Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

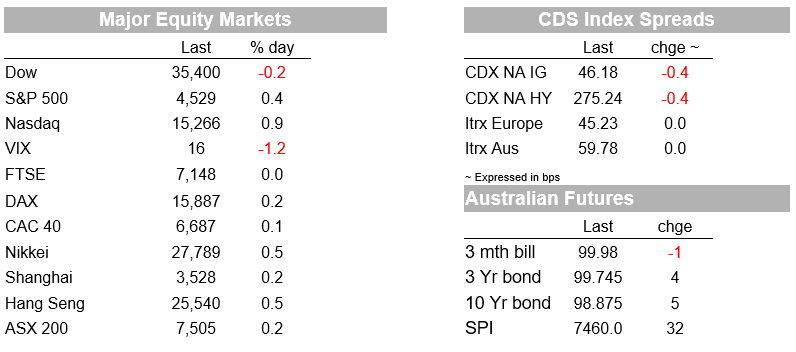

A quiet night with markets continuing to bask in the glow of Powell’s Jackson Hole speech. The explicit de linking of tapering to rate rises has allowed equity markets to rally, while yields have moved lower. The S&P500 rose 0.4% overnight and is up 1.3% since Jackson Hole on Friday.

A quiet night with markets continuing to bask in the glow of Powell’s Jackson Hole speech. The explicit de‑linking of tapering to rate rises has allowed equity markets to rally, while yields have moved lower. The S&P500 rose 0.4% overnight and is up 1.3% since Jackson Hole on Friday. Technology stocks led the rally in US equities overnight (IT sub-sector +1.1% and NASDAQ +0.9%), more than offsetting the decline in insurers (‑1.2%) and energy (-1.2%) following Tropical Storm Ida. The rate-sensitive 5 year Treasury yield fell -3.0bps to 0.7676% and is down -8.0bps since Jackson hole. The 10yr yield has also fallen -2.8bps to 1.28% and is down -6.7bps since Jackson Hole. Moves since Jackson Hole have been led by real-yields with the 10yr TIP down 9.0bps to ‑1.09% and the breakeven is up 2bps to 2.3681% since Friday.

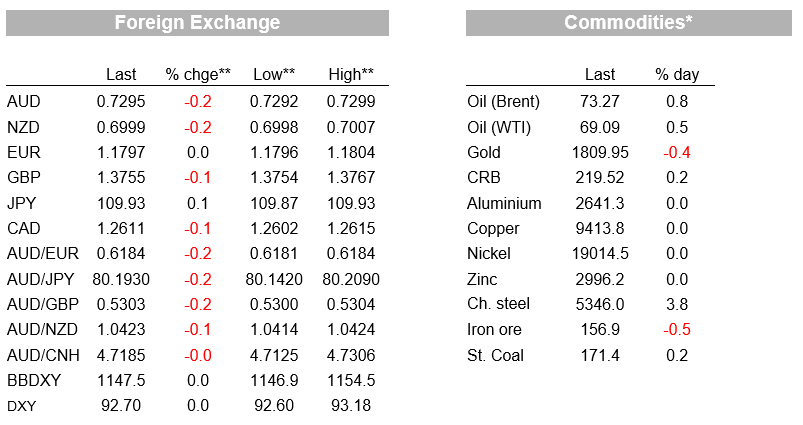

FX moves have been muted with the USD broadly flat against most pairs (EUR +0.0%, GBP -0.1% and USD/Yen +0.1%). The Swiss Franc has been the exception with USD/CHF +0.7% and EUR/CHF +0.7 %, the only reason your scribe could find was leveraged funds reducing long positions and some vague svpeculation the SNB may have intervened to weaken the CHF. The AUD was also on a weaker side, down ‑0.2% to 0.7295 with 0.73 proving to be a sticky resistance level at the current juncture. As for month-end flows, most models favour dollar selling, especially given US equity market outperformance. For reference, over the month the S&P500 is up 3.0% (NASDAQ 4.0%) and the Eurostoxx 50 +2.0% (Eurostoxx 600 +2.4%) as of Aug 30 closes.

