On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

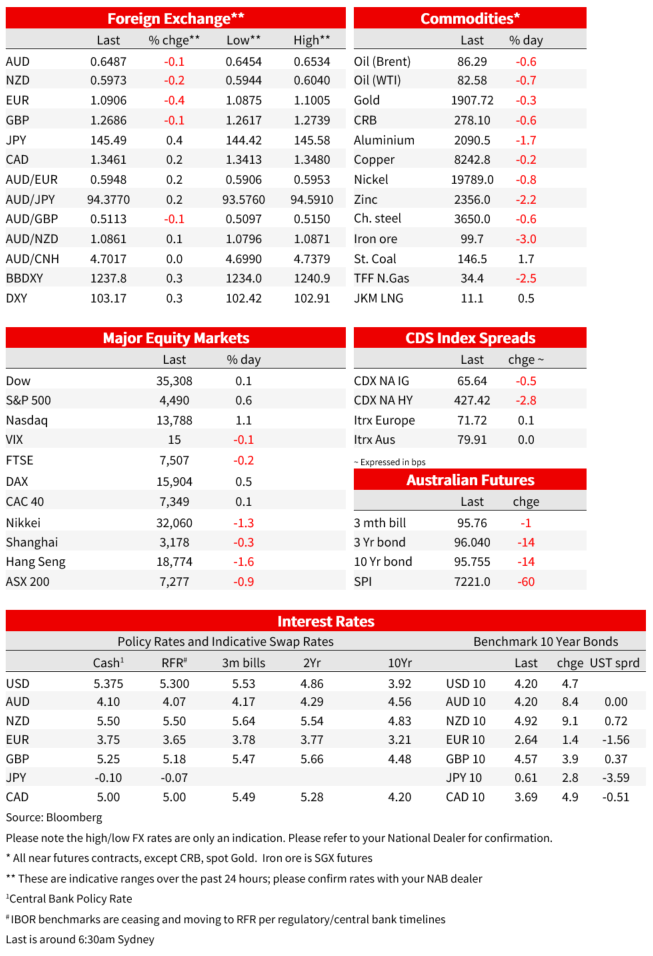

US equities started the new week on a positive note, notwithstanding a negative lead from Asia. Core global yields have continued their ascendancy while the USD is broadly stronger with negative China sentiment weighing on the AUD and NZD

NZ: Perform. of services index, Jul: 47.8 vs. 49.6 prev.

Oh Lord, when it rains it pours

When it rains it pours – Luke Combs

Amid a light trading environment, US equities have started the new week on a positive note, notwithstanding a negative lead from Asia. Chinese investors cannot catch a break with bad news followed by more bad news – A top private wealth manager missed payments on Monday. Core global yields have continued their ascendancy with the UST curve bear flattening. The USD is broadly stronger with negative China sentiment weighing on the AUD and NZD while the move up UST yields weighed on JPY.

US equities opened higher and then range traded before another surge higher into the close . In a light summer trading session (17% below the 30day average), Big-tech companies led the gains within the S&P 500 with the IT sector up 1.85% while Communication Services gained ~ 1.04% and Health Care was +0.33%. Meanwhile rate sensitive sectors, Utilities (-0.83%) and Real Estate (-0.54%) were the notable under performers.

The S&P 500 closed 0.57% higher while the NASDAQ was 1.05 %. Smaller stocks were under pressure with the Russell 2000 closing -0.24% while industrials were little changed, the Dow ending the day +0.07%. Earlier in the session the Eurostoxx 600 closed little changed (0.15% higher) with the retail sector outperforming while mining and energy underperformed. Like in the US, volumes were also light (~25% below the 20-day average). Overall equity investors have started the new week with cautiously optimistic watching the move up in core global bond yields and the turmoil coming from China’s economic woes. China reports July activity data today (see more below)

Yesterday Asian equities closed in negative territory with the Hang Seng China Enterprises Index leading (-3.09%) the declines. China CSI 300 was -0.73 while the Hang Seng was -1.58%. For China the adage when it rains it pours seems quite appropriate currently with investors seemingly unable to catch a break. Bad news is being followed by more bad news, China’s loss of economic momentum has not been helped by renewed concerns over the property sector. But signs of contagion are making a bad situation worse. Yesterday China’s banking regulator announced set up a task force to assess the risks at Zhongzhi Enterprise Group, one of the nation’s top private wealth managers, after a unit missed payments on multiple high-yield investment products .

