On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

Equities in the US finished Friday on new highs.

https://soundcloud.com/user-291029717/new-highs-fast-jabs-and-more-inflation-brush-off?in=user-291029717/sets/the-morning-call

“Cause we gon’ rock this club, we gon’ go all night; We gon’ light it up like it’s dynamite; ‘Cause I told you once, now I told you twice; We gon’ light it up like it’s dynamite” Taio Cruz 2010

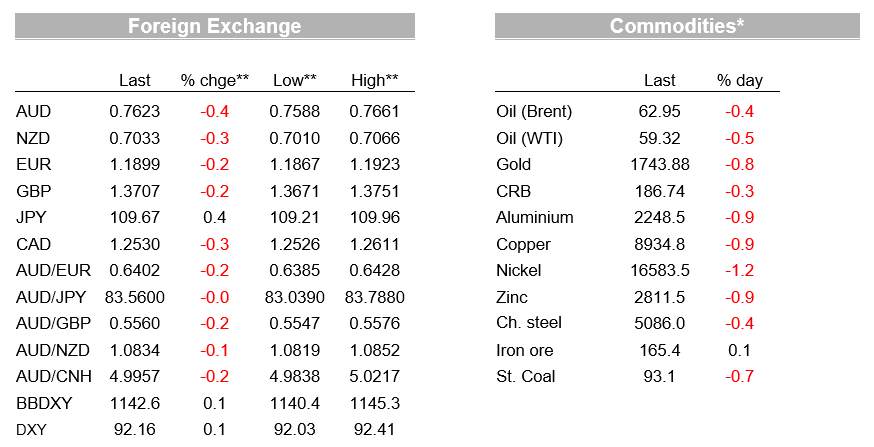

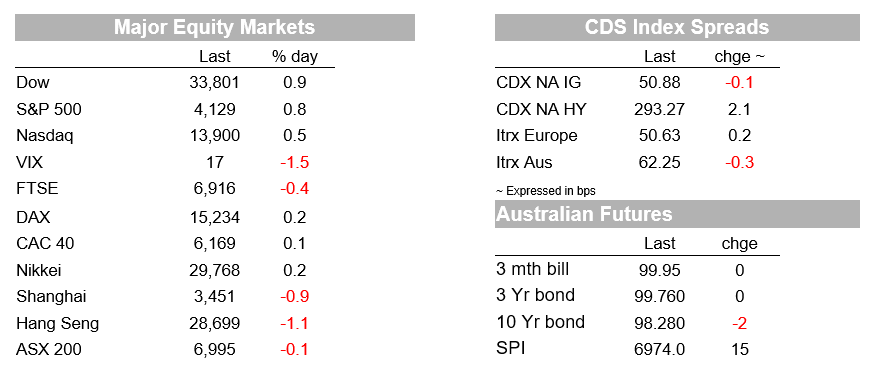

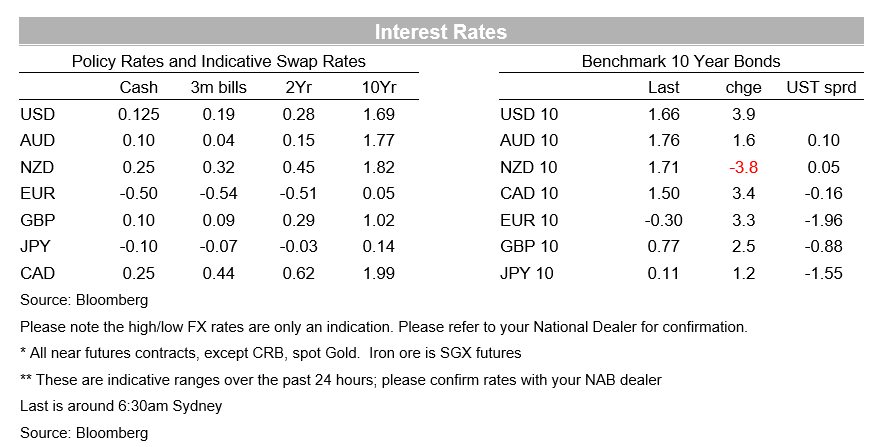

Equity markets lifted further on Friday to record highs with investors upbeat ahead of Q1 earnings season this week. A stronger than expected US PPI print (core 3.1% v. 2.7% expected) did not faze equity investors, though did help drive bond yields higher with the US 10yr yield up 3.9bps to 1.66% (intra-day high of 1.685% after the PPI data). Nevertheless, over the past week yields have consolidated with 10yr yields down 5bps on the week, allowing some breathing space for equity investors with the S&P500 up 0.8% on Friday and 2.7% on the week. The broader thematic of a rapid rebound in the US economy on the back of an impressive vaccine rollout continues with the CDC noting 183.5m doses have been given and 60.6% of the 65 years population is now fully vaccinated. The USD moved in line with yields with DXY up 0.1% on Friday, but down 0.9% on the week. Commodities were also weighed down by a higher USD and higher yields.

