Online retail sales growth slowed in May following a fairly strong April

Insight

Inflation expectations continues to influence markets.

https://soundcloud.com/user-291029717/inflation-hugs-and-shrinking-deficits?in=user-291029717/sets/the-morning-call

She got me under pressure, She got me under pressure – ZZ Top

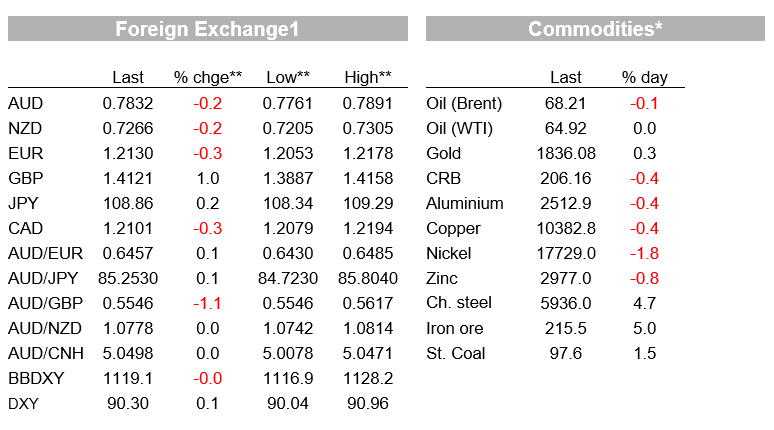

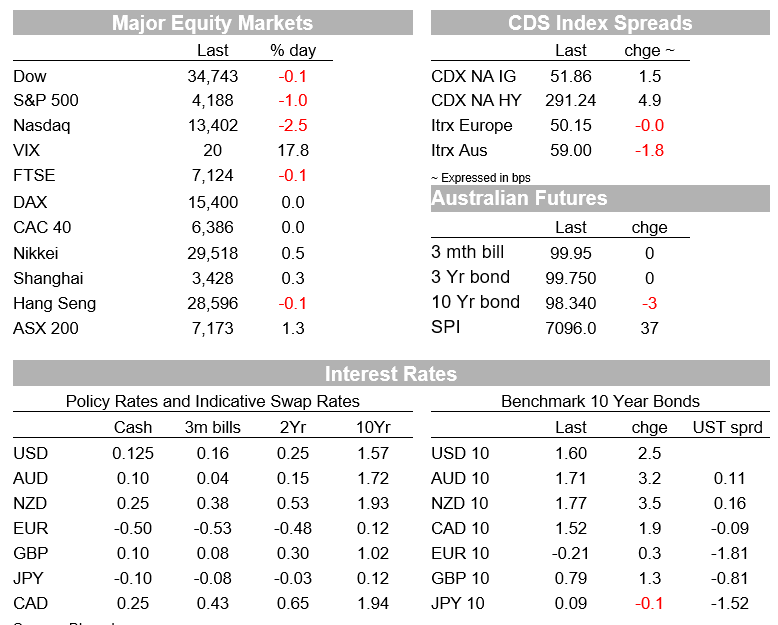

Well not sure inflation is a “She” but following a surge in commodity prices during our day session yesterday, another rise in US inflation expectations has been the main theme from the overnight price action. Tech stocks have borne the brunt of it with the NASDAQ leading the decline within US equity indices amid a clear switch towards value stocks. The UST curve has bear steepened and the USD has stayed close to its recent lows. GBP is the G10 outperformer while AUD and NZD are little changed after trading higher overnight.

Yesterday commodities began the new week with bang . Iron ore led the surge higher, jumping close to 10% at the open while metals and energy commodities gained between 1% and 2%. Friday’s soft payrolls report favoured the notion that the Fed along with other Central Banks will not be removing the punch bowl anytime soon, hence providing a fertile environment for the global economic recovery. Issues with the Colonial Pipeline also raised US oil supply concerns while in China expectations of stricter environmental regulation has added to the bull case for copper, a key ingredient in the green energy drive while steelmakers are still making money notwithstanding the increase in iron ore prices.

Overnight commodity prices settle down a little bit. Iron Ore ended the day” just 3%” higher at $213 while aluminium and copper ease by 0.4%. Oil prices are little changed, after trading over 2% higher intraday.

Still the move up in commodity prices did the damage with a new surge in US inflation expectations overnight, steepening the nominal curve. The five-year breakeven reached its highest since April 2011, trading to an overnight high of 2.77% before easing down to 2.73%. The 10-year breakeven, jumped 8bps to an overnight high of 2.5858%, pulling back to 2.53%, still up 4bps on the day. The nominal 10-year rate has traded a 1.56-1.60% range and currently sits near the top of that range, up 2bps for the day. Meanwhile the 30y bond now trades at 2.32%, 4bps higher relative to Friday’s close.

Unsurprisingly, Tech stocks have borne the brunt of it with the NASDAQ leading the decline within US equity indices amid a clear switch towards value stocks. The rise in inflation expectations along with higher nominal yields means growth stocks with higher earnings/cashflows projected out in the future now need to be discounted at a higher rate. Meanwhile as inflation expectations move higher value share become more attractive. The NASDAQ has ended the session down 2.55%, the S&P 500 is -1.04% dragged down by the IT sector (-2.53%) while Utilities and Consumer staples closed up 1.10 and 0.77%.

Moving onto currencies, USD indices have remained close to their recent lows and within G10 GBP is the outperformer, up just under 1%. Cable traded to a high of 1.458 before settling down at 1.4118. following the passing of the Scottish elections risk event. The Scottish National Party fell one seat short of an outright majority, reducing the chance of a near-term vote on independence, but aligning with the Green Party, which increased its share of the vote, would give enough votes to form a pro-independence majority. However, there are many hurdles to cross and a long time before a second referendum becomes a real threat. Current polling shows Scotland only roughly 50:50 on independence and PM Johnson would need to agree to a referendum, something that is likely to be resisted. We remain positive on the outlook for the GBP and see further strong gains ahead.

The move up in commodity prices helped the AUD trade to a fresh two-month high of 0.7891 , but now trades at 0.7830 little changed on the day. NAB’s business outlook survey wasn’t a market mover but showed several indicators stretching to fresh record highs, including the key business conditions variable, capacity utilisation and capex. There was also evidence of higher inflationary pressure.

The NZD has made a fresh two-month high, clearing the 0.73 mark, with an overnight high of 0.7305, since falling back to 0.7270. We put resistance at 0.7315 and a clearing of that would open up another look at the year-to-date high of 0.7465. Our fair value models for the AUD and NZD suggest higher levels for both currencies are likely amid an increase in risk appetite and buoyant commodity prices.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.