Online retail sales growth slowed in May following a fairly strong April

Insight

It’s been another mixed session.

https://soundcloud.com/user-291029717/mixed-sentiment-sees-markets-move-sideways?in=user-291029717/sets/the-morning-call

“We’re the kids in America (whoa); Everybody live for the music-go-round; Bright lights, the music gets faster; Look, boy, don’t check on your watch, not another glance; I’m not leaving now, honey, not a chance” Kim Wilde 1980

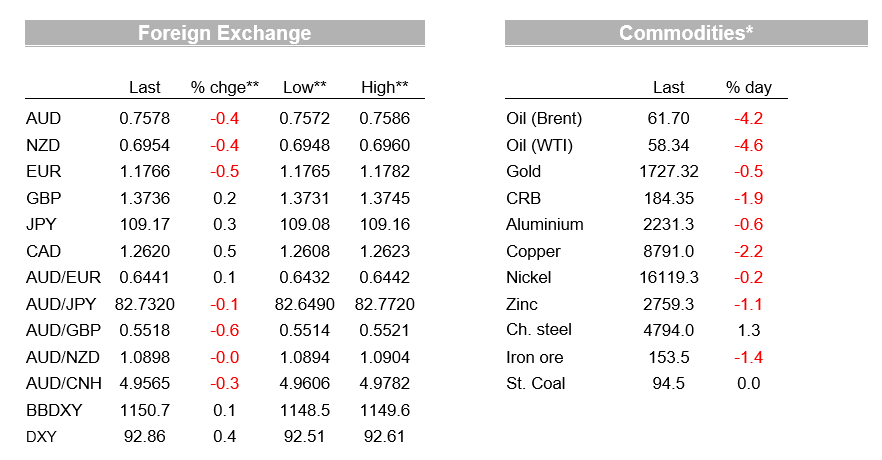

The USD continues to push higher with DXY +0.4%, near its year-to-date highs and above its 200-day moving average, while EUR (-0.5%) remains under pressure, falling through 1.18 and currently trading at 1.1766 due to concerns over rising virus cases in Europe amid a slow vaccine rollout. The tantalising prospect of economic re-opening resulting in a sharp rebound in activity in the northern hemisphere remains. However, for Europe though such a recovery is being pushed back by a quarter amid the slow vaccine rollout, while vaccine supply is being disrupted globally amid vaccine nationalism from Europe to India. The US is also seeing ongoing signs of rebound with Jobless Claims coming in lower than expected (684k v. 730k expected and 781k previously), while President Biden has raised his vaccination targets for his first 100 days in office from 100m to 200m Americans. Meanwhile in Australia the sharp recovery seen to date has seen the budget deficit improve dramatically, now expected to $150bn for 2020-21 from the projected $197.7bn back in October.

The US rebound is seeing markets question Fed rates/QE guidance at times with equities jittery at the open after Fed Chair Powell mentioned tapering in an interview: “As we make substantial further progress toward our goals, we’ll gradually roll back the amount of Treasurys and mortgage-backed securities we’ve bought” (see CNBC for details ). Nothing new in those words of course, but a hint that as the economy rebounds, Fed guidance could evolve, particularly around the asset purchase program. There was also plenty of other Fed speak with the Fed’s Evans emphasising tolerance for above target inflation (“we should be comfortable with a sustainable 2.5% inflation rate for a year”), Fed’s Bostic outing himself as one pencilling in a hike for 2023, and Vice-Chair Clarida emphasising he does not see the $1.9 trillion stimulus as being inflationary on a 3-5yr horizon.

The S&P500 traded down almost 1% at one point in reaction to that headline, but has fully recovered losses to currently trade up 0.5% with 9 of the 11 sub-sectors in the green. The cyclical rotation continues with stocks tied to re-opening leading the rebound intraday (e.g. American Airlines up more than 4%; Boeing up 3.3%). Vaccine news in the US is very positive (in contrast to Europe). President Biden has pledged to double the initial target of 100m doses in 100 days to 200m. Meanwhile the US is now showing sharp falls in hospitalisations for those aged over 65 years given the aggressive vaccine rollout (see WSJ for details ) – CDC reports 71% of those aged over 65 years have had at least one vaccine dose and almost half (44.8%) have had the full two doses (see CDC for details). Given COVID-19 impacts the most on older age demographics, the high vaccination rates amongst older age cohorts suggests the US will continue to ease restrictions despite the recent uptick in virus cases in a some states.

US yields have edged up 1.4bps to 1.62%, though a weak 7yr auction may suggest tepid investor demand amid the recovery narrative. The 7-year Treasury auction came in 2.5bps above secondary market yields at the time. Bond auctions are coming under focus given the amount of debt issuance needed in order to fund the ballooning budget deficit as a result of massive fiscal stimulus. Note a very weak 7-year auction last month, which came 6bps above pre-auction levels, triggered the initial break in the US 10-year yield above 1.5%. In contrast across the pond, European government bond yields have rallied on the less optimistic outlook with German 10yr yields -3.8bps to -0.38%. Looking to next week, there a few reports that recent losses in bond funds over the past few weeks may see a significant portfolio rebalancing out of equities and into bonds to maintain asset allocation weights, and that such rebalancing into quarter end may be behind some of the recent pullback in yields.

Also in vaccine news, AstraZeneca restated the results from its large-scale Covid-19 vaccine trials yesterday, after US regulators raised doubts around the initial results. The updated results show the vaccine was 76% effective, only marginally lower than the original 79%. AstraZeneca and Oxford University, with which it has developed the vaccine, said they planned to seek emergency use authorisation in the US shortly. The vaccine is already in wide use in the UK and has also been used in Europe, albeit supply bottlenecks have crippled its distribution on the continent. Elsewhere, India has reportedly banned the export of Covid-19 vaccines, in order to prioritise domestic vaccination. India is a major production hub for vaccine producers and the measures, which the FT reports could last two to three months, could slow down the vaccination drive in other countries, including the UK.

In FX, it has been a story of USD strength with the DXY up 0.4% and now above its 200-day moving average at 92.88. Much of the strength in the USD is coming at the expense of EUR which is trading below 1.18 at 1.1766. Differences in the vaccination path and the pushing back of the European economic recovery story by a quarter is the main driver. Vaccine nationalism also risks the vaccine rollouts in other countries, particularly Asia which is not well advanced in their rollouts. As such a period of USD strength may persist with economic data likely to rebound strongly in the US as re-opening continues. Other FX pairs have also reflected USD strength with both the AUD -0.4% and NZD -0.4%

Finally in Australian news, the government budget deficit is improving much more quickly than forecast. The AFR reports the deficit for 2020-21 is expected to come in at around $150bn, compared to the most recent December MYEFO projection of $197.7bn (see AFR for details). My colleague Ken Crompton notes that for rates, lower issuance might keep AU-US spreads a little tighter in the short term, but ultimately the extent to which improving fiscal position is driven by better macro fundamentals rather than deliberate fiscal tightening points towards wider spreads – other things remaining equal.

A quiet day for Australia with no data scheduled. Offshore the German IFO and US PCE figures are likely to be the most market moving pieces of data. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.