Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

War still rages, but Eurozone stocks and EUR roar back to life

https://soundcloud.com/user-291029717/risk-on-but-war-still-on-too?utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

A glance across market, in all things Eurozone especially, could leave any casual observer forgiven for assuming that the war in Ukraine might have ended overnight. Not so, sadly. The news alerts from the BBC, FT, et al, that greeted me switching on my phone this morning were in relation to Ukraine accusing Russia of a hospital bombing atrocity in the city of Mariupol. There are others too in relation to fears of radiation leaks at Ukraine nuclear sites (e.g. the power is reportedly out at the Chernobyl site) and of Russian President Putin’s end-game being to reduce Ukraine to rubble.

In this context the sharp rally in all things Euro (EUR/USD +1.5%) Eurozone stocks (Eurostoxx 50 and Germany’s DAX both up more than 7%) and benchmark Eurozone Bonds (10-year Bunds +10.5bps) is surely just noise, not signal? Well, maybe not. As my London colleague Gavin Friend notes overnight, one reason for optimism is European talks on issuing more joint debt to finance a fast-tracking of green energy and renewables, defence and in the shorter-term, subsidies for the exorbitant price of energy that households and businesses are having to pay. Talks on this start in Versailles Thursday. If this idea does get off the ground it will, for one, be a powerful offset to a lower EUR, from the sharp deterioration in The Eurozone trade and current account balance that dramatically higher energy prices are bound to inflict.

To this we might add suspicions the ECB might not fully reverse it’s early February ‘hawkish tilt’ when it meets later today, given that inflation is destined to push still higher given the latest energy price shock, and perhaps too with a nod to the EUR, whose sharp weakening of late is a very unwelcome development in terms of exacerbating energy-driven inflation pressures.

As, or perhaps more importantly, comments out of Russia and Ukraine are leading to some hope that compromise is possible . Earlier in the week, a Kremlin spokesman told Reuters it was now not focusing on regime change in Ukraine, but would be open to neutrality, if Ukraine would accept the independence of the two break away regions in the Donbas, as well as Crimea. This claim has been repeated overnight by a Kremlin spokesman on TASS. Yesterday, President Zelensky talked of being open to compromise in these areas. That looks like the basis of negotiations at least, in which respect foreign ministers of the two nations are scheduled to meet in Turkey today.

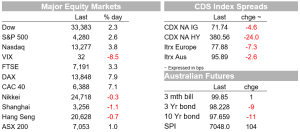

To markets, and an hour ahead of the NYSE close, the S&P 500 is up over 2.5% and the NASDAQ almost 4%, following the 7.4% rise in the Eurostoxx 50, 7.1% rise in France’s CAC 40 and 7.9% rise in the DAX.

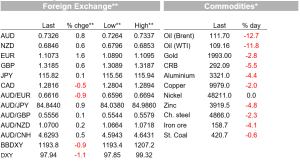

As well as any or all of the above as drivers, also helpful to the cause has been a (very) sharp fall-back in oil prices, Brent crude currently off almost $18 to $110 and WTI $16 lower at $108 (warning – it may be a lot different by the time you are reading this). The (TFF) European gas benchmark price, that was as high as EUR335 per Mwh on Monday, closed at $147.90, down 30% on the day. Commodity prices are in a sea of red elsewhere, including Ally down 4.5%, Copper 2%, iron ore future -5.5% and gold and silver both down 3%.

In currencies, the USD’s pre-eminent safe haven status of late mans that it has fallen victim to the sharp reversal in risk sentiment, the DXY index currently off 1% le that aforementioned 1.5% rise in EUR/USD . The rise here has only by bested by the Swedish Krone and which has been the real whipping boy at the heights of market turmoil (Sweden being a small, open European economy and net energy importer – not hard to see why, is it?). SEK is up 2.8% overnight.

Notable is that AUD is stronger not weaker notwithstanding the fall back in commodity prices and which have been the main driver of recent strength. Its (positive) correlation with risk sentiment is back to the fore overnight – plus the absolute level of commodity prices is still consistent with much higher AUD levels. And comments from RBA governor Lowe yesterday, that higher rates this year were ‘plausible’, at least did no harm to the currency. AUD/USD is currently +0.7% on the day at 0.7317, NZD/USD a slightly lesser 0.5%.

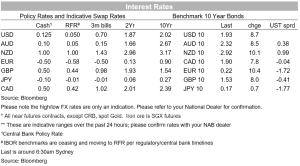

Finally in bonds its been to some extent a case of the tail wagging the dog with 10-year Treasuries up 10bps following similar sized moves in Germany and France, while US 2-year Notes are currently +7.5bps, so a slight reversal of the recent strong curve flattening bias. On the data front, US JOLTS (job openings) were 1.3m in January, down from a (revised higher) record high of 11.4 in December, suggesting that the labour market remained strong despite the disruptions from Omicron’s spread.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.