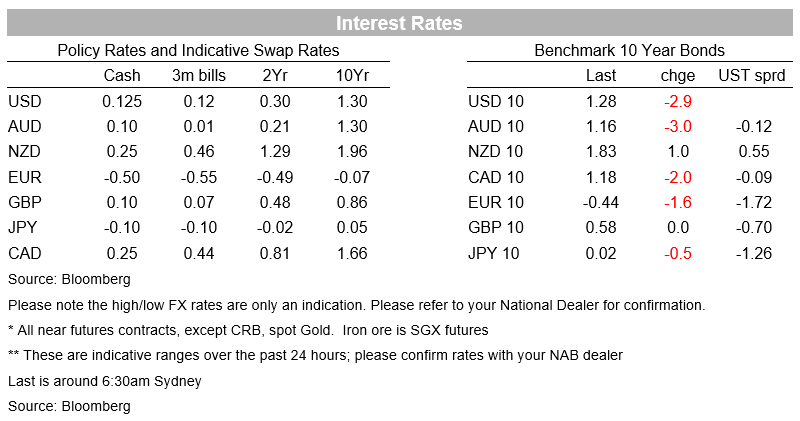

Markets outside of month end flows are likely to remain ahead of payrolls on Friday given the linking of tapering and rate rises to labour market developments. Another stellar print would firm up expectations of a near-term taper announcement as early as the September FOMC meeting, while a weaker print would see such an announcement pushed back to November or December. Progress on the labour market is also key in assessing ‘maximum employment’ and at the current payrolls pace, payrolls return to their pre-pandemic levels within seven months (as early as February 2022), while to get back to where trend payrolls would have been without the pandemic takes ten months (as early as June 2022). Accordingly the dot plot at the September FOMC meeting will be watched closely and it is worth noting that even at the June FOMC meeting, 7/18 FOMC officials at the June meeting had pencilled in a 2022 rate hike.

In terms of specific news there hasn’t been much given the northern hemisphere holiday season. The UK also had its Summer Bank Holiday on Monday. The European Union recommended halting non-essential travel from the US because of the rise of delta. Note the EU travel advisory is reviewed every two weeks with the US only having being added to the ok list in June (see WSJ: EU Recommends Halting Nonessential Travel From the U.S. Over Covid-19 ). Eurozone confidence figures were also out with confidence a tad below expectations at 117.5 against 118.0 expected. The only other piece of data worth noting was German CPI figures which were as expected at 0.1% m/m and 3.4% y/y, ahead of the wider Eurozone measures today.

Across the pond US Pending Home Sales missed (-1.8% m/m vs. +0.3% expected), while the Dallas Fed Manufacturing Index fell back to +9 from 27.3, and its lowest reading since January. Comments within he survey pointed to supply chain issues hampering production with a shortage of raw materials as well as ongoing labour shortages. The survey suggests supply chain issues are likely to hamper production – picked up in the press as well.

Meanwhile in China, the current regulatory crackdown continues with President Xi urging more work to strengthen anti-monopoly and anti-unfair competition regulations, and to improve the fight against pollution (see CCGTN: Xi highlights anti-monopoly regulation, anti-pollution fight, better reserve system ). The regulatory crackdown has the potential to slow growth and the PMIs and monthly activity indicators will be watched closely in this regard. For parents another interesting development was the announcement of curbing of videogame time for those under 18 years. New restrictions will mean there will be no online videogames during the school week, with access for one hour a day on Fridays, weekends and public holidays. To enforce the rule all online videogames will be required to connect to an “anti-addiction” system.

Domestic focus will be on the pre-GDP partials to assess whether Q2 GDP could print negative. Elsewhere the focus will be on the Chinese PMI, EZ CPI and US Conference Board Consumer Confidence. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.