We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Markets hold, and more importantly extend yesterday’s post-Powell moves.

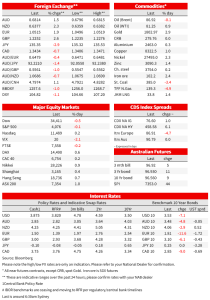

Markets hold, and more importantly extend yesterday’s post-Powell moves. A softer than expected US ISM Manufacturing print (49.0 vs. 49.7 expected) played to recession and disinflation views, as did slightly softer than expected Core PCE Inflation (0.2% m/m vs. 0.3% expected). China’s covid soundings were also positive for sentiment. The US 10yr yield fell -7.1bps to 3.53%, taking its cumulative fall since Tuesday to -21.2bps. There has been a noticeable paring of rate hike expectations with markets now pricing a peak US Fed Funds Rate of 4.86%, down from 5.0% on Tuesday. Markets have also increased expectations of rate cuts in H2 2023 with 46bps of cuts now priced, from 36bps on Tuesday. Reflective of that, real yields have tumbled with the 10yr TIP yield now at 1.16% from 1.48% on Tuesday and well down from its recent October highs of 1.74%. Equities have held on to gains with the S&P500 heading into its last hour of power down just -0.1% after surging 3.1% on Wednesday. The USD also continues to weaken with the DXY -1.1% with notable moves seen across most pares: AUD +1.5%; NZD +2.2%; EUR +1.9%; GBP -+2.6%; USD/Yen -2.9%.

24 hours on from Powell on Wednesday, it is clear markets read the speech as not as hawkish as feared. With price action continuing overnight, it suggests the initial reaction wasn’t only about market positioning, but markets are reading a genuine signal from the shift. For your scribe the most significant bit of the speech was the cautious acknowledgement around inflation trends, though it is of course “it will take substantially more evidence to give comfort that inflation is actually declining”. That acknowledgement included: (1) noting “goods prices should begin to exert downward pressure on overall inflation in coming months”; (2) “ [if] new lease inflation keeps falling we would expect housing services inflation to begin falling sometime next year”; and (3) there is uncertainty around core services inflation outside of housing, though “some measures of wage growth have ticked down…But the declines are very modest so far”. Overall that suggests the Fed is not blinkered to economic developments and that rhetoric will change depending on how the data prints – just as it did under Powell in late 2018 and early 2019.

There were two data prints overnight that suggest inflation pressures are easing. The ISM Manufacturing Index fell to 49.0 against 49.7 expected and 50.2 previously. It is the first sub-50 print since May 2020. The details were encouraging from an inflation point of view with the Prices Paid Index falling to 43.0, its lowest since May 2020. The Supplier Deliveries Index also eased to 47.2 and prior to October it it’s the first reading under 50 since February 2016. At NAB we combine prices paid and supplier deliveries into what we call a ‘Fed Pressure Index’ which is now the lowest since February 2017. Historically our Fed Pressure Index correlated well with core inflation excluding housing prior to the pandemic. Also relevant was a fall back in the New Orders Index to 47.2, while the Inventories Index remained slightly in expansion at 50.0. A commonly used recession indicator is to take the difference between new orders and inventories and at -3.7 is in recession territory (see ISM Manufacturing report for details). Anecdotes within the report were mixed, though many did point to economic uncertainty creating a slowdown in orders and customers cutting back on orders.

[see charts on the ISM below]There was also other key data out, including the PCE figures and Jobless Claims. Core PCE inflation in October was 0.2% m/m against 0.3% expected. An upward revision did see the annual rate come in as expected at 5.0% y/y, though the alternative Dallas Fed Trimmed Mean version was softer at 4.7% y/y. As for Initial Jobless Claims, they fell back to 225k last week from 241k, possibly distorted by the Thanksgiving holiday. In contrast, my colleagues in BNZ point out that the continuing claims indicator showed the biggest jump for the year (57k) to 1608k, suggesting that those that are losing jobs are finding it harder to get re-employed. Continuing claims are now 23% above the low of the past year, which is also consistent with what is seen in a recession. Meanwhile Challenger Job Cuts rose an absurd 416.5% y/y due to base effects, though in levels terms it is now at its highest since January 2021. Finally, the Atlanta Fed updated its GDP Now tracker for Q4 which was revised down to 2.8% from 4.3%.

The other positive development over the past few weeks as been China’s soundings around its Covid situation. This continued yesterday. The city of Beijing said it will allow low-risk patients to do home isolation if they choose, instead of going to government quarantine facilities. This should help alleviate some of the acute supply chain issues as well as perhaps citizens no longer being discouraged from going out due to fears of being pinged and being sent to a quarantine facility. Other cities are likely to follow the move. USD/CNY is down over ½% to 7.05. Finally, reports indicate that the EU will set the price cap on Russian oil at USD60 per barrel , a figure that is unlikely to impact Russia given its oil trades at a discount to benchmarks already. The figure will be regularly reviewed and should be “at least 5% below the average market price for Russian oil and petroleum products”. Oil prices show modest gains, supported by a weaker USD and more optimism around future Chinese demand as COVID-related restrictions ease. Helping the supply side, OPEC cut crude oil production by just over 1 million barrels a day last month.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.