We expect growth in the global economy to remain subdued out to 2026.

Insight

The non-farm payrolls data on Friday showed 20.5 million new job losses in one month in the US and yet equities rose

https://soundcloud.com/user-291029717/markets-ignore-205-million-us-job-losses-hope-springs-eternal?in=user-291029717/sets/the-morning-call

“The road behind was rocky; But now you’re feeling cocky;…Ain’t nothin’ gonna break-a my stride; Nobody gonna slow me down, oh no; I got to keep on moving”, Matthew Wilder 1983

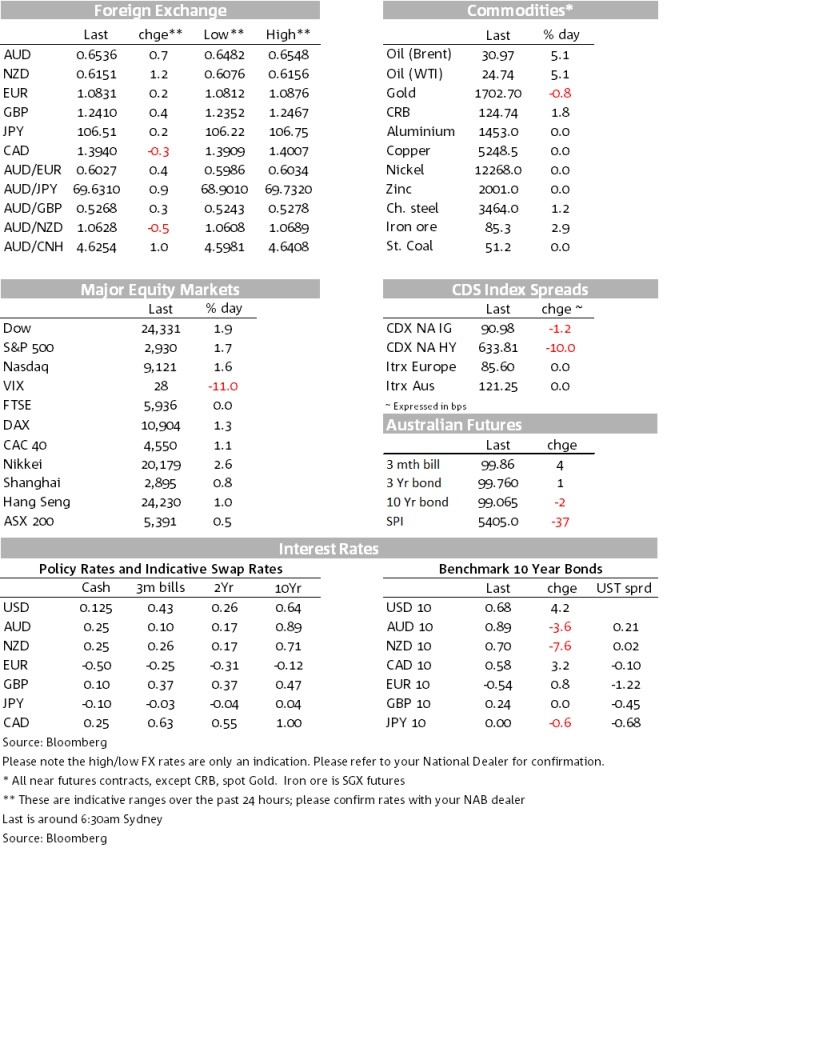

Risk sentiment was unfazed by Friday’s shocking Payrolls numbers which while slightly better than expected, still saw unemployment rising to 14.7% (from 4.4%) and 20.5m jobs being lost. Instead markets focused on how quickly activity is likely to resume following the rollback of containment measures, while concerns over US-China trade were alleviated after China’s VP He and US’ Lighthizer and Mnuchin phone call on Friday. Equities rose with the S&P500 +1.7%, while the G10 FX global growth proxies rallied with the AUD +0.7% and NZD +1.2%. Speculation of negative rates in the US has helped put the USD on the backfoot with the DXY -0.2% (and at one point -0.4%), though late in the session yields rose with Fed Funds Futures no longer pricing negative rates (Dec 2020 implies now +1bps from a low of -4bps). A speech schedule that has Fed Chair Powell speaking on Wednesday was interpreted as a likely opportunity for the Fed to push back on negative rates (recall Fed’s Barkin did this on Thursday), while on Sunday the WSJ’s Fed whisperer Timiraos penned a piece “Despite Recent Bets, Fed Isn’t Likely to Consider Negative Interest Rates” (see WSJ for details). Yields consequently rose with US 10yr yields +4.2bps and 2yr yields also rose 2bps to 0.16%. There is little on the radar today domestically apart from a speech by Treasurer Frydenberg.

Overall the data was a little bit better than expected, but still disastrous with 20.5m jobs lost (-22m expected) and the unemployment rate rose to 14.7% from 4.4% (16.0% expected). Underneath the hood the employment situation was even worse with the BLS noting the unemployment rate was understated by around 5 percentage points, meaning the unemployment rate was more like 19.5% and thus well above the consensus (for a detailed explanation see the BLS). The response rate of the Household Survey had also fallen sharply to 70% from 83% in April 2019. Still, the data is not new news with the Weekly Jobless Claims over the past seven weeks being equivalent to around 20.5% of the labour force having filed for unemployment benefits. A similar deterioration in the labour market was also seen in Canada where the unemployment rate rose to 13% (albeit below the consensus of 18.1%) and in Ireland where unemployment rose to a record 28.2% from 15.5% in March.

