NAB specialists and clients from across the bank’s Fund Sponsors, Strategic Investors and Alternative Assets (FSA) business gathered over lunch recently to share career stories and advice on promoting greater diversity and inclusion.

US CPI cools as expected, but with even more encouraging details.

“And my soul keeps a-singing the blues; Roll over Beethoven; Tell Tchaikovsky the news; Well, if you feel and like it”, Chuck Berry, 1956

An as expected US CPI and favourable details in the core has seen sizeable moves in markets, further extending the positive start to the new year. Core CPI came in as expected at 0.3% m/m and 5.7% y/y. Importantly the 3m annualised core rate is now running at 3.14%, its lowest reading in 15 months. The split of Core CPI was even more favourable with the Powell’s glamour statistic of ‘services less shelter’ now running at 1.2% 3m annualised, while ‘goods excluding energy’ is in outright deflation at -4.8% 3m annualised. Rents of course is bucking that trend, running at 9.2% 3m annualised and reflecting the rental market in H1 2022, but new rents as measured by Zillow etc has slowed sharply which should mean this category will turn in a few months’ time (see chart below). Overall inflation is easing in the US, with markets taking that as a sign that the Fed will be able to pause, and that as the economy starts to react to the monetary tightening put into place, the Fed will cut rates in H2 2023. For reference headline inflation was -0.1% m/m and 6.5% y/y.

Market moves were sharp. US Fed Funds pricing is now expecting a 25bp hike in February, with now only a 10% chance of a 50bp hike. That compares to a 25.6% chance of a 50bp hike the day before. There is also some probability that the Fed is now one and done and can pause after February with only a cumulative 46.1bps priced for February and March (meaning around a 15% chance of the Fed doesn’t raise rates in March), compared to 50.6 the day before. Rate cuts in H2 2023 were also extended with 52bps worth of cuts priced after rates peak around 4.9%, compared to 49bps worth the day before. Yields fell sharply with 2-year yields down around -8bps post the numbers and are down around -9.6bps over the past 24 hours to 4.13%. 10-year yields fell around -8.4bps post the numbers and are now down around -9.2bps over the past 24 hours to 3.45%. With CPI details soft, implied breakeven fell around -1.8bps with the 10yr implied now at 2.22%, while real yields have fallen sharply by -7.9bps to 1.22%. the 2Y/10Y curve is barely changed at -70bp. Continuing the week’s theme of solid interest in UST primary markets, the 30Y note auction late in the session stopped through with indirect bids of nearly 75%.

Equity markets, which had rallied sharply since the beginning of the year, extended gains with the S&P500 up 0.5% as we head into the close and is currently at its 200day moving average at 3,984. For equities, the next three weeks brings a flurry of profit reporting with banks first up with BofA, JPMorgan, Wells Fargo and Citi Group all reporting before the market opens. Both headline earnings and anecdotes regarding the outlook will be watched closely to gauge the resiliency of households and firms to higher rates, and to what extent corporate earnings take a hit from higher rates. Some hint of where earnings may go for the tech sector at least could be reflected in TSMC’s earnings yesterday, which while beating expectations, said revenue could drop as much as around 5% in the current quarter. CEO C.C. Wei said he forecast a sharp drop in inventory in the semiconductor supply chain through the first half of this year, and that would be followed by a recovery in the second half (see WSJ:

