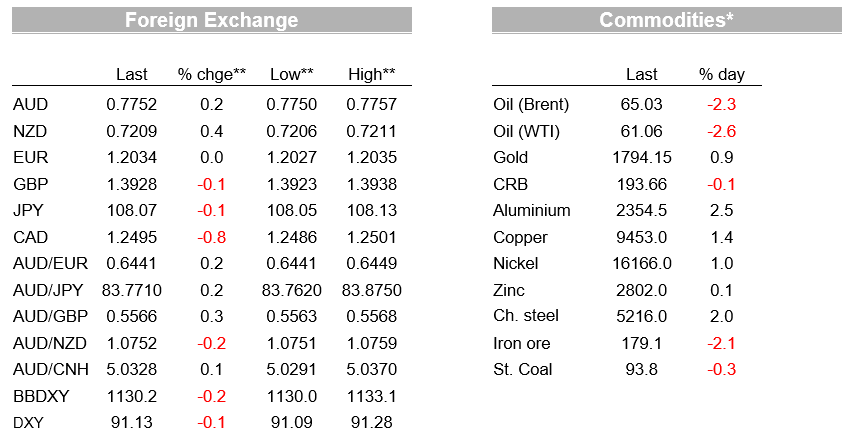

“You’re the voice” was ranked the sixth most Ozzest songs of all time by Triple M. Little less known was Whispering Jacks roaring success overseas, including in Canada where overnight in analysts are asking whether the BoC’s hawkish tilt of now expecting conditions for a rate hike to be met in H2 2022 instead of 2023 previously, proves to be a watershed moment for central banks. Judging by rates action overnight, not yet with global rates little changed outside of Canada (US 10yr yield -0.2bps to 1.56%). Similar sentiment was expressed in FX markets with CAD soaring (USD/CAD -0.8%), but with only small spillovers to other commodity currencies with AUD +0.2% and NZD +0.4%. The USD remains on the backfoot with BBDXY -0.2% with little movement in the majors. Data releases were limited overnight.

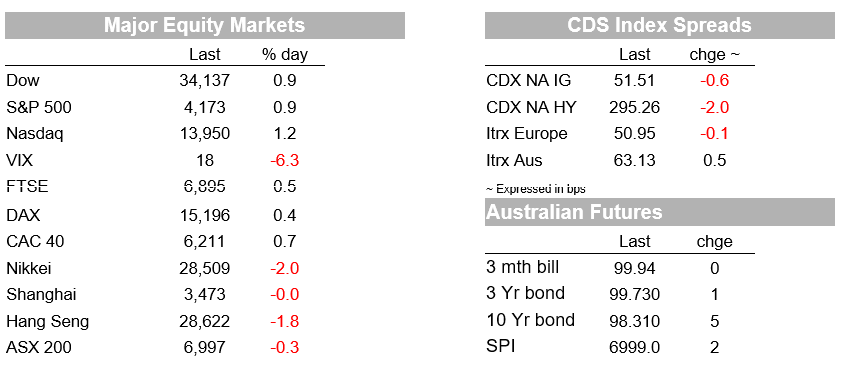

‘Buy the dip’ mentality appears to be back in equities with little else to explain the 0.9% rise in the S&P500 overnight following two days of decline. Notably a tilt back to cyclicals has occurred with the Russel 2000 +2.4% after yesterday’s sharp fall of -2.0%. Netflix’s disappointing earnings yesterday after the close hasn’t had much impact on the broader tech sector, although its own share price is down some 7% overnight. In general, earnings results have been overwhelmingly positive, with the more than 70 S&P500 companies to have reported so far having beaten analyst expectations by some 23% on average.

The hawkish tilt by the Bank of Canada (BoC) was the biggest event overnight. Rates guidance was pulled forward by at least six months with the post-Meeting Statement stating the BoC expects the conditions for raising rates in the second half of 2022, from prior guidance of “into 2023” which was just one meeting ago in March. The exact wording was: “ We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on the Bank’s latest projection, this is now expected to happen some time in the second half of 2022” (see BoC Statement for details).

Canada now joins Norway in flagging the possibility of seeing the conditions for normalising rates earlier than previously projected based on better than expected outcomes, rather than sticking to prior calendar-based guidance. As BoC Governor Macklem noted in Q&A “our forward guidance is not calendar based, it’s outcome based” and that the guidance is “a commitment not to raise interest rates until those conditions are met. What we do when those conditions are met we’ll have to assess that at the time”.

