Coming in for landing in a heavy cross wind

Insight

Markets were generally quiet to start to week ahead of key risk events later in the week (BoE Thursday, US ISM Services Thursday, US Payrolls Friday).

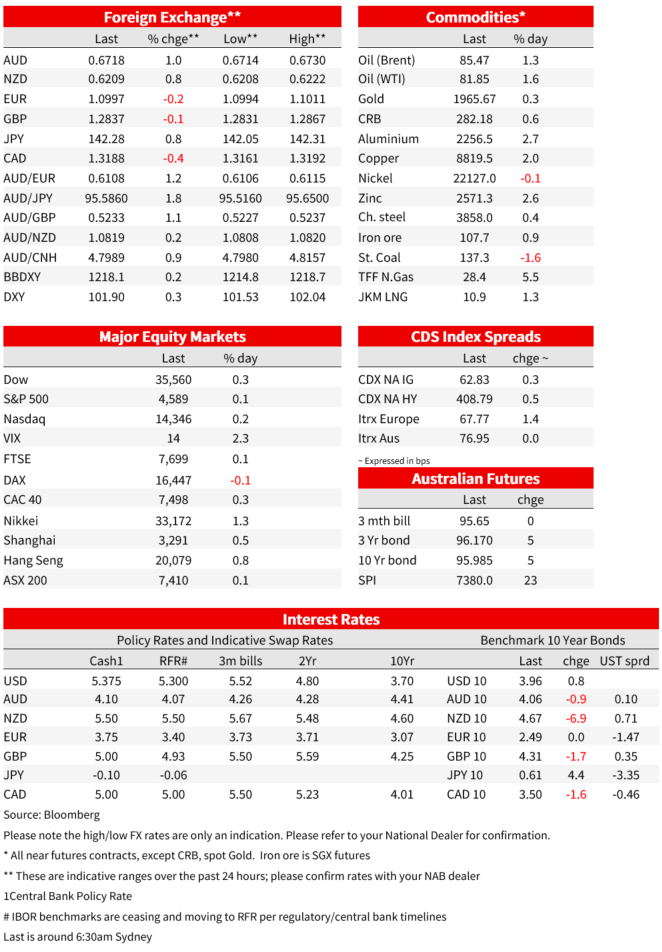

Markets were generally quiet to start to week ahead of key risk events later in the week (BoE Thursday, US ISM Services Thursday, US Payrolls Friday). Yields were little changed over the past 24 hours, retracing the 2-5bps rise seen APAC, with US 10yr +1bps to 3.96%, and 2yr +1.0bps to 4.88%. Ditto US equities with the S&P500 +0.1%, and is now 4.3% away from its record high after having rallied 28.3% from its 2022 low. Chinese stimulus details did though buoy Asian equities and commodities in general (copper +2.0% and at a three month high, though supply risks in Chile were also a factor). Also in the background was the US Treasury announcing larger than expected Q3 issuance of $1.007 trillion in the third quarter, well up from the $733 billion amount it had predicted in early May, and around 100-200bn greater than what many analysts had pencilled in.

Yesterday there was a report from China’s NDRC detailing plans to remove restrictions from consumption and also announcements by Beijing and Shenzhen to follow through with the Politburo’s pledge to optimise property policies. Commodity-linked currencies rose with the AUD +1.0% to 0.6718, NZD +0.8% to 0.6209 and USD/CAD -0.4% to 1.3188. The strength in commodity currencies came despite a stronger USD (DXY +0.3%), partly driven by Yen weakness with USD/JPY +0.8% to 142.18, to be higher than it was prior to Friday’s BoJ meeting. The BoJ’s unscheduled bond purchase the driver; evidently the BoJ doesn’t want yields to move too fast.

There wasn’t much in the way of top tier data to move markets, particularly ahead of risk events later in the week. Eurozone Q2 GDP was slightly stronger than expected at 0.3% q/q vs. 0.2% q/q. The prior quarter was also revised higher to 0.0% from -0.1%. Although the data beat, the details were less flattering with Italian GDP -0.3% q/q, Germany flat, with strength in the quarter driven by Ireland at +3.3% q/q. With the European PMIs showing a slowing services sector, the data is also seen as largely dated. Eurozone Core CPI was also a tenth higher than expected at 5.5% y/y vs. 5.4% expected, but again in the near term the growth outlook will be of greater focus given the softening in inflation seen across the Atlantic. ECB pricing was little moved with 8.7bps priced for September and a cumulative 15.6bps priced by February. In China the PMIs came in mixed with Manufacturing at 49.3 vs. 48.9 expected, and Non-manufacturing 51.5 vs. 53.0 expected. However, the figures were overshadowed by stimulus talk.

In the US the Chicago PMI rose less than expected at 42.8 vs. 43.5 expected and 41.5 previously. A spike in aircraft orders in June may see this measure lift later this year. The Dallas Fed Manufacturing Survey rose a little more than expected at -20 vs. -22.5 expected from -23.2 previously. Although very second-tier, the anecdotes within this survey were interesting. One that caught your scribes eye was: “We had hoped to not have to raise prices but are having pressure from others to hire away our workers, so we are implementing wage increases that need to be covered by raising prices again. ” That suggests the tight labour market has the potential to continue to drive inflationary pressure, even as some of the pandemic driven inflationary forces ease back (see Dallas Fed: Texas Manufacturing Outlook Survey).

The Fed’s latest Senior Loan Officers Survey, pointing to still tightening credit conditions, but the contraction in loan demand has shown some moderation. The hard data to date suggests the credit tightening isn’t slowing activity as yet. The Fed’s Goolsbee was also on the wires noting that that lower inflation is positive but that he hadn’t decided whether to support pausing rates at the next policy meeting. Both Goolsbee and Kashkari yesterday seem to be talking up the prospect of a soft landing. Goolsbee noted: “This business cycle was so sufficiently strange and sufficiently unusual, that I don’t think that the normal rules of a direct tradeoff between unemployment and inflation necessarily have to apply,” ” They certainly have not applied in the last six months.“. Market pricing for the Fed was little changed on the comments or on the second-tier data with around 11 basis points of rate hike premium priced over the next two policy meetings which is largely unchanged from the end of last week.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.