A private sector improvement to support growth

Insight

The US dollar and Treasury yields both fell back on Friday in what was a good day for equities everywhere – except Australia.

ANZ NZ Feb Consumer Confidence 79.8 from 83.4

Tokyo Feb CPI ex-food & energy 3.2% from 3.0% vs 3.1% expected

Japan January unemployment rate 2.4% from 2.5% vs 2.5% expected

Australia January Home Loan Values -5.3% yr/yr from -4.3% vs -3.0% expected

China Feb Caixin Services PMI 55.0 from 52.9 vs 54.5 expected

S&P Global final Feb Eurozone Services 52.7 vs 53.0 prelim.

S&P Global final UK Services PMI 53.5 vs 53.3 prelim.

S&P Global final US Services PMI 50.6 vs 50.5 prelim.

US ISM Services headline index 55.1 from 55.2 vs 54.4 expected

US ISM Services Prices Paid 65.6 from 67.8

US ISM Services Employment 54.0 from 50.0

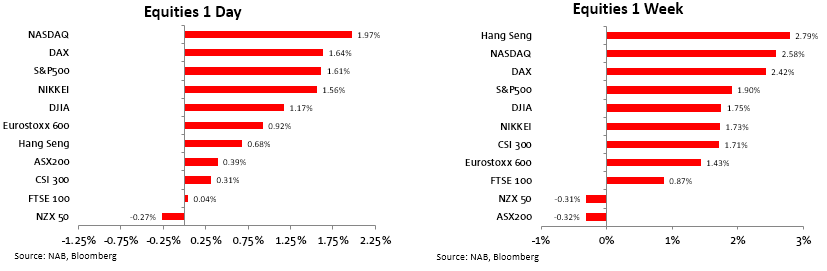

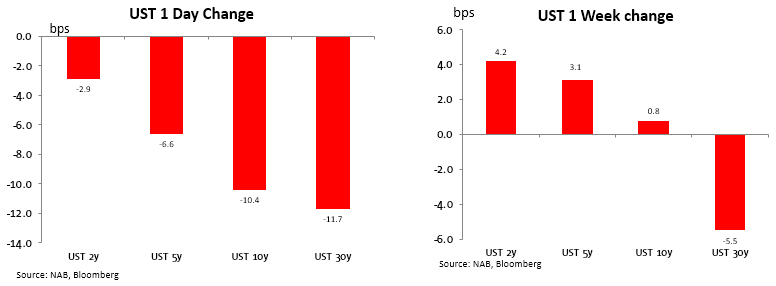

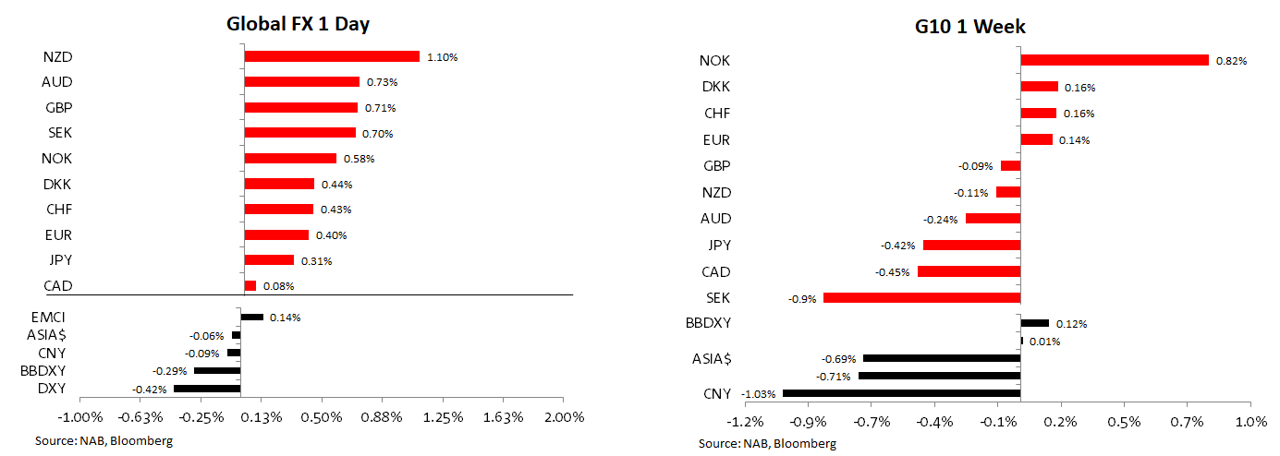

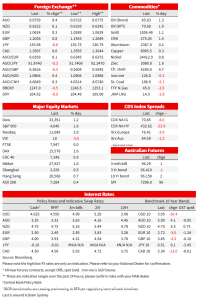

10-year US treasury yields’ sojourn above 4% commencing in the middle of last week is currently looking like just that – temporary – with the yield ending Friday at 3.95%, 11bps down on the day and against Thursday’s 4.09% high. A lot flowed from that, with the US dollar weaker across the board and now more than 1% back from its late February high (BBDXY) and stocks up as much as 2% Friday (NASDAQ) with good gains too for the S&P 500 (1.6%) and Eurostoxx 50 (1.3%) and 600 (0.9%).

There was no obvious catalyst for Friday’s price action, with US Treasury yields and the USD already heading lower, and stocks higher, in front of Friday’s supposedly all-import US ISM Services report. The headline reading of 55.1 (from 55.2 in January) was just on the high side of expectations (54.5) and signals continues good growth in the US services sector, represents some 80% of the US economy. The Employment reading was also strong, up to 54.0 from 50.0. Yet after some market convulsions immediately after the release, markets resumed travel in their pre-ISM release direction.

On supportive factor here was the Prices Paid component of the ISM report, which while still high at 65.6 is down on January’s 67.8, representing a fourth consecutive monthly decline and further off its December 2021 high of 84.5. So some relief, we suspect, that the blip higher in the Manufacturing ISM Prices Paid reading two days prior was not repeated in the Services survey.

