We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

It’s a third successive day of relative calm across markets, though an upside surprise to German CPI has seen European yields push higher.

It’s a third successive day of relative calm across markets. Equities are a little higher, US yields have seen only modest moves, and the US dollar is softer on the DXY. European yields are higher after an upside surprise to German CPI and signs of sticky core inflation.

For Europe it was back to inflation watch in the lead up to Eurozone March preliminary CPI figures tomorrow. Spain provided a downside surprise on headline, with the harmonised rate falling to 3.1% y/y from 6.0% on a 1.1% m/m (consensus 3.7/1.6). That on sharp base effects as the rise in energy prices a year ago dropped out of the calculation. Core inflation, however, dipped just one tenth to 7.5% from 7.6% and continued to suggest persistent underlying pressures which are the key focus for the ECB. Later in the day, Germany provided an upside surprise, falling to 7.8% y/y on a 1.1%m/m gain (Consensus 7.5/0.8) from 9.3% y/y in February. No core figures were released, but Bloomberg estimates that core inflation rose from 5.4% to 5.7%. The larger fall in headline in Spain is because its energy prices responded faster to wholesale market moves than other countries early last year, but base effects also sharply flattered the German number, German energy inflation fell sharply from 19.1% in February to 3.5% in March.

German 2yr yields pushed higher after the German upside surprise, up as much as 14bp intraday at 2.79%, with the 2yr now sitting at around 2.74% and 9bp higher on the day. That came after an initial move lower on the back of the Spanish data to a low of 2.50% was unwound. German 10yr yields were 4bp higher. For context, 2yr yields are still about 60bp below its level on 9 March, before the banking turmoil. ECB pricing implied an 81% chance of a 25bp increase at the April meeting, and now prices 60bp of additional tightening by September, up from 50bp yesterday. The Eurozone wide preliminary figure is released this evening, with expectations for the headline rate to dip to 7.1% from 8.5% on a 1.1% m/m, but the core rate to rise to a new record of 5.7% from 5.6%. The US 10yr yield lost 2bp to 3.55%.

In equities, the S&P500 is up 0.6%, extending yesterday’s gains. US Banks stocks, however, underperformed, with the KBW bank index 1.3% lower. Financials was the only sector in the S&P500 to see declines on the day, with gains led by real estate and IT. In a further sign that the volatility of the past couple of weeks may be receding, the VIX index fell back below 20, its lowest level since 8 March. In Europe, the Euro Stoxx 50 was 1.3% higher.

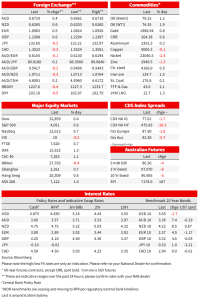

The US dollar was weaker, down 0.5% on the DXY. At 102.15, The DXY is only a little above its recent low of 101.92 on 23 March. European currencies were towards the top of the G10 leader board with the euro gaining 0.6% to 1.0905. The Australian dollar was 0.4% higher at 0.6710, currently not far from intraday high of 0.6718.

We also heard from Fed speakers overnight. Richmond Fed President Barkin said he saw the possible range of outcomes going forward “as pretty wide…if inflation persists, we can react by raising rates further”. He added “if I am wrong about the pricing dynamics at play, or about credit conditions, then we can respond appropriately.” But he was far from dovish, explaining why he supported a rise at the last meeting, he said “ If you back off on inflation too soon, inflation comes back stronger, requiring the Fed to do even more, with even more damage.” Boston Fed President Collins sounded more hawkish than Barkin, saying “inflation remains too high, and recent indicators reinforce my view that there is more work to do.” The key question for policy makers is how much sustained tighter credit will slow the economy. In Collins mind, tighter bank lending standards “may partially offset the need for additional rate increases.”

Minneapolis Fed’s Kashkari, who was at the centre of the government’s response to the 2008-2009 financial crisis, sounded a note of caution. While noting it wasn’t his forecast, he did say that “Banking panics and banking stresses tend to take longer than you think. In 2008, it took a couple years. ” While he doesn’t think we have that kind of situation here, “every time in 2008, we thought we are through it there was another shoe yet to drop.” Adding little insight to help size up the impact of tighter credit conditions, he simply added that “What’s unclear right now is how much of the banking stresses of the past few weeks is leading to a sustained credit crunch which would then slow down the US economy.”

On the US data flow, US Initial jobless claims rose 7k to 198k last week, past its cycle lows if you squint at the chart, but jobless claims are still at very low levels consistent with a still tight labour market. Worker Adjustment and Retraining Notices (WARN), which oblige employers with more than 100 full-time workers to provide written notice to the state and workers at least 60-90 days ahead of planned plant closings and mass layoffs, as well as the more widely followed Challenger job layoff series, have been picking up over recent months, and some softening should be more evident in claims through the second quarter.

In Australia yesterday, Job vacancies fell just 1.5% in the three months to February to be 9% below their May 2022 peak. That was a smaller decline than the 4.6% fall in the prior 3 months and still leaves vacancies 92% above their pre-pandemic, February 2020 levels. Job vacancies were not cited as top tier in the RBA’s data dependent run into the April board meeting, but today’s data certainly add to the February employment print in suggesting a still very tight labour market backdrop into 2023, even if some of the acute tightness from late 2022 may have abated and the pace of employment growth had slowed. While the Monthly Inflation Indicator on Wednesday added further confidence to the widely held expectation that Australian inflation peaked in Q4, ongoing tightness in the labour market could support some stickiness on the path back to 2-3%.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.