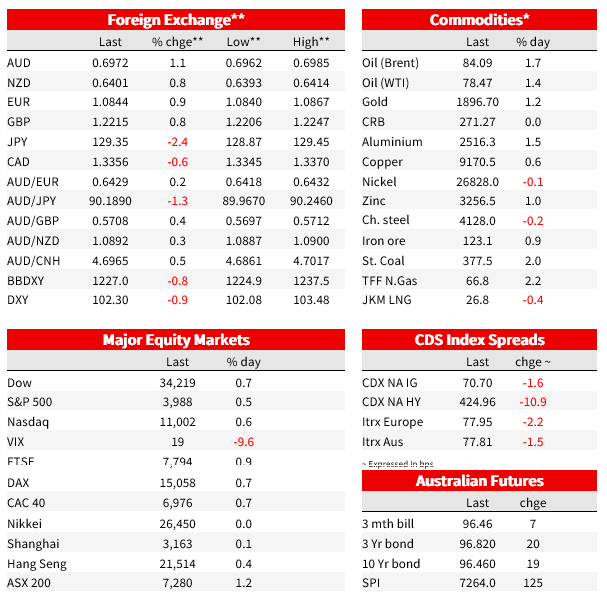

In FX, it was all about USD weakness with the DXY -0.7% post the CPI figures and -0.9% over the past 24 hours. Most pairs surged higher after some initial volatility as people digested the figures. USD/JPY was the standout over the past 24 hours -2.4%, breaking through 130 to 129.35. Yesterday there was talk of the BoJ further adjusting YCC with the Yomiuri newspaper stating the BOJ will consider adjusting bond purchases or other policy changes to counter turbulence caused by tweaks to its yield-curve control settings last month. The AUD was the other standout +1.1% to 0.6972. Other pairs were NZD +0.8% to 0.6401, EUR +0.9% to 1.0844, GBP +0.8% to 1.2215. Reflective of USD weakness, the gold price also surged up 1.2% to 1,897 (after briefly breaking through 1,900).

As for the Fed’s reaction, we had three Fed speakers who seemed to give more support to a 25bp move in February. The Fed’s Harker said: “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed,” Harker said in a speech to a local group in Malvern, Pa. “In my view, hikes of 25 basis points will be appropriate going forward.” Some prospect of a pause of course is getting close, with Harker also stating: “At some point this year, I expect that the policy rate will be restrictive enough that we will hold rates in place to let monetary policy do its work”. The Fed’s Bullard who has been much more hawkish said the Fed needed to keep to their script and get rates to 5% and then “The Fed is going to have to maintain rates at high enough levels” to bring inflation down and keep it down. Barkin also made similar comments, but also noted CPI was being distorted by declining goods prices that the median CPI had stayed high (the Cleveland Fed’s median CPI was 0.4% m/m along with the trimmed CPI, compared to core CPI of 0.3% m/m).

Other data out overnight included US Jobless Claims, which remained very low at 205k against 215k expected. It is difficult to seasonally adjust at this time of year and what we do know is job layoffs are lifting, but there still remains 1.7 job vacancies per unemployed person in the US. Elsewhere, yesterday China’s PPI was much softer than expected at -0.7% m/m against -0.1% expected. Much can probably be attributed to December’s covid situation and weakness elsewhere in the economy. This in some ways is old news now that China has pivoted to living with covid and is supporting its property sector. CPI was as expected at 1.8% y/y. There data was not market moving, though for those looking for a reason to expect disinflation, it would be one.

Finally in Australia, two pieces of data worth noting yesterday: (1) SEEK Job Ads fell 2.6% in December, its seventh consecutive month of decline, with the level of ads now 21.1% below their May 2022 peak. It is likely a combination of normalising labour supply as net migration lifts (the working age population 15 years plus increased by 417k over the year to November 2022, compared to 104k in the year to November 2021; note it was 333k in year to November 2019), a slowing of hiring as the rapid reopening recovery fades, fewer people working fewer hours due to illness, and in some industries an outlook for slowing in activity as tighter financial conditions start to bite, driving; and (2) Freight service imports fell sharply in November to 5.4% of the value of imported goods, from 6.4% and well down from the peak of 6.7%; prior the pandemic it averaged 3.1%. The fall in realised freight costs confirms that the earlier fall in global container shipping rates is now flowing through to Australian importers.

Macro chart of the day – US inflation is easing sharply

Markets chart of the day – US dollar firmly lower and helping to lift the gold price

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.