A tariff reprieve, but a weaker starting point

Insight

NAB has pencilled in a 25bp hike, we also think there is a real risk that the RBA hikes by 50bps, and that this risk is higher than the 22% chance that markets are currently pricing.

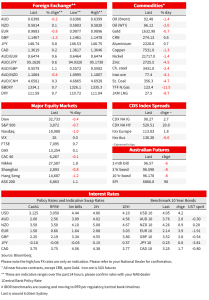

Another day and another WSJ piece by Fed Whisperer Timiraos. This piece which was out on Sunday morning emphasising that the Fed could indicate it needs to lift rates higher than previously expected at Wednesday’s FOMC meeting, even as it leaves the door open to downshift the pace of hikes at the December meeting (see WSJ: Cash-Rich Consumers Could Mean Higher Interest Rates for Longer). The article seemed to be the main driver in Asia for the lift in yields and a dip in US equity futures, which continued overnight amid month end flows. The US 10yr yield rose +4.2bps to 4.05% and terminal Fed Funds pricing also lifted to 4.97% by May 2023 from 4.91% on Friday. Reflective of that the 2yr yield was up 7.2bps to 4.48% with the 2/10s curve flattening slightly to -43.9bps. The S&P500 fell -0.7%, but that comes after Friday’s 2.5% rise and gains in October of 8.0%. The USD gained (DXY +0.7%), but NZD (+0.1%) and AUD (-0.3%) did outperform; NZD likely due to the entry of NZGBs into the World Bond Index. All eyes this morning on the RBA and whether they remain trapped by their rhetoric and hike by 25bps (as NAB is expecting), or whether they hike by 50bps which we see as a real possibility (see details below).

Dataflow overnight was to the downside with Eurozone inflation hot (10.7% y/y vs. 10.3% expected) and markets price around a 52% chance of another 75bp hike at the December ECB meeting. On the positive side for Europe, Q3 GDP was slightly stronger than expected at 0.2% q/q against the 0.1% consensus. Although no details are given, The Italian statistics office suggested inventory accumulation was a driver, and most analysts continue to see Europe heading into recession. Across the pond, US data was also weak with the Chicago PMI at 45.2 against 47.3 expected and 45.7 previously. Similar for the Dallas Fed Manufacturing Index at -19.4 against -17.4 expected and -17.2 previously. Both of these suggests downside risks to tonight’s ISM Manufacturing Index. Details though were interesting with new orders in negative territory for both, but still strong reads for employment and for prices – suggesting little inflation relief is yet in sight and illustrative of the strength in order backlogs.

In Asia yesterday, the Chinese PMIs printed weak at 49.0 vs. 50.9 expected. Importantly declines were driven by both non-manufacturing (48.7 from 50.6) and manufacturing (49.2 from 50.1). The growth picture in China remains sluggish given the zero-COVID policy, highlighted by COVID19 cases released yesterday which showed a further rise to 2,675, the highest in nearly two months, with the virus spreading rapidly in two-thirds of provinces. As well as causing local economic disruption as lockdowns, there remains an impact on global supply chains, with reports of staff fleeing Apple’s key production plant in Zhengzhou to avoid lockdown requirements. The USD/CNY moving back over 7.30 on USD strength and China’s self-inflicted economic malaise, and perhaps was one reason for why although both NZD (+0.1% to 0.5814) and AUD (-0.2% to 0.6394) outperformed overnight, AUD/NZD moved lower (-0.4% to 1.0998). As for other FX moves the EUR was -0.8% and GBP -1.3%.

Although not usually market moving, Japanese MoF data showed that Japan spent a record USD42b in the four weeks to 27 October to prop up the currency, a step up from the USD19b September spent in late September in the first round of intervention. The aggregate USD61b spent has slowed the pace of yen depreciation, but more will need to be spent to prevent further depreciation against a backdrop of the BoJ’s ultra-easy policy stance and rising rates elsewhere. USD/JPY is up 0.7% to 148.69. The funding of the Japanese intervention is also under focus, with further intervention likely seeing selling of US Treasuries, adding pressure to yields in the near term (although the pressure would be even greater if Japan abandoned its YCC policy)

Across the ditch, my NZ colleagues at BNZ are very excited about NZGB entering the FTSE-Russell World Government Bond Index and estimated that around $2b of inflows for the first month of NZGB’s inclusion in the index and around $4b over the first three months. Flows related to this has likely been a driver behind the NZD being higher on all the key crosses. While one can point to month-end support, the NZD has been well supported through October overall following wider NZ-global rate spreads after the more hawkish RBNZ update earlier in October, and some recovery from an oversold level being two key driving forces. On the rates side, NZGBs were driven lower yesterday on big offshore flows as they enter the WGBI. Local dealers were well prepared for the onslaught of buying activity but swap spreads still widened as NZGB’s outperformed. NZGB yields were 4-8bps across the curve, led by the long end, the 10-year rate closing the day down 7bps to 4.16%. The 2-year swap rate rose 3bps to 5.02% while 10-year swap fell “only” 3bps to 4.61

Ahead of today’s RBA meeting, RBA whisperer McCrann penned a piece last night arguing the RBA must lift by 50bps today. Although NAB has pencilled in a 25bp hike, we also think there is a real risk that the RBA hikes by 50bps, and that this risk is higher than the 22% chance that markets are currently pricing. As for McCrann’s article, he noted “the Reserve Bank must lift its official interest rate by 50 points at its Cup Day meeting and do the same again at its last meeting for the year in December” with the reason being “what the CPI ‘showed’ was inflation getting worse not better as the RBA – and all those so-called ‘experts’ – had predicted. Or perhaps more accurately, had hoped ” and that should the RBA do 50bps today, then they should do another 50bps in December at “the very least” (see McCrann: Reserve Bank must deliver two 50-point interest rate rises).

Finally, yesterday’s Australian retail sales data showed the consumer remained resilient, while business credit also continued to boom. Nothing here to suggest much of an activity hit from higher rates so far outside of housing. As for details retail sales were 0.6% m/m against 0.4% expected, and business credit was 1.3% m/m, following 1.2% in August. In six-month annualised terms, business credit is growing at 17.9%, its highest six-month annualised pace since March 2008. Housing credit growth remained at 0.5% m/m, though is slowing with the 3-month annualised now running at 5.8% from 8.6% in early 2022. Just out at was CoreLogic house price data with dwelling prices down -1.2% m/m in October with falls led by Brisbane (-2.0% m/m), Sydney (-1.3% m/m) and Melbourne (-0.8% m/m). Since their respective peaks, dwelling prices have fallen 10.2% in Sydney, 6.4% in Melbourne and 6.2% in Brisbane (see AFR: Brisbane posts the sharpest house price decline on record for details).

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.