We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

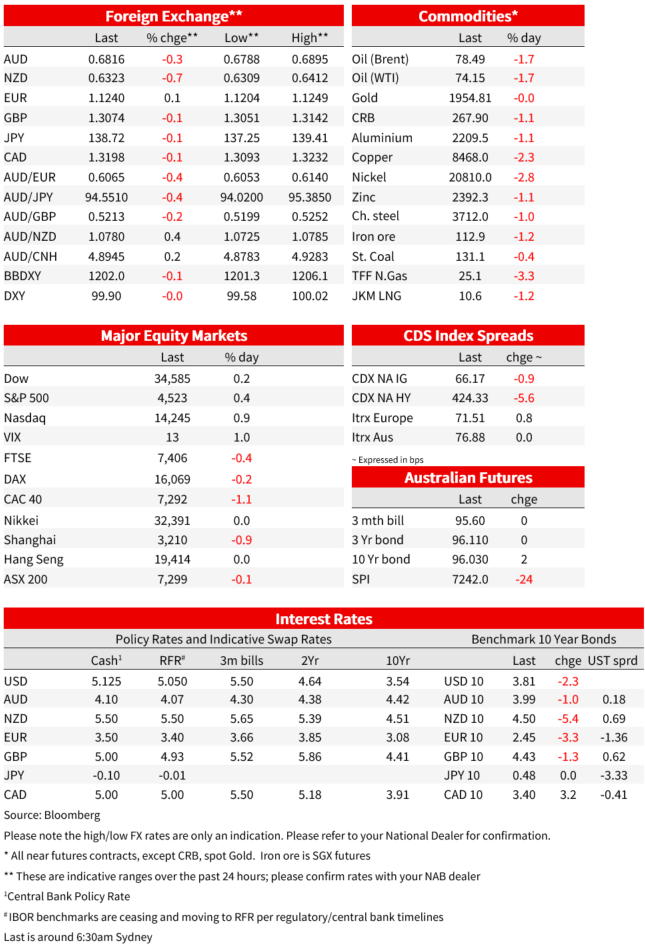

Underwhelming China economic data has weighed on sentiment, mostly in Asia and Europe with a decline in CNY also spilling over to NZD and AUD. Core global yields are a tad lower while US equities have resumed their upward trajectory.

NZ: Perform of services index, Jun: 50.1 vs. 53.3 prev.

CH: GDP (y/y%), Q2: 6.3 vs. 7.1 exp.

CH: GDP (q/q%), Q2: 0.8 vs. 0.8 exp.

CH: Industrial production (y/y%), Jun: 4.4 vs. 2.5 exp.

CH: Retail sales (y/y%), Jun: 3.1 vs. 3.3 exp.

CH: Fixed assets invest. (YTD, y/y%), Jun: 3.8 vs. 3.4 exp.

US: Empire manufacturing, Jul: 1.1 vs. -3.5 exp.

Underwhelming China economic data has weighed on sentiment, mostly in Asia and Europe with a decline in CNY also spilling over to NZD and AUD. A slower China with lower price pressures also weighed on core global bond yields. After a small decline on Friday, US equities have resumed their upward trajectory with earnings season and Fed policy outlook the focus

Yesterday’s China released its Q2 and June activity readings with most of the details coming on the softer side of expectations. The main theme being that China’s economic momentum is slowing with deflation an additional concern . The economy grew at 0.8%qoq in Q2, down from the 2.2% recorded in Q1. On a yoy basis the economy grew at 6.3% well below the 7.1% expected, implying some hefty downward revision to previous quarters. The June activity readings revealed a mixed picture of an anaemic consumer (sluggish retail sales 3.1%yoy vs. 3.3% exp. and below the 12.7% in May) versus stronger than expected industrial production (4.4%yoy vs 2.5% exp. and up from 3.5% in May) and investment (3.8% ytd/yoy vs. 3.4 exp and down from 4% in May).

Delving further into the data, fixed asset investment by private companies declined in June and the household savings rate remain elevated . A combo highlighting a very subdued animal spirit with the loss in private momentum fuelling weakness in the labour market, particularly amongst the youth up to 21.3% vs 20.8% in May. The GDP deflator was negative in Q2 for the first time since 2020 and increasing concerns of deflation.

China’s equity benchmark CSI 300 index closed 0.82% lower on Monday with Asian counterparts also weaker. The negative vibes also weighed on European equities with the EuroStoxx 600 down 0.62%. In contrast, after recording a small decline on Friday, US equities resumed their upward trajectory with the S&P 500 closing up 0.39% while the NASDAQ was +0.93%. On company news, Activision Blizzard shares rose 3.14% after Microsoft and UK regulators held “productive” talks needed to clear the companies’ $69bn take-over while Ford shares fell 0.89% after cutting the price on the electric version of its F-150 truck. The earnings reporting season hits up with a busy schedule tonight ( see more below).

China’s underwhelming data releases also weighed on its currency with USD/CNH rising from 7.15 to 7.19 overnight. Looking at the USD, it has been a quite 24 hours with the greenback mixed versus G10 pairs and little changed in index terms. The euro managed to edge a little bit higher again, up 0.11% to 1.1238 while CHF gained 0.2% to 0.8604.

GBP (1.3074) and USD/JPY (¥138.70) are essentially unchanged while NZD and AUD are a tad softer showing their greater degree of sensitivity to China and CNY fortunes. NZD is down 0.75% over the past 24 hours to 0.6325 while the AUD is down 0.32% to 0.6820, after a brief overnight dip below 0.68.

The NY Empire State survey was the only notable data release overnight and it provided another piece of evidence of “better than expected” US narrative. The survey is quite volatile, but it did print a better than expected 1.1 outcome in July vs -3.5 expected. Importantly for the Fed, the prices paid and prices received indices both fell to levels not seen since mid-2020, feeding the disinflation narrative.

Global yields traded lower overnight reversing some of the uptick recorded in the previous trading day. 10y Bunds fell 3.5bps to 2.472%, 10y UK gilts eased 1bps to 4.425% while in the US, UST yields are down between 2 and 3bps. 10y UST Note now trades at 3.80% after trading in a 3.7676% to 3.8343% range overnight

In other news, Russia has decided to halt a wartime deal that allowed grain to flow from Ukraine to countries in Africa, the Middle East and Asia .Russia suspended the so called Black Sea Grain Initiative until its demands to get Russian food and fertilizer to the world are met, insisting the decision had nothing to do with a Ukraine drone attack on an important bridge linking the Crimean Peninsula. The decision could have a significant impact on food inflation, particularly for developing nations. Wheat and corn futures pushed higher overnight but the move wasn’t sustained and prices for both are down about 1% for the day

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.