NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

The RBA increased interest rates by 25bp to 3.1% and continues to guide that “the Board expects to increase interest rates further over the period ahead".

It has been a reasonably quiet night for news flow, although US equities continue to head lower, on track for their fourth consecutive daily decline. Oil prices are lower, with Brent oil down 4% and back below US$80/bbl. The RBA hiked 25bp, as widely expected, and played a reasonably straight bat in the post meeting statement continuing to signal more hikes are expected but adding it ‘is not on a pre-set course.’

US equities are lower, continuing yesterdays sells off on track for their fourth consecutive day of declines. While there is nothing especially noteworthy in the data or news flow, what headlines there have leant negative. A slew of growth warnings from Bank CEOs were of some note, with Goldman Sach’s David Solomon warned of job cuts, an uncertain outlook, and “some bumpy times ahead” while JPMorgan Chase’s Jamie Dimon warned of a ‘mild to hard’ recession and Bank of America said it is slowing hiring as fewer employees leave. At the same conference though, JPMorgan’s consumer bank co-head said that consumers’ holiday spending has been “so far, so good” and card delinquency levels are still low.

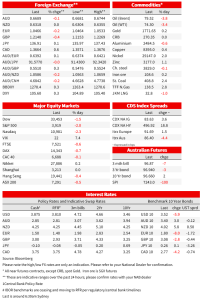

The S&P500 is currently off another 2% on top of yesterday’s declines, while the Nasdaq is tracking 2.3% lower. 10 of 11 sectors in the S&P500 are lower, led by communication and energy. Shares in Asia were mixed. The Hang Seng lost 0.4%, while the Nikkei gained 0.2%. The Euro Stoxx 50 was 0.4% lower, with European bourses generally seeing small declines.

FX moves have been generally muted. The dollar is 0.3% higher on the DXY managing small gains against most g10 currencies. The AUD was 0.1% lower at 0.6689, among the better performers of the past 24 hours. The Aussie traded to an intraday high of 0.6744 before softening through the US session alongside declines in equities and as the US dollar generally strengthened. The NOK (-0.9%) and the CAD (-0.6%) underperformed, weighed by lower oil prices.

US yields were down across the curve in the past couple of hours after being little changed for most of the day. The 10yr is 6bp lower 3.52%, while the 2yr is 3bp lower at 4.35%. The German 10yr was 8bp lower at 1.80%. Brent oil is down 3.8% to $79.52/bbl and its lowest since January. Bloomberg cites some analysts pointing to low liquidity, with traders stepping back as we head to the end of the year. Brent open interest is at the lowest since 2015.

Domestically, the RBA increased interest rates by 25bp to 3.1%. That was near-universally expected by economists, though market pricing allowed a 20% chance of no change. 3yr futures-implied yields rose 8bp on the announcement, but are little changed over the last 24 hours. The RBA statement underwent relatively minor revisions and the substantive final paragraph was largely unchanged. The RBA continues to guide that “the Board expects to increase interest rates further over the period ahead ” although in smaller nod toward the prospect of a pause in early 2023 than many were expecting did add “it is not on a pre-set course.” Barring some rapid turn in the data flow, the RBA looks set to continue hiking into next year. Markets currently price 15bp for the February meeting.

The data flow overnight was thoroughly second tier. Germany Factory Orders rose 0.8% in October against 0.1% expected, continuing to suggest a shallower downturn than previously feared. October Industrial Production numbers are published today. The US trade balance widened to $78.2bn from 73.3bn, not far off consensus for $80bn. On data flow since 1 December, including the trade data, the Atlanta Fed’s GDP now estimate has been revised higher to 3.4% from 2.8%.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.