We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The run of worse than expected (global) inflation-related news continues to ripple through markets, the latest culprits being core Eurozone CPI and revised US Q4 unit labour costs.

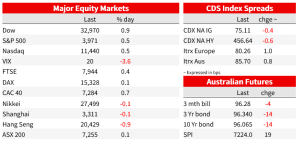

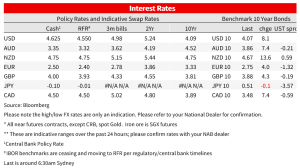

The run of worse than expected (global) inflation-related news continues to ripple through markets, the latest culprits being core Eurozone CPI and revised US Q4 unit labour costs. 10-year US Treasuries were already pushing above 4% during yesterday’s Tokyo session and bearish curve steepening has been the order of the European and US trading days, US 2s currently +3bps and 10s +8bps (to 4.07%) relative to Wednesday’s New York close. Yields are though back slightly from the highs following comments from Atlanta Fed president Raphael Bostic (see below), the latter also a catalyst for a smart intra-day turnaround in US stocks where the major indices are all currently in the green with an hour of NYSE trade to go. The US dollar is stronger against all G10 currencies – featuring losses of between 0.5% and 0.7% for the Aussie, Kiwi, Euro, and Sterling, albeit also back from their intra-day lows post Bostic. US ISM Services top Friday’s dance card and where there will be as much interest in the ‘Prices Paid’ sub-series as the headline reading.

While no great surprise after this week’s higher than expected Spanish, French and German CPI, Eurozone core CPI at 5.6% in February up from 5.3% in January and (officially) 5.3% expected, still managed to make a negative impression on bond markets. Headline CPI at 8.5% was down from 8.6% but 0.2% stronger than the beginning-of-week survey median.

Perhaps more disconcerting, at least for the US bond market, was the revised Q4 data on Unit Labour Costs, now put at 3.2%, a very hefty upwards revision from 1.1% originally reported and meaning that productivity in Q4 is now calculated at just 1.7% (annualised rate) down from 3.0% first reported.

Atlanta Fed President Raphael Bostic has spoken in the last 90 minutes or so and said he is ‘firmly in the quarter-point move’ camp. He says the Fed could be a position to pause by ‘mid to late summer’ but that ‘ I do think we’re in a period now where it is appropriate for us to be cautious….(because) there is a plausible case to suggest we’re going to see some more robust slowdown’ In an essay published earlier on the Atlanta Fed’s website, Bostic wrote that he wanted a 5.0-5.25% policy rate (i.e. only another 50bps from here).

Earlier Thursday, Boston Fed President Susan Collins said in a radio interview policymakers need to keep raising interest rates to get inflation under control, though exactly how much higher borrowing costs need to go will hinge on incoming data, and that ‘then I do believe that it will be important to hold there for some time because it takes a while for the effects of tighter financial conditions to work through the economy’. Very much ‘on message’.

Bostic is not a 2023 FOMC voter yet his remarks, which crossed the wires at about 5:30 AEDT, look to have been the catalyst for the early afternoon rally of more than 0.5% in the S&P 500 and NASDAQ, so both more than reversing morning losses to currently sit up 0.4-0.5% with an hour of NYSE trade still ahead. This follows an up-day for European stocks (e.g. Eurostoxx 50 +0.6%).

US Treasury yields reached an intra-day high of 4.09% at 10 years before peeling back slightly post Bostic (4.07% now) and 2s a high of 4.94% but are back down to 4.90% for a net gains of just 2.5bps on Wednesday’s NY close

In currencies, it’s been onwards and upwards for the US dollar in conjunction with the US 10-year yield sailing up through 4%. USD indices are just back from their highs – again post Bostic – but BBDXY is still up just over 0.4% on the day and the narrower DXY 0.5%. Every G10 currency is weaker against the greenback, EUR and SEK faring worst at -0.7% while AUD has (just) been spared a revisit to sub-0.6700 (low of 0.6707) and currently sits 0.5% down on 24 hours ago at 0.6727.

Yesterday in Australia, Dwelling approvals fell -27.6% m/m in January (Consensus -7% and NAB -8%). A reversal in volatile attached (apartment) approvals, which fell 40.8% after a 41.9% rise in December drove the decline, but more surprising was the weakness in detached house approvals which fell 13.8% m/m. We caution against overinterpreting given January seasonality can be difficult to adjust for, and we would note that a 14% m/m fall in January 2022 was almost fully unwound in the following month. In trend terms, house approvals are now 43% below their peak in February 202. We get January Home Loan data today (see below).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.