Economic and financial market update

Insight

Oil market volatility is showing no signs of let-up , Brent crude down to a low of $83 overnight on a Wall Street Journal report suggesting Saudi Arabia was contemplating a 500,000 barrels per day production increase from December.

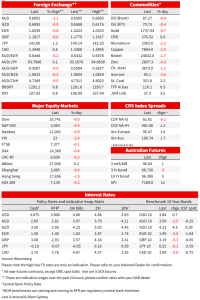

The main themes in Monday’s APAC session – rising covid infection rate in China and related lockdowns/stay at home orders – continues to reverberate, seeing US stocks weaker heading into the last hour of NY trade and AUD one of the weakest G10 currency performers. The latter is alongside what is now about a 50% retracement of the dop in USD/CNY, from 7.33 to below 7.03 following the news the week before last of reductions in quarantine restrictions for covid patients and close contacts. US bond yields aren’t much changed so far in this Thanksgiving (and east-coast snowbound) shortened week, though yields have ticked higher after a less than stellar 5-year note action.

Currency markets are showing a bit more life than equities or bonds at the start of the week and where the USD is about three quarters of a percent up on the end of last week, led by a 1.25% drop in USD/JPY (back to above ¥142 and 1% drop in AUD/USD, trading either side of 0.66 overnight and down from very close to 0.68 at its nest last week. EUR/USD is the main contributor to the 0.8% rise in the DXY, down 0.8% at 1.0238.

AUD/USD weakness closely tracks the further retracement in USD/CNY, which from a low point of around 7.0250 last Monday in the wake of news China was relaxing quarantine rules, closed overnight at 7.1650. Yesterday’s news of more than 20,000 new covid infections on Sunday, one death reported on Saturday and two on Sunday, stay-at-home orders in Shijiazhuang and the imposition of a 5-day lockdown in the Baiyun province of Guangzhou, are the drivers of this turn against the RMB and renewed weakness in the Hang Seng, albeit the latter ended in Hong Kong less than 2% down having more than 3% lower earlier in the day.

Oil market volatility is showing no signs of let-up, Brent crude down to a low of $83 overnight on a Wall Street Journal report suggesting Saudi Arabia was contemplating a 500,000 barrels per day production increase from December. This is in the context of EU sanctions on Russian oil that are due to commence on 5 December (and efforts, not yet completed, to cap the price of Russian oil above which insurance for cargoes would not be available). The report has been denied by Saudi Arabia, unsurprisingly in so far as they, and fellow OPEC+ members, appear united in wanting to control production to keep an effective $90 floor under Brent crude. There will likely need to be a significant rise above $90 before production increases come onto the agenda. Brent crude is currently little changed on Friday’s close, at just above $87.

A couple of central bank speakers worth noting. San Francisco Fed President Mary Daly has been out saying that the Fed needs to be mindful of the lags with which monetary policy is transmitted to the economy and adds that ‘while the Funds Rate is 3.75%-4.0%, financial markets are acting like it is around 6%’. A curious comment, that on one interpretation could be seen to suggest that financial conditions (recently much easier of course) have tightened by much more than the current calibration of Fed policy would suggest is reasonable. Daly does though re-iterate that the Fed still has ‘a lot of work to do to restore price stability’ and her outlook (unchanged) is for the Fed Funds Rate peaking around 5%.

Also speaking has been Austrian central bank Governor and ECB GC member Robert Holzmann, a known hawk, who says that he favours a 75bps mid-December rate hike if inflation this month stays the same, and only a step down to 50bps if it shows a major reduction (the data is due on 30 Nov). In contrast, Portuguese central bank governor Mario Centeno says ‘many’ conditions are in place for the December increase to be less than 75bps. NAB still favours 50bps on 15 December.

The Fed’s Mester has just hit the wires saying the Fed isn’t anywhere near stopping but that she doesn’t think market expectations (for the Fed) are off.

Bond markets have been reasonably subdued overnight with 2-year Treasuries flat to Friday’s New York close at 4.53% and 10s currently -1.5bps at 3.81%. Yields in the belly of the cure are up on their intraday lows, following a 5-year note auction that cleared about 0.7bps above its when-issued/pre-auction level and with indirect bidders, view as a proxy for foreign demand, down on October’s 68% at 66.2%. Earlier, 10-year Bunds finished 2bps lower and 10-year gilts -5bps.

Equites are into the last hour of the New York day with the S&P500 currently down 0.4% and NASDAQ -1.0%, in the case of the latter led by a 2% fall for Apple, on fresh concerns about iPhone production out China’s Foxconn factory. Consumer discretionary and energy sub-sectors are leading the weakness evident in the S&P500.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.