We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Ahead of US CPI tonight, oil prices have ratcheted higher as OPEC+ cuts continue to bite

I met a man in Texas, And oh, he was so fine, And I said to myself, Self, I’m gonna make him mine, He owned a lot of oil wells and his bank roll sure was healthy, And I knew if I married him I’d suddenly be wealthy – Dolly Parton

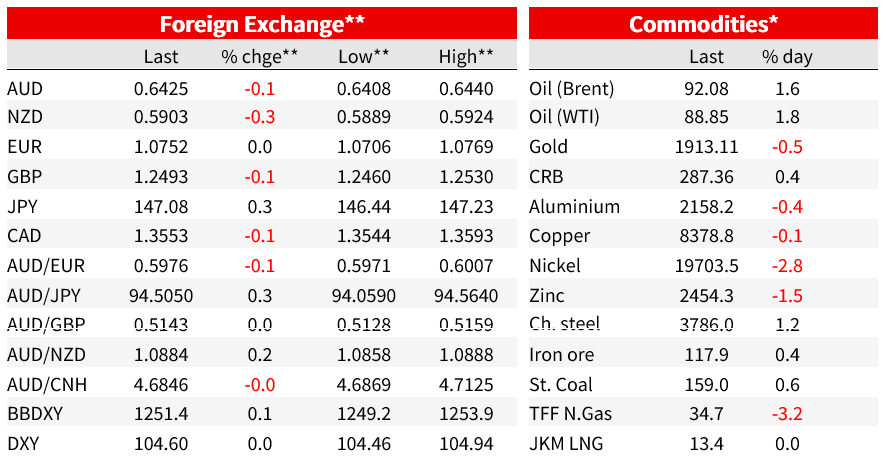

Apologies, that is cringeworthy. But hey, there aren’t a lot of ‘oil’ songs around. Limited movements across market ahead of US CPI tonight, with bond yields little changed either side of an ok 10-year Treasury Note auction, though equities are mostly lower, led by a near 1% fall for the NASDAQ while in currencies, the USD has recouped a little of Mondays Yen and Yuan inspired losses. The only G10 currency up on the USD is CAD, aided by a further lift in oil prices and where WTI crude is up almost 2% to around $89 (and Brent to above $92).

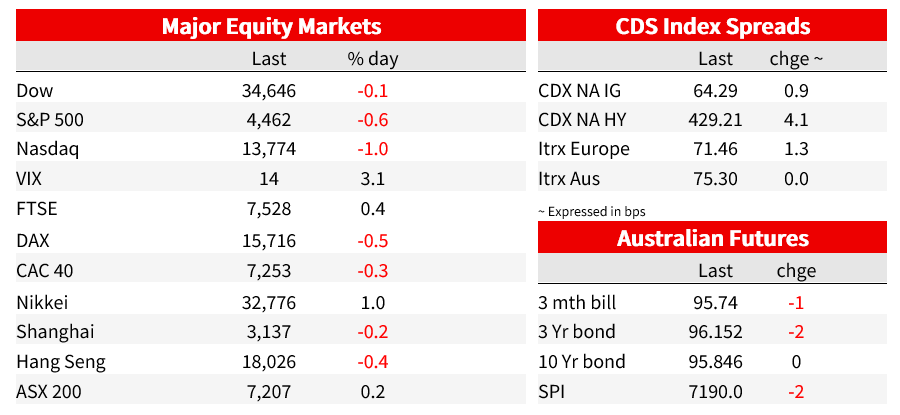

Ahead of this week’s banner economic event tonight that is US CPI, US technology stocks have led broader stock market declines, the NASDAQ finishing just over 1% down and the S&P500 by 0.6%. Some stock-specific action has driven the NASDAQ fall, with Oracle down 14% after issuing new revenue guidance below prevailing street expectations, and Apple off about 2% in what is being viewed as a classic ‘sell-the-news’ response to a new product launch (in this case the iPhone 15). Earlier Tuesday, European stocks closed mixed (nothing up or down by more than 0.5%) following what wa also a mixed APAC day (Nikkei up1% and ASX 200 0.2% but Shanghai and Hong Kong slightly lower).

