NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

Oil has hit a two-year high.

https://soundcloud.com/user-291029717/oil-nudges-higher-bond-yields-bounce-back-ahead-of-fomc-meeting-this-week?in=user-291029717/sets/the-morning-call

I knew you were waiting, I knew you were waiting (For Jay Me) – Aretha Franklin

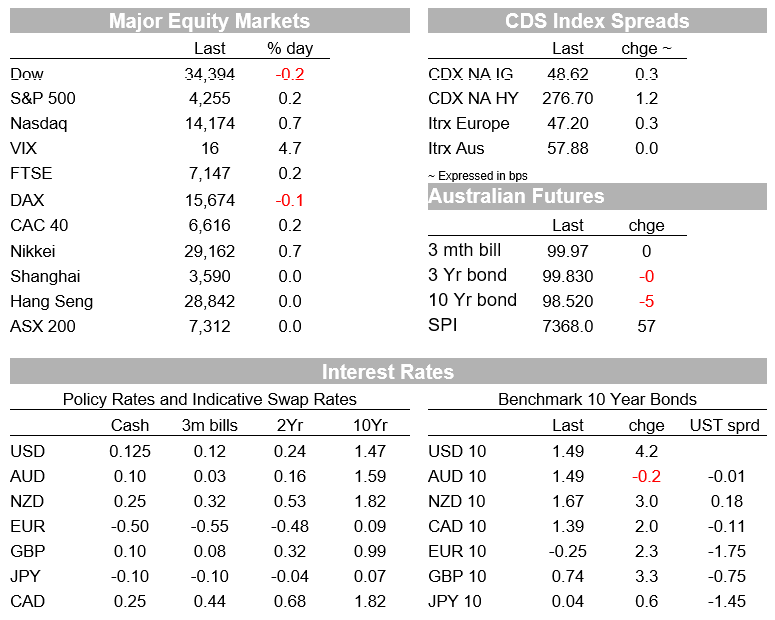

There isn’t a whole lot of rhyme or reason to market pricing since late last week, beyond position adjustment/squaring into Wednesday’s FOMC meeting (early Thursday morning our time). Case in point is the interest rate sensitive NASDAQ, just closing +0.74% to a record high on a night when US Treasury yields pulled back up to almost 1.5%, after coming close to 1.4% not long after last week’s ‘shocking’ US CPI figures. The US dollar is not much changed overall, nor too AUD after falling back on Friday to the bottom from nearer the top of the excruciating 0.77-0.78 effective range at the end of last week. The NOK is the strongest G10 currency on higher oil prices, JPY the weakest on higher US bond yields.

There hasn’t been much by way of key economic news, or developments out of the G7 heads of state gathering in Cornwall, south west England over the weekend and Monday, save that UK PM Johnson looks to have been left in no uncertain terms that he has only a few weeks (i.e. month-end) to resolve the business of cost border trade between Britain and Northern Ireland in a way that preserves the integrity of the EU single market and poses no threat of the Good Friday peace agreement. In the meantime Johnson has delayed the planned further re-opening of the UK economy by four weeks beyond the original June 21 date, justified on the premise it will allow more time for people to get vaccinated. Not that this means a huge amount in practise. Spectator gatherings at sporting events (e.g. Euro 2000 and, presumably, Wimbledon starting next week) are being deemed as ‘tests’ to track the risk of covid infections, while family gatherings and the like can still be for as many as 30 people.

Closer to home, the UK and Australia are reportedly close to being able to sign a free trade agreement as early as today, but where the G7 agreement to end government support for coal-fired power stations by the end of the year – which presumably Morrison presumably did not have to sign up to, Australia not being formally part of G7 – might or might not be a source of last minute friction needing to be ironed out. Australian deputy PM Michael McCormack has been quoted Monday as saying coal will be around for “many more years to come”.

Ahead of Wednesday’s FOMC meeting, overnight we had a NY Fed survey of three-years ahead inflation expectations, which rose to an eight-year high in May of 3.6% (previously 3.1%), while the year-ahead version rose to a record high to 4.0% (previously 3.4%). This survey follows a fall in expectations measured by the University of Michigan survey that was released Friday showing 5-10 year expectations down to 2.8% from 3.0% and 1-year ahead from 4.0% to 4.6%, and a fall over the past month in implied break-even inflation rates from traded nominal and real Treasury yields. Plenty for everyone on the FOMC to argue their corner this week. In the meantime, legendary hedge fund manager Paul Tudor Jones is reported saying he’s nervous the central bank isn’t moving quickly enough to address problematic inflation, warning its insistence that recent price spikes are only temporary is “disingenuous” and telling investors to double down on defensive investments like cash, commodities and even volatile bitcoin. The latter has risen back above $40,000 since he spoke.

In commodity markets oil prices hit a fresh 2-year high as investors continue to bet of impending tighter supply/demand conditions due to a low level of investment in the sector as nations attempt to turn “greener” and shareholders demand dividends and other capital returns over re-investment by oil (and other resources) companies. Prices peaked overnight at $71.78 for WTI and $73.64 for Brent crude. Our BNZ colleagues note that data from the NY Mercantile Exchange shows rising interest in $100 call options for WTI oil delivered in December 2022 and that they are now the most widely owned WTI call contracts. A mixed performance from commodities elsewhere; in metals aluminium is up as is nickel as well as iron ore futures (the latter by more than 3%) but copper is down. Gold is off $11 to $1,866.

In bonds 10-year Treasuries have come into the NY close +4.4bps at 1.496%, following a rise of 2-3bps in benchmark European bond yields. In equities, the aforementioned 0.74% rise in the NASDAQ record closing high of 14,174 compared to a lesser 0.2% gain for the S&P and quarter percent loss for the Dow. Earlier, European bourses all ended with small gains bar the German Dax which finished 0.13% down

In FX, having falling back quite sharply on Friday from a high of 0.7776 to a low of 0.7688, its been meandering within a tight 0.77-0.7720 effective range so far this week. NZD has fared a little better up 0.15% to 0.7141 having been Friday’s biggest loser. NOK shows it oil price credentials up 0.3% while USD/JPY, which somewhat surprisingly failed to track falling US Treasury yields lower last week, is back up above Y110 (+0.4%) on Monday’s snap back in 10-year Treasury yields.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.