Friday’s equity market gains meant a decent extention of what as of Thursday night’s close was a small-scale ‘up’ week. Hong Kong’s Hang Seng finished in pole position, +2.8%, with added support Friday from the Caixin Serives PMI which at 55.0 from 52.9 in January corroborated the message from the NBS editions earlier in the week – the Chinese consumer is back.

On this score, China’s annual National Party Congress commenced on Sunday (continues through March 13) . Premier Li Keqiang submitted his final government work report, in which he outlined a GDP growth target of ‘around 5%’ for this year with a focus on expanding domestic demand, with a CPI target of about 3%, budget deficit target of 3% of GDP and the addition of 12 million urban jobs. Defence spending is slated to rise 7.2%, its fastest pace in four years. There was some speculation last week of a higher (closer to 6%) growth target for this year, but we doubt markets will be expressing much if any disappointment today, especially after last week’s string of upside PMI surprises.

The NASDAQ ended the week not far behind the Hang Seng, and decent gains for most other US, European and Asian stocks contrasted with a small down week for both the ASX 200 and NZX 50.

In bond market, Friday’s Treasury market rally meant that over the week 10s were virtually unchanged (up less than 1bps) but with further curve flattening most evident via a 10bps fall in the 2/30s spread.

Fed comments on Friday and over the weekend were very much ‘on message’ San Francisco Fed President Mary Daly (2023 non-voter) speaking on Saturday said policymakers will likely need to raise interest rates higher and maintain them at elevated levels for a longer period of time. “It’s clear there is more work to do,” Daly said, an that “In order to put this episode of high inflation behind us, further policy tightening, maintained for a longer time, will likely be necessary.” In a call with reporters following the speech, Daly repeated that she supports raising rates to somewhere between 5% and 5.5%, roughly in line with the December dot plot median of 5.1%.

Richmond Fed President Thomas Barkin on Friday evening (also a 2023 non-voter) said the central bank must continue raising interest rates and hold them there at a high level to move inflation lower over time. “Inflation is likely past peak,” Barkin said, “But I think it will take time to return to target, and, as a consequence, believe we still have work to do.” Barkin didn’t give a number for how high he thought rates needed to go but notes that policymakers’ projections “made clear that we don’t anticipate rate cuts this year”.