Sentiment instead continues to be buoyed by the rolling back of containment measures (NZ to level 2 today, France and Spain to implement some rollback today). Australia last Friday announced a plan for a 3-stage rollback of measures by July 2020 and which could see the return of 850k jobs. It will be up to individual states to rollback measures with WA moving to stage two by the weekend and NSW implementing stage one on Friday. Importantly though, even after stage three, social distancing is expected to remain place with gatherings limited to 100 people along with physical distancing guidelines of 1.5m apart. Travel restrictions would also remain in place apart from a mooted Australia-NZ-Pacific bubble. It could thus be some time until life returns back to some semblance of what it was pre-COVID-19.

Still Australia’s lockdown is ending a lot earlier than expected (and indeed much of the world), which should see a much less decay of human capital than seen in past recessions, as well as investment plans merely being delayed rather than being cancelled on the whole. A sharp pick-up in economic activity is being priced by markets, and should occur as long as there is no second wave of infections that necessitates the re-implementation of containment measures. Markets are thus likely to be increasingly sensitive to the track of new COVID-19 cases in countries that have begun to ease restrictions. Progress on a vaccine/effective treatment would also be a game changer with the leading candidate so far being the Jenner Institute’s (Oxford) trials with notable immunologist Peter Docherty saying a vaccine could be there as early as September (see Lunch with the AFR for details).

Speculation the US could embark on negative rates has been pushed back on. Fund Funds Futures has implied an effective rate as low of -4bps on Friday morning, but it has ended back in slightly positive territory at 1bps. Longer-term yields also rose with 2yr yields +2bps to 0.16% and 10yr yields +4bps to 0.68%. Helping to push back pricing was a speech schedule that revealed Chair Powell would be speaking on Wednesday night, while on Sunday the WSJ’s Timorous (who is widely seen as a Fed whisperer) said “Federal Reserve officials are unlikely to consider using negative interest rates to stimulate economic growth in the current coronavirus-induced downturn after concluding the tool’s clear costs outweigh its uncertain benefits” (see see WSJ for details). Separately, the Fed said that it would taper its US government bond buying under its QE programme for the week ahead from $8b per day to around $7b per day. It also said it would taper its purchases of mortgage bonds from $6b to $5b per day.

Was a phone call between China’s VP He and US Treasury Secretary Mnuchin and Trade Representative Lighthizer. The call helped assuage concerns over a re-igniting the trade war after recent comments by President Trump. A joint statement was released which noted that the parties “agreed that in spite of the current global health emergency, both countries fully expect to meet their obligations under the agreement in a timely manner.” Nevertheless, it is still unclear whether China can actually deliver on its purchase commitments, while President Trump later in a Fox news interview said he was “having a very hard time with China” and “I’m very — I’m very torn as to [the trade deal] — I have not decided yet, if you want to know the truth.”

Positive risk sentiment and commodity price gains (oil: +5%, copper: +1.5%) supported G10 global growth proxies. The NZD was the top-performing currency on the Friday session, rising 1.2% to around 0.6135, with the AUD sitting just behind on the current leader-board. The CAD rose 0.4%, with the market paying little attention to the Canadian employment report which revealed, amongst other things, that almost 40% of Canada’s labour force worked less than half their usual hours, or not at all. The JPY was the only currency to fall against the USD on the session (-0.4%).

Australia and China appear to be at loggerheads over barely imports with China threatening tariffs within 10 days unless Australia can explain why it shouldn’t. The tariff dispute on barely has been ongoing, though in the current climate is being tied to deteriorating relations between Canberra and Beijing (see AFR for details).

A very busy week ahead domestically with the NAB Business Survey on Tuesday and Unemployment data on Thursday which is likely to be grim. NAB expects job losses in April to total 650k (mkt: -550k), with unemployment almost doubling to 9% (mkt: 8%) on its way to a forecast peak of about 12% in June. Wages data is also out on Wednesday, but is unlikely to be market moving given it largely pre-dates COVID-19 impacts. Across the Ditch the RBNZ meet on Wednesday and the Budget is on Thursday.

China will be a key focus to see if the sharp recovery in the industrial side of the economy is sustained, and whether the Chinese consumer is still lagging the recovery. Key Chinese activity data are on Friday (Industrial Production, Retail Sales, Fixed Asset Investment), Aggregate Financing figures are due anytime in the week, and the CPI is on Tuesday. The US has a quieter week with the focal point being Retail Sales and Industrial Production on Friday.

It’s a quiet start to the week with only NZ’s Business Confidence and Card Spending scheduled, while a speech by Australian Treasurer Frydenberg will likely delve more into the impact of COVID-19 on the economy and the government’s fiscal response so far. Internationally more countries are expected to announce/implement a further easing of containment measures, including France and Denmark. Key releases in detail:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.