We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

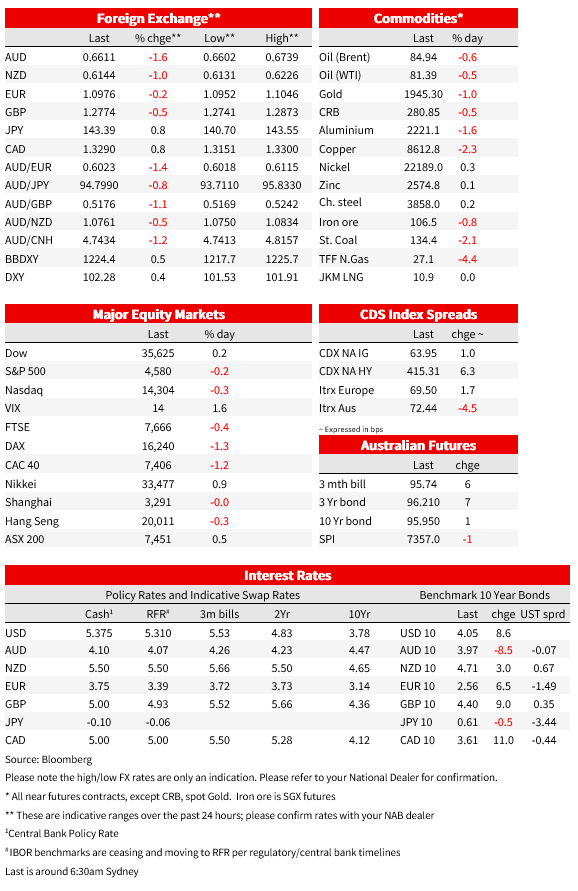

The US Treasury curve bear steepened following news the US government will increase its bond issuance by more than previously thought. US equities recorded small declines and the USD is stronger across the board with the AUD the notable underperformer, RBA on hold and underwhelming China data not helpful.

NZ: Dwelling consents (m/m%), Jun: 3.5 vs. -2.2 prev.

AU: Home loans value (m/m%), Jun: -1.0 vs. 1.8 exp.

AU: Building approvals (m/m%), Jun: -7.7 vs. -8.0 exp.

CH: Caixin PMI manufacturing, Jul: 49.2 vs. 50.1 exp.

AU: RBA cash rate target, Aug: 4.1 vs. 4.35 exp.

GE: Unemployment rate (%), Jul: 5.6 vs. 5.7 exp.

EC: Unemployment rate (%), Jun: 6.4 vs. 6.5 exp.

US: JOLTS job openings (k), Jun: 9582 vs. 9600 exp.

US: ISM manufacturing, Jul: 46.4 vs. 46.9 exp.

Good Morning

Ha ha ha

Pump it

Ha ha ha…And pump it (louder) – Black eyed Peas

US Treasury yields are higher with the curve showing a bear steepening bias following news the US government will increase its bond issuance by more than previously thought. The US manufacturing sector contracted by a ninth consecutive month while downward revision to JOLTS data revealed US job openings fell in June to the lowest level since April 2021. The USD is stronger across the board with the AUD the notable underperformer, RBA on hold and underwhelming China data not helpful. US equities take a breather amid rise in yields and mixed earnings reports.

The main market news from the overnight price action has been the rise in UST yields driven by the long end of the curve. The move up yields began halfway through European session and then accelerated after the US opening. Although there was no particular trigger, the uptick in yields has come a day after the US Treasury department said it would increase its net borrowing estimate for Q3 to $1 trillion, compared to its $733b estimate of three months ago. Reuters also noted the US Treasury is suggesting Treasury General Account (TGA) balances at $750bn by the end 2023, over $100bn more than consensus estimates, implying the department must be planning on a deficit far greater than the CBO’s estimate of $1.54 trillion.

The steepening of the curve has been driven by expectations of an increase in longer dated UST issuance with the 30y part of the curve driving the move. The 30y bond climbed 9.4bps to 4.10% with the technical picture no suggesting an easier path towards 4.25%. the 10y rate is up 8.4 bps to 4.046% while the 2y is up 3bps to 4.91%.