And finally from Boston Fed President Susan Collins (also a non-voter): “I anticipate that reducing inflation back to target will require additional federal funds rate increases to bring interest rates to a sufficiently restrictive level, and then holding there for some perhaps extended time.”

From the ECB, President Lagarde told El Correo in an interview published on Saturday night that, “It is very likely that we will raise interest rates by 50 basis points (in March)…this was a decision that was indicated at our last monetary policy meeting and all the numbers we have been seeing in recent days are confirming that this interest rate hike is very, very likely.” She went on to say “I cannot tell you how high rates will go…I know that they will be higher than they are now and we still have more work to do because we cannot declare victory. We are making progress, but we still have work to do”. Lagarde’s ECB GC colleague Madis Muller earlier (late Friday) said “It’s most likely this won’t be the last rate rise in this cycle…It’s quite possible that interest rates will need to stay high for quite some time so that we can be sure that inflation will come back to, and remain at, close to 2%.”

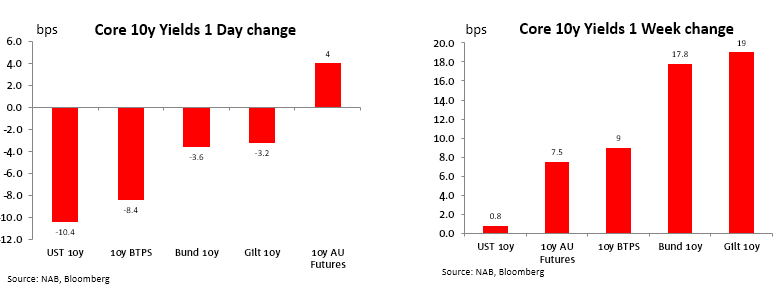

The flat week for US 10s contrasted with higher yields elsewhere, of 7.5bps for Australia and 18-19bps for both Bunds and Gilts (the latter despite BoE Governor Bailey indicating earlier in the week that it was possible the Bank of England could already be done tightening).

In currencies , a glance at the daily and weekly chart below tells us that almost all of the net change in major currencies over the week occurred on Friday (e.g. DXY and BBDXY both -0.5% Friday and DXY -0.7% on the week, BBDXY -0.8%). GBP was Friday’s best performer, for no obvious ‘new news’ reason albeit a re-rating of Sterling is in our view justified by the ‘Windsor Agreement’ stuck earlier in the week re-writing the Northern Ireland protocol within the post-Brexit EU-U trade agreement. On the week, it was the NZD which fared best (0.9%) keying, for one thing, off the Strong China PMI data and a related pull back in USD/CNY from above 6.95 to below 6.90, but where the AUD was somewhat restrained by the softer than expected 0.5% Q4 GDP print in mid-week. From a post-GDP weekly low of 0.6695, AUD ended Friday at around 0.6770.

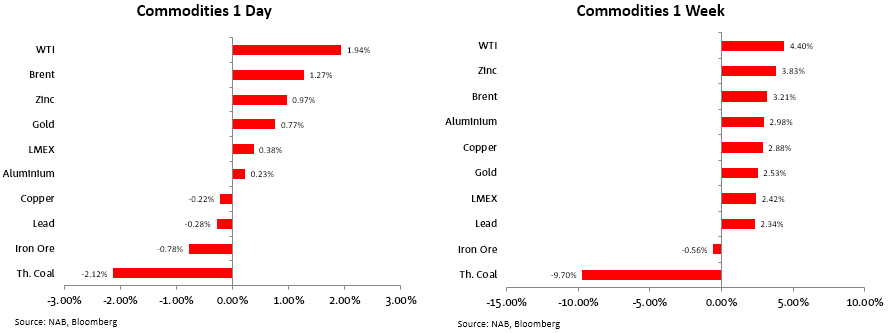

In commodities , gains for everything last week bar a small fall for iron ore and near 10% drop for thermal coal are consistent with the accelerating growth signals from China’s PMIs and the modestly weaker USD.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.