The BoC also announced an as expected tapering of its asset purchases to $3bn a week from $4bn a week and down from last year’s original pace of $5 bn a week, reflecting the “progress made in the economic recovery”. The tapering is also in line with lower bond issuance (recall post the budget earlier this week it was announced that bond issuance would be C$286bn from C$374bn). The BoC currently owns 40% of bond outstandings and without a change in weekly purchases the percentage of bonds the BoC would own would quickly escalate.

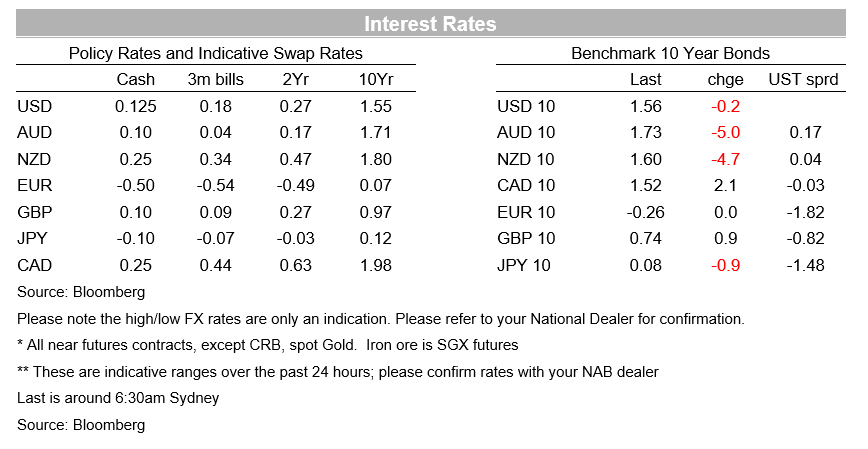

The market reaction was swift with the CAD appreciating almost 1% overnight (USD/CAD -0.8% to 1.2495) and trading close to its highest level since early 2018. The Canadian 10-year bond yield jumped 6-7bps to an intra-day high of 1.557% but closed at 1.52% (up only 2.4bps on the day). Bill futures sold-off 9-10bps and with an almost 50% chance priced that the BoC will raise rates this time next year.

The key question for markets is does the BoC Statement prove to be a watershed moment for central banks in which they revert back to outcomes based guidance as the data improves and away from calendar based guidance that was calibrated in the depths of the pandemic? Our eyes will be on US Fed Chair Powell in his press conference next week where no doubt he will be asked a question, as well as to the RBA on May 4 and the Statement on Monetary Policy where the unemployment rate track is running more than a year ahead of prior forecasts.

Interestingly outside of Canada, there has been little movement in global rates. The US 10-year rate is trading at around 1.57% currently, close to yesterday’s close, while European rates were little moved ahead of the ECB meeting tonight. The strength in the CAD though has spilled over into the AUD (+0.2%) and NZD (+0.4%) overnight. The AUD is currently trading at 0.7752.

Like global rates, movements in the major currencies (the EUR, JPY and GBP) have been small overnight. An on-consensus UK CPI print with core at 1.1% y/y had little impact on GBP.

The EUR briefly dipped below 1.20, but it has since recovered to 1.2034 to be unchanged on the day. There was little reaction to news that Germany’s Constitutional Court had made a summary judgement that allows the German government to participate in the €750b European recovery fund. The USD is down marginally overnight, in index terms, mainly reflecting the appreciation in the CAD.

Across the ditch, NZ Q1 CPI yesterday was right in-line with market expectations, with headline inflation of 0.8% q/q in Q1 and 1.5% y/y on a year ago. The RBNZ’s Sectoral Factor Model of core inflation increased to 1.9% y/y, from 1.8%, its highest level since 2010 (note the RBNZ targets inflation at 1-3%). There was little market reaction with markets continuing to price around a 50% of a 25bps rate hike by mid-2022 and full hike by the end of the year.

NAB also finalised its Australian Q1 CPI forecast following the NZ numbers yesterday, sticking to our initial forecast of 0.9% q/q for headline and 0.5%q/q for core trimmed mean. NZ’s Q1 CPI did not tilt the risks around our initial forecast given the on-consensus read. We continue to flag upside risks to our forecasts based on the possibility of higher than expected rental inflation and uncertainty around the ability of retailers to pass on higher input costs. Our Trimmed Mean measure is 0.54 unrounded with a low bar to rounding up to 0.6 q/q. Australian Q1 CPI is published next week on 28 April (please see NAB’s CPI Preview Update for details).

A very quiet day with no data scheduled for Australia. Offshore the biggest evet is the ECB, though no change to rates or guidance is expected. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.