Online retail sales growth slowed in May following a fairly strong April

Insight

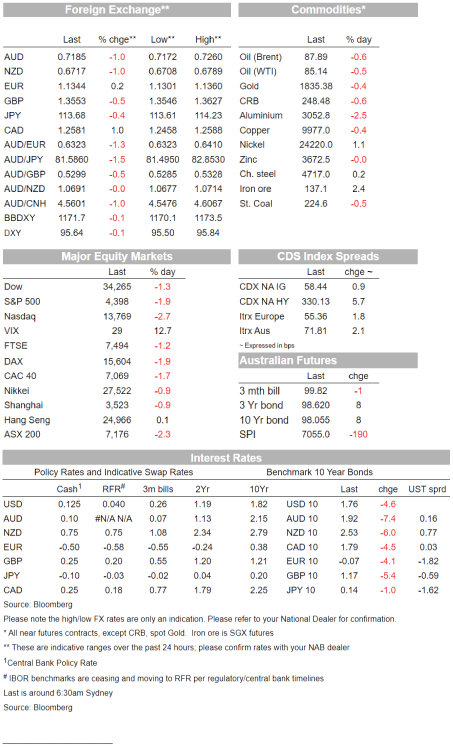

Bond yields retreated at the end of last week even though the assumption remains that the Fed will signal a March hike.

Equity markets continued their fall on Friday with the NASDAQ down a sharp -2.7% and the broader S&P500 also closed deep in the red at -1.9%. One catalyst for the sell-off was Netflix’s disappointing subscriber growth figures (reported after the close on Thursday) with Netflix down -21.8% on Friday. A pivot away from pandemic-tech may also be on with Peloton also disappointing. Tech earnings this week will be under focus (Microsoft and Apple report) as of course will be the FOMC decision on Wednesday. So far the NASDAQ is down by ‑14.3% from its November high and the Broader S&P500 is down -8.3% from its recent high. Note the S&P500 is now below its 200-day moving average, a potentially bearish signal.

It is also worth noting the equity meltdown is being felt in other risk assets with key commodities lower on Friday (brent oil ‑0.6%; copper -0.4%) along with G10 global FX risk proxies with the AUD -1.0%, along with NZD -1.0%. Crypto has also been mauled with Bitcoin down -16.2% to $35,850. Safe haven FX in contrast was bid with USD/JPY -0.4% and USD/CHF -0.6%. Geopolitical tensions in Europe between the Ukraine/Russia is also a factor here with politicians again meeting on Friday. The USD interestingly fell marginally with DXY -0.1% as EUR rose +0.2%. Note GBP also fell -0.5% with GBP the worst performer last week, down some -0.9%.

The sharp sell-off in equities is now feeding back into rates with US 10yr yields falling to as low as 1.73% before closing down by -4.6bps to 1.76%; note they only recently hit 1.87% on 18 January. 2yr yields in contrast closed just 1bps lower, meaning the 2/10s curve has flattened further by -3.3bps to 75.0bps. There is some speculation that Fed Chair Powell may dial back on the hawkishness in Wednesday’s post-FOMC press conference on Wednesday. Key will be on his potential comments around inflation and whether he still sees inflation moderating back towards 2% with a relatively shallow rate hike path. That implies a lot of the price increases we have seen are transitory, even if Fed Chair Powell is no longer using that word. The spread of the Omicron variant has the potential to extend supply chain disruptions. Chair Powell will also be asked about where the Fed sees neutral (Fed dot plot suggests 2.50% with markets heavily discounting this given 5Y1Y OIS Fwds are at 1.68%) and also whether the Fed sees the need to go into restrictive territory.

Where the Fed put for stocks remains hotly contested, but it certainly is a lot lower than the current -8.3% fall in the S&P500 so far given how hot core inflation is. Fed speak just prior to the blackout period seemed to emphasise that officials arenot too worried about a move higher in yields. Markets continue to be well priced for Fed hikes in 2022 with 4.2 hikes priced, while the small chance of a 50bps hike in March has unwound with markets back to fully pricing a 25bps rate hike. Meanwhile Fed rate hikes for emerging markets are a possible headwind in 2022 with the IMF’s Georgieva stating Fed hikes could “throw cold water” on already weak economic recoveries in certain countries. Georgieva noted those emerging markets with high levels of dollar-denominated debt to “ act now. If you can extend maturities. Please do it. If you have currency mismatches, ow is the moment to address them”. Those comments echo what China’s President Xi said last week about the potential for spillovers to emerging markets from aggressive fed rate hike.

