Economic and financial market update

Insight

Markets are treading water ahead of the FOMC meeting tomorrow morning.

https://soundcloud.com/user-291029717/treading-water-but-inflation-expectations-are-on-the-rise-again?in=user-291029717/sets/the-morning-call

Oh, I can’t fight this feeling any longer

And yet I’m still afraid to let it flow – REO Speedwagon

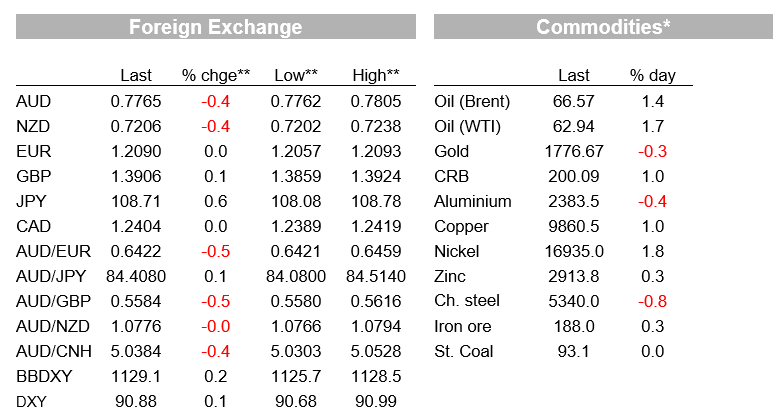

US equities treaded water ahead of the FOMC tomorrow morning, but US Treasuries yields were a bit livelier, climbing around 5bps in the 5 to 30y space with a rise in inflation expectations the main driver. It seems the UST market can no longer fight that feeling of higher inflation with 10y breakevens testing 2.40%. The USD is little changed, but true to form JPY is weaker following the move up in UST yields while the AUD and NZD are a tad softer notwithstanding a solid night in the commodity space.

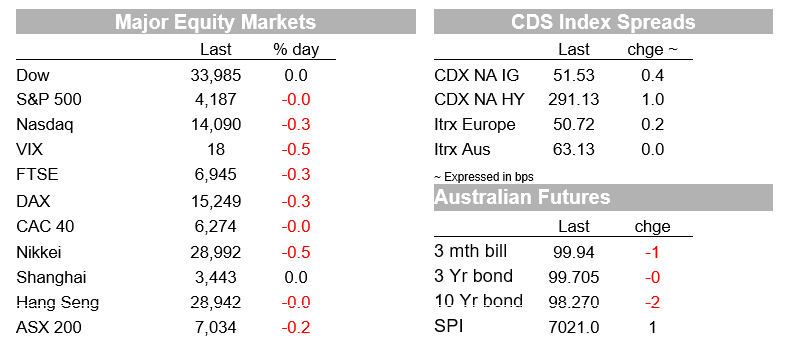

The S&P 500 traded in and out of positive territory ending the day at -0.01% while the NASDAQ fell 0.34%, recording its first down day in three. Tesla led the decline in the NASDAQ while after the bell Google parent Alphabet climbed over 4%, more than reversing its decline during the day, following a profit and revenue report that exceeded analysts’ expectations. Microsoft reversed a gain and dropped 3.5% after reporting revenue that missed the highest analysts’ estimates. Earlier in the session, European equities closed modestly lower with the Stoxx Europe 600 Index ending the day down 0.08%.

After about 30% of companies in the S&P500 earnings reports, in addition to the theme of looking to pass higher input costs to the consumers, the other emerging theme from this season, is that in spite of 88% of companies beating earrings expectations just 58% of reporting companies have seen a higher stock price post-result, suggesting the market ebullience is showing signs of fatigue.

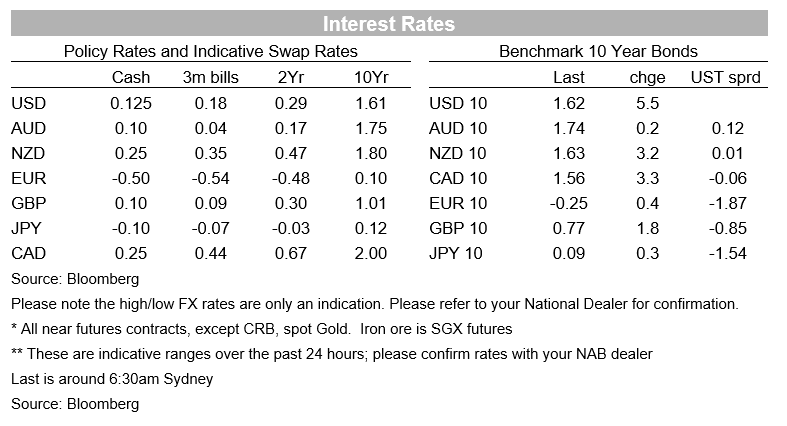

Meanwhile movement in UST yields have been livelier with the 5 to 30-year part of the curve climbing around 5bps during the over the past 24 hours. The rise in yields began during our session yesterday and gathered momentum overnight, a big jump in US consumer confidence alongside higher oil prices likely contributing to the move (see more below). A closer look at the gains in the 10y nominal yield also reveals the bulk of the rise can be attributed to the move up in the inflation expectations component with the 10y breakeven gaining 4bps and now trading just under the 2.40% mark ( 2.3950%).

The US Conference Board’s measure of consumer confidence rose to 121.1 from 109.7, well above the consensus, 113.0 . The rise in the index is almost entirely due to a 28.5-point leap in the present situation index. The expectations index, by contrast, rose a trivial 1.5 points. The index’s breakdown suggests, the latest round of stimulus payments alongside the improving Covid picture is making the US consumer feel pretty good about the economy and their household finances today. Not surprising with the fuller re-opening underway, the Labour Differential index (Jobs Plentiful less Jobs Hard to Get) within this report jumped from 8.0 in March to 24.7, the highest since last March. Yet another sign from the coalface of an abundance of jobs on offer.

Playing with the grain of higher inflation expectations and with little chance of getting an economy-wide increase in the minimum wage to $15 per hour through Congress, President Biden is set to sign an executive order forcing federal contractors to pay the rate (currently $10.95 following an executive order from President Obama) from March 2022.

Oil prices have led the gains in the commodity space, up just under 2% with the market buoyed by expectation of solid demand. BP CEO Bernard Looney said in a Bloomberg Television interview that China’s oil demand is above pre-pandemic levels and then added “America is almost back to where it was. The vaccines are going to kick in now in Europe. Then of course the question is what happens in the rest of the world.”

Iron ore prices hit a record high $193.85 per tonne, beating the previous spike seen in 2011. Copper prices also continue to rise and are just shy of the 2011 peak. Strong demand for both commodities is said to be underpinned by strong physical demand from China.

Moving onto FX, price action has been fairly subdued. The USD is a tad stronger in index terms largely reflecting a weaker JPY, yesterday the BoJ update had little impact as usual, instead higher US Treasury yields have likely been the main cause of a 0.6% rise in USD/JPY to 108.70.

Despite the higher commodity prices backdrop, the NZD and AUD have surprisingly underperformed, edging lower overnight to add to the small loss seen during local trading hours. The NZD has kept its head above the 0.72 mark, but only just, while the AUD is down 0.45% for the day to 0.7765.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.