Core global yields have retained their upward trend with the UST curve showing a bear flattening bias. The 2y UST rate climbed another 6bps to 4.959% while the 10y UST yield climbed 3bps to 4.19%, after trading to an overnight high of 4.215%. Earlier in the session, European yields also traded higher with the curves also showing a bear flattening bias. The 10y Bund yield gained 2bps tp 2.64% while 10y Gilts climbed 4bps to 4.57%. Money markets added 2bps to ECB peak rates, pricing a 3.95% deposit rate by year-end, the highest since policymakers raised policy rates 25bps on July 27, meanwhile in the UK the market lifted BOE rate hike expectations close to 10bps, pricing a 5.90% peak by March — highest since Aug. 1.

Monday was devoid of top economic data releases with the move up in yields seemingly driven by sentiment and a reassessment of central bank policy outlooks – a higher for longer theme. In addition Jason Wong, my BNZ colleague, noted that data compiled by Bloomberg shows the largest weekly outflow from the biggest Treasury ETF fund (TLT) since March 2020, with an exodus of more than $1.8b last week. So rather than higher yields attracting investors, Jason argues the flow data suggest higher yields have been caused by diminishing interest to participate in the market for whatever reason. The BoJ relaxation of YCC and Fitch downgrade of the US sovereign rating putting some focus on the poor US fiscal metrics are good arguments that spring to mind with Bill Gross making a solid case for 10y UST yields fair value at 4.5% also likely played its part.

On a more positive note, the NY Fed released the July 2023 Survey of Consumer Expectations, showing median inflation expectations declined across all three horizons, falling from 3.8% to 3.5% at the one-year-ahead horizon – lowest since April 2021, and from 3.0% to 2.9% at both the three-year and five-year-ahead horizons.

The move up in UST yields as well as negative vibes coming from Asia supported the USD with the greenback modestly stronger across the board. Over the past 24 hours the DXY and BBDXY indices gained ~0.25% with the USD also outperforming all G10 pairs. The repricing of BoE rate hike expectations helped GBP show some resilience, only down 0.09% to 1.2685 while the Euro (-0.35% t0 1.0905) and other European currencies (NOK -0.44% and DKK -0.36%) struggled a little bit more.

The AUD and NZD are only down 0.14% and 0.12% respectively, but of note both antipodean pairs recorded fresh year to date lows. CNH and CNY came under pressure during our day session yesterday, not helped by the pessimistic sentiment on China. After the Zhongzhi missing payment news, USD/CNH traded to an overnight high of 7.2927, with the AUD dragged down to an overnight low of 0.6454, similarly the kiwi traded to a fresh YTD low of 0.5944. Later in the session with US equities showing some positive signs both antipodean pairs recovered a bit of ground with the AUD now starting the new day at 0.6487 while NZD is at 0.5976.

The move up in UST yields lifted USD/JPY back above the ¥145 mark ( now at ¥145.55), a level that instigated talks intervention by the MoF/BoJ back in June. That said given YCC policy and BoJ resistance to a big move up in J10y GB yields, a weaker JPY is a natural outcome when UST yields are trading higher. Some verbal intervention now seems only a matter of time, but the market looks set to test the MOF/BoJ resolve.

In other news, Argentina’s government devalued its official exchange rate by ~ 18% to ~ 350 pesos per dollar and hiked its key interest rate by 21% to 118% in a drastic policy shift amid a shortage of funds and concerns over its currency. The move was triggered by news that populist Javier Milei who vowed to burn down the central bank, won surprisingly strong support in a primary vote. The congressman identifies as a libertarian and supports dollarizing the economy.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.