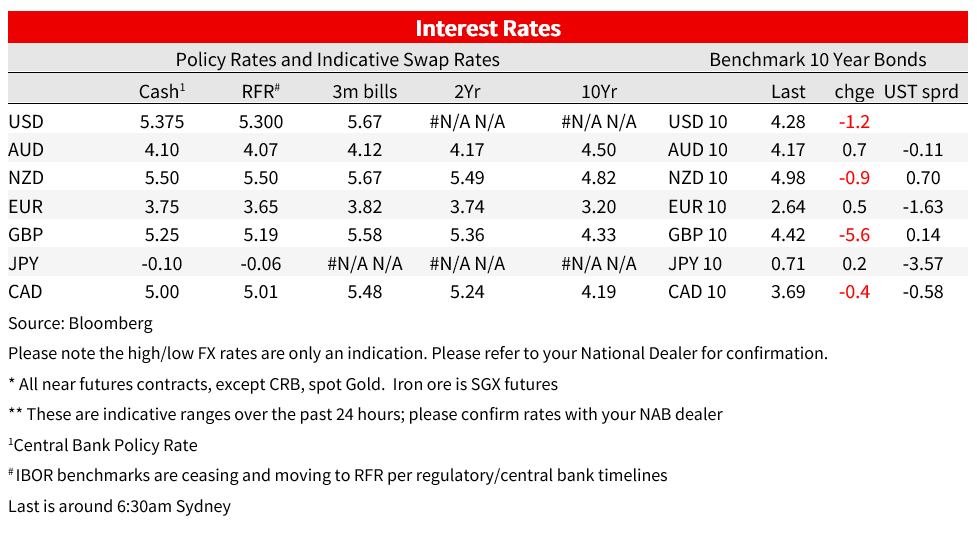

In bond markets, US Treasury yields are a touch lower than Monday, with 10s -2.0bps to 4.27% (so a bit of a pull back from Monday’s JGB-inspired move up). The Treasury’s $35 billion 10-year note auction was awarded at 4.289%, the highest result since 2007, but matching the pre-sale ‘when-issued’ yield at the 1pm bidding deadline, so eliciting little post-auction reaction. The 30-year sale, on Thursday and post US CPI, could be more interesting.

In currencies, following Monday’s JPY and CNY inspired USD losses, there has been no follow through Tuesday, amid a bit more scepticism as to whether the BoJ might really abandon negative policy rates before year end (albeit we have seen no row-back from any BoJ official to Governor Ueda’s weekend Yomiuri comments). USD/JPY is back up by 0.4% while USD/CNY flat-lined just below 7.30 through Tuesday’s session. Other G10 currencies show losses of 0.1-0.3% (AUD -0.1% to 0.6426) the only exception being CAD, +0.1%. Gains for the latter follows latest oil price gains as the impact of OPEC+ supply cuts continue to be felt. WTI crude is up $1.60 to $88.88 as I type (a bit back from earlier highs).

On the data front, UK labour market data showed headline earnings up to 8.5% in July versus 8.2% expected and with June revised up to 8.4% from 8.2%. Ex-bonuses, and of more significance, the rise was a lesser 7.8%. unchanged and in line with expectations. Moreover, the unchanged 3m/3m rate reflected a combination of increase in public sector pay growth (6.6% from 6.2% – not something ‘employers can can/pass on through higher prices – with private sector pay growth down to 8.1% from 8.2%. meanwhile the (more up to date Decision Makers Panel data for August published by the BoE last week shows a slower rate of pay growth than the (July) ONS figures). Market reflection on this appears to be the reason that UK money markets slightly reduced pricing for a BoE quarter point rate hike last week (from 78.5% to 76%) and GBP was weaker not stronger out of the data.

In other data, the German ZEW survey showed a further deterioration in the Current Situation reading, to -79.4 for September from -71.3 – a level last seen during the pandemic – but an unexpected improvement in Expectations, to -11.4 from -12.3, against consensus for a fall to -15.0. We also had the latest US NFIB small Business Optimism survey, little changed at 91.3 in August. A depressed level, albeit still up its April 2023 cycle low.

Yesterday’s NAB Business Survey showed conditions rose 2 points in August, continuing a run of resilience through the middle of the year where conditions have remained well above average despite the broader slowing in the economy. the survey results for August suggest the economy remains resilient into Q3, after posting positive, if below par, 0.4% growth in Q2. Business confidence edged up to +2 index points, only a little below its long run average and sharply contrasting depressed consumer confidence. Trading conditions, profitability and employment all rose, with a broad-based uptick in conditions across most industries. Capacity utilisation also rose back above 85%. The confidence and forward orders measures both edged up though they remain below average, weighed down by deep negatives in the retail sector. Cost and price growth measures remained elevated in the survey.

In contrast, Consumer Confidence remains exceptionally weak (-1.5% this month) wallowing near GFC and pandemic era lows. In trying to reconcile the contrast, we might note that while consumer spending growth has slowed, in line with the ongoing hits to real incomes, such that (as per Q2 GDP) there is a per capital recession, the level of consumer spending remains quite high. One way to reconcile this might be to note that inward migration is running very strong, such that many businesses are still enjoying relatively high levels of activity.

Finally, in news just in Reuters is reporting that the ECB will, as part of tomorrow’s Governing Council meeting, issue downgraded growth forecast for 2023 and 2024 but will continue to see inafltion above 3% next year. The market goes into tomorrow’s meeting seeing rate hike odds at roughly 50:50.

Coming Up

Market prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.