Key for the near-term outlook will be whether yields continue to consolidate around these levels, or march higher. The Fed’s Kaplan noted he wouldn’t be surprised if 10 years drifted up to a yield of 1.75 to 2.0%, while a recent WSJ survey has economists pencilling in a 10yr yield of 1.9% by year’s end and 2.5% in 2023. Key for the rates outlook will be inflation data, a hint of that on Friday in the reaction to the PPI which was greater than expected. Core PPI (excluding food and energy) rose 0.7% m/m v. 0.2% expected, while the annual rate also lifted to 3.1% from 2.7%, partly reflecting base effects, but also higher commodity prices and supply-chain disruptions. Note this week we get CPI data on Tuesday (see coming up for details). Bond supply is also another factor with US Treasury issuing $38bn of 3-year bonds, $38bn of 10-year bonds and $24bn of 30-year bonds. Kaplan though notes there is no shortage of capital flowing to Treasuries.

Fed speak has turned more positive on the economy, though officials still see any near-term inflation pick-up as transitory. Chair Powell speaking on 60 Minutes on Sunday said “We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation coming much more quickly”. As for how will the Fed know if it is right on inflation, the Fed’s Clarida noted on Friday “ If inflation at the end of the year has not declined from where it is in the middle of the year that will be some good evidence” that the Fed’s current outlook is wrong. And that while the baseline is for any lift in inflation to be transitory, “in the risk case in which inflation were to begin to move above a level consistent with price stability, we would have the tools to address that and I am confident that we would.” (see Bloomberg Surveillance Podcast for the interview ).

The Fed’s Kaplan also noted that he wants to start talking about tapering asset purchases seemingly in Q3. Kaplan said: “You don’t want to be pre-empetive, but I also don’t want to be so reactive that we are late” and that he would be looking at both data and forecasts over the next “several months ” and would advocate forcibly. More positive Fed speak recently and some notion of inflation starting picking up given the quicker than expected recovery sees the consensus for a Fed rate hike in mid-2023, a year earlier than what the Fed is signalling (see WSJ survey for details). Unemployment is expected to fall sharply to 4.8% by year’s end, while the projected lift inflation is likely to show a little bit of persistence with 2.6% y/y pegged for December. Kaplan’s comments also serve as a reminder that the Fed’s comments and projections will likely change as the economy evolves.

The other broader thematic continues to the US outperformance relative to Europe and what that means for European yields. The ECB’s Panetta in a weekend interview noted Europe will underperform the US: “And, unlike the United States, we will not return to our pre-crisis growth path, meaning that we may have permanently lost two years of growth.” AND “we need more ambition to help economic activity reach its potential and see inflation converge towards our aim. Given the diverging near-term paths, the ECB is likely to continue to intervene to keep rates yields low in Europe with Panetta noting the rationale for the ECB’s earlier intervention “ We saw the risk that the increase in yields in the United States could spill over to the euro area. If we hadn’t intervened, the tightening of financing conditions would have had a negative impact on growth and inflation in Europe. With inflation projections still way below 2%, we couldn’t accept a tightening of financing conditions, irrespective of its cause or origin – this would have been inconsistent with our policy mandate.” (see Panetta interview for more details).

FX moves on Friday were mostly modest. The USD managed a small bounce to end the week with DXY +0.1%, but down 0.9% on the week and remains near two week lows. The fall in the USD last week can be explained by the pullback in Treasury yields and further improvement in risk appetite. If yields start march higher, particularly real yields, the USD may get some support. European-US growth divergences don’t appear to be affecting the Euro with EUR only down 0.2% on Friday and is up more than 1% on the week, closing at 1.19. There were similarly modest falls in the AUD (-0.4% to 0.7620) and the NZD (-0.3% to just below 0.7040) on Friday. The NZD and AUD were both little changed last week despite broad-based USD weakness.

The CAD was the top performing currency on Friday (USD/CAD -0.3%) after another blockbuster Canadian employment report. Canadian employment growth was almost three times expectations in March, at +303k, while the unemployment rate fell from 8.2% to 7.5%. Despite new Covid-related restrictions coming into force in Ontario on Friday, there has been speculation the Bank of Canada could signal a tapering of its bond buying as soon as this month’s meeting.

Aussie jobs data for March on Thursday is the key event for Australia with NAB seeing upside risks to the consensus and pencilling in jobs growth of +55k (consensus 35k) and for the unemployment rate to decline two-tenths to 5.6% from 5.8% (consensus 5.7%). Also out in the week is the NAB Business Survey on Tuesday (no hints here) and the W-MI measure of Consumer Confidence on Wednesday. The government is also expected to update its vaccine rollout timeline.

Offshore the focus is on the US, China, and the Q1 earnings season; the RBNZ also meets but no change to rates or guidance is expected at this ‘interim meeting’. Detail below:

A quiet day with no data scheduled domestically. Offshore China’s Aggregate Financing Data could be released from anytime today, while elsewhere it is very quiet. Details below:

Customers can receive Australian Markets Weekly and other updates directly in their inbox by emailing nab.markets.research@nab.com.au with the name of their NAB relationship manager.

Read our NAB Markets Research disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.