Across the Atlantic meanwhile the ECB continues to downplay the inflation narrative with ECB President Lagarde stating we’re unlikely to face same inflation as in the US, we’re not seeing wages negotiations being way up. U “When I look at the labor market we are not experiencing anything like The Great Resignation, and our employment participation numbers are getting very close to the pre-pandemic level” “ So I think those two factors, if you look at them carefully, are clearly indicating that we’re not moving at the same speed, and we’re unlikely to experience the same kind of inflation increases that the U.S. market has faced.” President Lagarde highlighted US core inflation is at 5.5%, compared to 2.6% in the euro area, a different picture (see CNBC event with Lagarde for details).

Finally in Australian news, WA reported 24 virus cases. WA had only recently indefinitely extended their interstate border restrictions due to the Omicron wave seen in the rest of Australia. NZ has also seen cases of community transmission with NZ now moving into the red level in its traffic warning indicator system. My colleagues across the ditch at BNZ note the red level setting is not a lockdown, but does impinge business (and personal) activity to some extent, largely through gathering limits (typically 100). This will most impact things like events, hospitality, weddings , funerals etc.

In Australia it is all about Q4 CPI and how high it prints relative to the RBA’s November SoMP forecasts. Anything above a 0.6% q/q for core trimmed mean would be an upside surprise to the RBA’s November forecasts. NAB has pencilled in a print of 0.8% q/q and 2.5% y/y (consensus 0.7/2.4). Such an outcome would mean the RBA needing to revise up their CPI forecasts and we think the Bank will be able to forecast core inflation being at the mid-point of the 2-3% band across the entire forecast horizon – an important outcome given trimmed at 2½% was not forecast until December 2023. Come the RBA’s February meeting, QE is clearly gone, while the rates view depends on the RBA’s willingness to tolerate inflation at or above target as it waits until wages growth is closer to 3% plus. For Headline, we pencil in 1.2% q/q and 3.4% y/y (consensus 1.0/3.1%) (see NAB’s CPI Preview for details). Note the NAB Business Survey for December is also Tuesday.

Offshore the FOMC meeting on Wednesday is the main game in town, especially for risk assets. it is expected the Fed will give a nod to a March rate hike, but play down the need to move in increments of 50bps as the market had started to price late week. With a total of 4.2 hikes priced for 2022 along with QT having been flagged for H2, it is hard to see the FOMC meeting tilting the Fed more hawkish. The exception would be if Chair Powell repeated his 2018 “long way from neutral” comments, or if he embellished on a Q&A question of whether the Fed needed to get into restrictive territory. The FOMC dot plot currently has neutral at 2.5%, well above the 1.69% that 5Y1Y OIS fwd swaps have. Other US data pieces include Q4 GDP figures on Thursday with the consensus at 5.3% annualised – note the Atlanta Fed’s GDP Now has Q4 at 5.1%. Jobless Claims on Thursday will also get a closer look after a greater than expected increase last week. Note the BoC also meets on Wednesday with markets pricing a 71% chance of a rate hike.

Elsewhere NZ also has Q4 CPI figures with consensus for headline at 1.3% q/q and 5.8% y/y. EZ/UK focus will be on the flash global PMIs on Monday, and then to German, French, Spanish, and Belgium Q4 GDP on Friday. Profit reporting season also continues with some notable names including IBM on Monday, Microsoft and Johnson & Johnson on Tuesday, Intel and Tesla on Wednesday, Apple on Thursday, and Caterpillar on Friday. Overall, about a fifth of the S&P 500 are expected to provide their quarterly updates this week. Equites have been under pressure from a rising rate environment with the NASDAQ down -14.3% from its November peak, while speculative names have tanked. One example is the ARK Innovation ETF which is down -42.8% from November and -54.3% from the peak back in February.

There is nothing domestically, and offshore is likely to be quiet ahead of the FOMC decision on Wednesday. Across the ditch NZ’s capital Wellington has a public holiday. Further afield it is global PMI day with most focus on the PMIs for Europe. UK Retail Sales for December disappointed sharply on Friday (-3.6% m/m vs ‑0.8% expected), indicating likely downside risks for the Services PMIs. Consensus looks for manufacturing at 57.5 and services at 52.0. There might be greater than usual focus on the US PMIs given the sharp fall in the prices paid out of the rival ISM survey.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.