Robust growth for online retail sales observed in June

Insight

Markets were relatively muted ahead of Powell’s remarks with US yields and the Dollar were tracking a little higher and equities a little weaker.

Markets were relatively muted ahead of Powell’s remarks with US yields and the Dollar were tracking a little higher and equities a little weaker. That promptly reversed course in the last couple of hours on Powell’s remarks as 5:30am, Sydney time. Equities are up over 2% and the dollar is down 0.6% on the DXY. While the key themes were largely on message (a slower pace of hikes is possible in December, but rates will need to go higher than September forecasts and remain restrictive for some time), the market reaction shows they were clearly less hawkish than feared. Elsewhere, Eurozone inflation came in softer than expected on the headline, though the core read remained stable at 5% y/y.

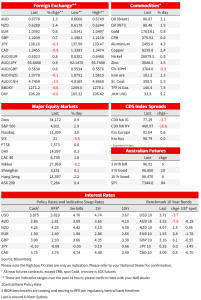

The USD convincingly reversed course lower on Chair Powell’s remarks. The dollar had been up as much as 0.3% earlier in the session but is now around 0.6% lower on the DXY. The tailwind from a stronger CNH saw the AUD and NZD outperform, up 1.3 and 1.4%. The AUD is now around 0.6778 and not far off its mid-November high of 0.6797. The EUR is 0.6% higher, while the yen gained 0.3%. That after reversing an earlier pushed higher in USD/JPY alongside the turnaround in treasuries, The USD at one point was up almost 1% against the yen reaching 139.89.

US yields had been higher ahead of Powell’s speech but reversed course as yields fell and the curve flattened on Powell’s remarks. The US 10 year is down 4bp to 3.71%, after touching an intraday high of 3.79%. The 2yr is 10bp lower to 4.38% but had been up around 4.55%. The 2s10s spread now back inside -70bp at -69.56. Equities turned sharply higher. The S&P500 is currently up around 2% after earlier being down around 0.5%, while the more interest rate-sensitive NASDAQ around 3%.

Despite the market reaction, the messaging from Powell largely stuck to the recent script. Powell said the “time for moderating hike pace may come as soon as December.” December pricing now sits at 52bp, from 54 before Powell spoke. But Powell also emphasised that rates would need to be restrictive for ‘some time’ and the fed funds rate will likely peak ‘somewhat higher’ than September forecasts. Powell noted considerable uncertainty about where rates will peak and said there is a long way to go to restore price stability and that a sustained period of below-trend growth is necessary to restore balance between supply and demand. In the Q&A he was also clear that the Fed is not assuming much help from the supply side of the labour market, saying it is unreasonable to expect participation gets back to pre-pandemic levels and that the hope is to balance the labour market by slowing jobs growth. There were some cracks of hope though. The October inflation data was a ‘welcome surprise,’ even though it will take ‘substantially more evidence’ to give comfort inflation is actually declining and by any standard ‘inflation remains much too high. Powell did note that goods prices should begin to exert downward pressure on overall inflation in coming months and that rents are a lagging indicator with timelier data pointing to a substantial slowing.

Before Powell’s remarks, it had been a busy day for data. There were further signs that the labour market was cooling, but only at the margin and not in a hurry. JOLTS numbers fell to 10.3m from 10.7, a little above consensus for 10.25. That’s now down noticeably from the 11.9m back in March, or alternatively down to 1.7 openings per unemployed person from 2.0. As importantly, quit rates fell further to 2.6% from 2.7%, just 0.2ppt above their prepandemic level after peaking in December 2021. All in all welcome news for the Fed that some of these indicators are heading in the right direction, but nothing to shake an assessment that the labour market is currently inconsistent with at-target inflation. Of some not ahead of Friday’s Payrolls report was ADP employment, which rose just 127k against expectations for 200k. It is only the fourth release using the new methodology, and it undershot Payrolls in August and September, but may signal some of downside risk for the 200k consensus on Friday

Eurozone inflation slowed to 10.0% y/y in November from 10.6%, below consensus for 10.4%. The downside surprise dutifully followed the signal from earlier regional prints with inflation slowing in Germany, Italy, Spain and the Netherlands. Ex energy and fresh food prices, inflation was 7.0% after 6.9%, while core CPI (excl food, energy, alcohol and tobacco) was steady at 5.0% y/y. The decline in the headline rate will be welcome relief and likely leans in favour of 50bps from the ECB on 15 December. Markets now price 56bp for December, down from 61 at the start of the week, the move coming following the lead form German and Spanish numbers on Monday. But inflation is still very high and volatility due to energy costs and interventions can swing the numbers.

President Lagarde said on Monday “it would surprise me” if inflation has peaked, while Vice President Guindos said on Tuesday “the signal we have to keep following is the evolution of underlying inflation.” One indicator of that, the core CPI, held steady in November.

China PMI data came in on the weak side of expectations, but the optimism about the potential for a move away from zero Covid won out again. The Composite PMI dipped to 47.1 from 49.0 to its lowest levels since the Shanghai lockdowns in April as virus disruptions weigh on activity. The Manufacturing number fell to 48 from 49.2, (f/c 49.0) (The Caixin Manufacturing PMI is due today). The non-manufacturing side was weaker still at 46.7 from 48.7 and 48.0 expected. Despite the evidence of near-term disruption to activity, the optimism evident on Tuesday founded on the prospects of eventual reopening extended. The Hang Seng was up another 2.2% to be 5.4% higher than last week’s close and 27% higher over November. The CSI 300 held on to yesterday’s gains. Helping the mood was some further hints of movement on covid zero. There has been some easing of widespread restrictions in favour of more targeted controls in Chonqing, Guangzhou, and Zhengzhou, home to Apple’s largest manufacturing site in China. Vice Premier Sun Chunlan said at a meeting with the National Health Commission that Bloomberg also reports that “as the Omicron variant becomes less pathogenic, more people get vaccinated and our experience in Covid prevention accumulates, our fight against the pandemic is at a new stage and it comes with new tasks.” Bloomberg notes that she didn’t use the term ‘dynamic Covid Zero.’

Domestically, the ABS’s new monthly inflation indicator rose 6.9% y/y, coming in well below the consensus of 7.6% y/y. Driving the miss was a steep fall in volatile fruit and veg prices (-6.3% m/m) and travel and accommodation (-6.4% m/m). This is not a full CPI, contains little new information on all-important trends in market services inflation, and does not mean the peak in inflation is past. The October data only reflects up to date price information for 62% of the basket. Despite the long list of caveats on the new data series, markets seized on the print. 3yr futures implied yields were 6bp lower on the data and are 10bp lower over the day. Futures markets price just a 75% chance of a 25bp hike in December, and peak rate pricing was pared to 3.75%.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.