We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The Bank of England has upped its forecasts for the growth of the UK economy this year – from 5 percent a few months ago, up to 7.25 percent.

https://soundcloud.com/user-291029717/lets-not-get-carried-away?in=user-291029717/sets/the-morning-call

So-uh, are you experienced?

Have you ever been experienced? (-uh) – Jimi Hendrix

After a negative start US equity have ended the day in positive territory, including the NASDAQ which ended a four-day losing streak. Ahead of payrolls tonight UST yields are steady with breakevens a tad lower. The USD is broadly weaker with the AUD and NZD bouncing back following yesterday’s China headline driven decline. RBA Deputy Governor Debelle speech was not market moving, but just like Jimi Hendrix, we will need to ask ourselves if we are experienced (higher inflation) before changing policy. BoE upgrades outlook, but Bailey says “let’s not get carried away”.

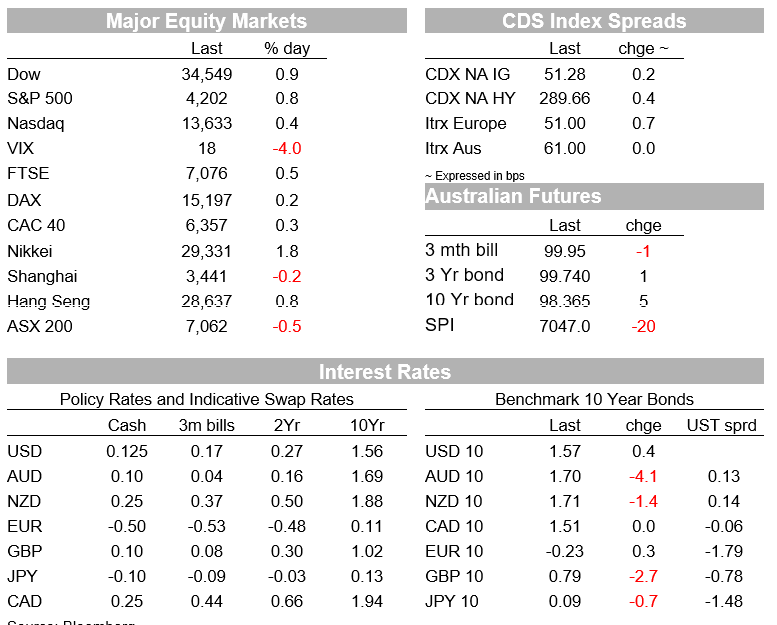

Following a negative start and volatile session, US equities have ended the day in positive territory, the S&P 500 climbed 0.82% with all sectors recording gains for the day . After spending most of the overnight session in negative territory, the last hour of power lifted the NASDAQ to +0.37%, ending a 4-day losing streak. Main regional European equity indices ended the day with modest gains, but the Stoxx Europe 600 Index eased by -0.1%, after paring a drop of as much as 0.7%.

US data releases beat expectations and in a small way probably helped with the positive vibes overnight. US Initial jobless claims fell to 498k from an upwardly-revised 590k and below the consensus, 538k. Given the ongoing improvement of the labour market, as evidenced in business surveys, it seems reasonable to suggest further declines in claims should be expected. Nonfarm labour productivity rose at a 5.4% annualized pace Q1, implying the pace of output was faster than businesses demand for labour.

Ahead of US payrolls tonight, UST yields have been marking time with the 10y tenor little changed at 1.5696%. After yesterday’s move up, breakevens have eased back from their multi-year highs with the 10y level down 2bps to 2.45% while the 5y is down 3bps to 2.677%.

Yesterday China came back online and while equity investors left their mojo on holidays with the CSI 300 ending the day down 1.22%, commodity investor came back with a bang, unleashing a new wave of solid demand. Iron ore prices topped $200 a ton for the first time ever with the Singapore iron future now trading at $200.1. The global economic recovery is lifting steel demand with China’s steelmakers keeping elevated levels of output, despite production curbs aimed at reducing carbon emissions and reining in supply. Bloomberg notes these measures have boosted steel prices and profitability at mills, allowing them to better accommodate higher iron ore costs.

Moving onto currencies the USD is broadly weaker with DXY slipping through support at 91.05-10 and now seemingly eyeing a move back to the lower levels of late April . After the BoE ( more below) GBP is the only G10 pair that is unchanged against the USD while all other currecnies are showing gains between 0.12% ( JPY) and 0.70% (CAD). Sandwiched in the middle AUD and NZD are 0.40% and 15% respectively, both antipodean currencies showing a decent recovery after yesterday’s China headlines decline.

Yesterday news hit the screens noting China was halting economic dialogue with Australia. The AUD fell from an intraday high of 0.7758% to a low of 0.7701 and in sympathy NZD fell from an intraday day high of 0.7729 to a low of 0.7186. China’s economic planning agency, the National Development and Reform Commission, announced the indefinite suspension of all activities under China-Australia Strategic Economic Dialogue. Our sense is that this is a government agreement aimed at promoting mutually beneficial and reciprocal economic cooperation and for now the dialogue breakdown does not appear to imply an imminent impact to Australia trade with China, although it does shine a light on the strained nature of the relationship.

There wasn’t much market reaction to RBA Deputy Governor Debelle’s speech last night. Most of his address was devoted at explaining in more detail the policy actions, how the huge volume of liquidity had helped to hold back borrowing costs, a reminder that higher asset prices (incl. housing) are part of the transmission mechanism and another reminder that it won’t be the likes of NAIRU models driving monetary policy decisions, but seeing actual inflation sustainably in the 2-3% target range, not forecasts. In his apt description, they’ll be driven by the “lived experience “. He mentioned and was asked about the AUD and we know that’s seen as an important element in their framework and will be in considering whether to extend QE come the July meeting, what other CBs are doing at the time. For more see here.

The Bank of England kept all its policy settings unchanged at its meeting last night, including its £875b government bond buying target. As widely expected, the Bank reduced its weekly QE bond buying pace, from £4.4b to £3.4b, to ensure it hits its bond buying target at the scheduled year-end date (the reduction to the bond buying pace doesn’t signal a change in the policy stance). Outgoing Chief Economist Andy Haldane, who has been vocal about what he sees as upside risks to both growth and inflation, voted for a reduction to the bond purchase target, effectively calling for the bond buying programme to end in August rather than December. The BoE raised its economic forecasts, with GDP now expected to get back to its pre-Covid levels in Q4 of this year, one quarter earlier than previously forecast, and unemployment now expected to peak at 5.5% rather than the previous 7.75% forecast. Still, Governor Bailey sought to hose down exuberant expectations, saying in the press conference “let’s not get carried away” and pointing out that, even on the Bank’s upgraded forecasts, the UK economy would still lose two years of GDP growth. UK rates and the GBP initially moved higher after the BOE decision, but they have since reversed course and the GBP (-0.1%) has underperformed on the day.

This morning the Fed released its Financial Stability report with the enclosed statement noting a rising appetite for risk across a variety of asset markets is stretching valuations and creating vulnerabilities in the US financial system, in this environment, prices may be vulnerable to “significant declines” should risk appetite fall.

Finally, on vaccines news , Pfizer and BioNtech announced they would be able to produce 3 billion doses this year, up from the previous 2.5 billion dose estimate from March. The news is encouraging given more countries are now relying on the Pfizer vaccine, including in Europe and Australia, with many having placed age restrictions on the use of AstraZeneca’s vaccine. Separately, the German government pushed back on suggestions from the Biden administration that Covid vaccine patents should be waived.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.