The move up in UST yields also lifted core global bond yields with German bunds extending their bear steepening bias to a fourth consecutive day. 10y Bunds gained +7bps to 2.56% while 10y UK Gilts were +9bps to 4.399%.

US data releases came in line with expectation and did not elicit a notable reaction by markets. That said the decline in the JOLTS data provided further support the idea the US economy can achieve a soft landing.

The US ISM manufacturing was little changed, up 46.4 from 46 and versus a consensus estimate of 46.9 . The index contracted in July for a ninth-straight month, leaving it consistent with further outright declines in manufacturing output. The employment subindex recorded the biggest decline within the subindices, down 3.7 points to 44.4, the lowest since July 2020. However, is worth remembering manufacturing only represent around 9% of payrolls and it has not been a good guide to the labour market dynamics. One positive was the rise in new orders, up 1.7 points to 47.3, so still in contraction but showing signs of improvement. Meanwhile the JOLT number came at a 9582k, little changed from the downwardly revised May number at 9616k (prev. 9824k). Importantly US job openings continue to show a gradual downtrend with the June print the lowest level since April 2021.The JOLTS data supports Fed Governor Christopher Waller’s thesis that wage disinflation can be achieved without outright job losses.

The uptick UST yields alongside mixed earnings reports triggered a cautious mood within equity investors. After two days of positive returns, the S&P 500 struggled to trade higher for most of the overnight session, ending the day down 0.27% while the NASDAQ was -0.43%. In late trading, Advanced Micro Devices gained after the company topped second-quarter estimates, Starbucks share dropped on news quarterly sales fell short of analysts’ estimates. Uber reported its first-ever operating profit, but it shares struggled with analysts concerned over the decline in growth. Meanwhile on the positive side Caterpillar shares gained after the company reported a bigger-than-expected profit.

Moving onto currencies the USD is stronger across the board supported by the uptick in UST yields and cautious move in equities. The DXY and BBDXY indiecs are up 0.42% and 0.52% respectively with the AUD and NZD the notable G10 underperformers.

The AUD has been hit by a trifecta with the pair down 1.58% over the past 24 hours to 0.6613. In addition to a stronger USD, the AUD has not been helped the RBA on hold and softer China data . Yesterday the RBA kept rates on hold at 4.10% as we had expected, but consensus was split going into the meeting with markets pricing just a 24% chance of a hike, while 18/30 economists were tipping a hike. Despite that hawkish bias, the extended staff forecasts to end 2025 (from mid-2025) gave a less hawkish feel. Importantly, CPI inflation is forecast to be within 2-3% by late 2025, and relative to the prior May SoMP the end 2024 forecast was unchanged at 3¼%. While the Bank maintained a tightening bias, the lack of policy move saw a number of economists (including NAB) shave back their expectations of peak rates from 4.6% to 4.35%. Market pricing shows an 80% chance of one more hike this cycle, with November being the most likely date, following the next quarterly CPI result.

The move lower in the AUD (as well the NZD, down 1% to 0.6155) was not helped by softer China data releases. Caixin index of manufacturing activity declined to a six-month low of 49.2 last month, pointing to a contraction in the sector as export demand slumped. A separate report showed home sales tumbled 33.1% in July, the most in a year. Yesterday we also had a new round of pledges by Chinese officials to support the economy, but the lack of fiscal spending commitment is making markets wary, yesterday China’s CSI 300 fell 0.4% and CNY was -0.49%.

The Euro has been the strongest of the rest of the majors, with EUR/USD only down modestly to 1.0975 . It wasn’t a market mover, but of note the unemployment rate in the Euro area was a record low of 6.4% in June, with revisions over the prior two months also taking the figures to that low. This is notable considering how close to recession the Euro area has been. GBP was -0.48% to 1.277 and USD/JPY now trades 143.20 (up 0.77% over the past 24 hours).

Coming Up:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.