Economic and financial market update

Insight

A quiet start to the week with no top-tier data. The biggest piece of news was the EU and UK agreeing to a new Northern Ireland trade agreement, now termed the Windsor Agreement.

A quiet start to the week with no top-tier data. The biggest piece of news was the EU and UK agreeing to a new Northern Ireland trade agreement, now termed the Windsor Agreement. The Agreement would create a new green lane for traders, scrapping trade restrictions between Great Britain and Northern Ireland. There would also be a new “Stormont brake” in the Agreement. Now it is now over to the UK Parliament. GBP was +1.0% on the news, along with EUR +0.6%, which was the major driver behind USD weakness (DXY -0.5%). Yields were broadly steady with the US 2yr -2.8bps to 4.79% and 10yr -2.5bps to 3.92%; the 4.0% mark remaining a key resistance level with a high of 3.98% overnight. Fed pricing was also little changed with a terminal 5.40% by September 2023 and now only 12bps worth of cuts in H2 2023. There was only one Fed speaker, Governor Jefferson who emphasised the commitment to the 2% inflation target. Equities rose with the S&P500 so far +0.6% into the close.

The only notable news was the UK and EU agreeing on a new trading arrangement for Northern Ireland, which had been a major sticking point in the post Brexit environment. The now termed the Windsor Agreement it softens the Northern Ireland protocol that was part of the 2019 Brexit deal, and will reduce trade issues between Britain and Northern Ireland, the latter which has effectively remained in the EU single market following Brexit. The Agreement creates a new green lane for trade, with British goods destined for the Northern Ireland market entering without customs checks while creating a separate process for goods going to Ireland through the province. The deal also gives the Northern Ireland assembly the power to ask the UK government to veto new EU regulations or laws that apply to the province – termed the ‘Stormont Brake’.

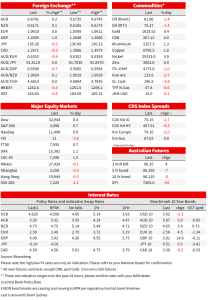

For the ‘Stormont Brake’ to work though, the devolved government needs to be functioning and not suspended as it is currently. Over the next few days we are going to hear whether there is any resistance in Parliament to passing the Agreement (see WSJ: U.K., EU Reach Deal in Bid to Resolve Northern Ireland Trade Issue). GBP reaction has been modest, though it has outperformed, up some 1.0% to 1.2059. The restrained move likely reflecting some recent anticipation of reaching a deal and also uncertainty over whether the UK Parliament will approve it. There has been some positive spillover in EUR, up 0.6% to 1.0610. Moves in GBP and EUR have driven USD weakness with DXY -0.5%. In contrast the AUD and NZD have largely tracked sideways and show little net movement for the week (AUD +0.2% to 0.6741, and NZD +0.1% to 0.6171).

Data was mostly second-tier. Headline US durable goods orders fell by more than expected at -4.5% m/m vs. -4.0% consensus, but importantly this was dragged down by volatile aircraft orders. Core Durable Goods orders ex-transportation rose stronger than expected at 0.7% m/m vs. 0.1% consensus, following a downwardly revised -0.4% in December. The underlying trend of course remains soft and the Dallas Fed Manufacturing Index was -13.5 vs. -9.3 expected; anecdotes were very mixed. If there was a glamour statistic to suggest that the hard data for January data in the US was overstated due to warm winter weather, pending home sales surged 8.1% m/m in January vs. 1.0% consensus. The first test of whether the ‘overstated warm winter’ thesis is real will come on Wednesday and Friday with the ISMs for February out. Across the pond Euro area economic confidence was little changed at 99.7 in February from 99.9, vs. 101.0 expected

There was one Fed speaker, though not market moving. Governor Jefferson gave a lecture on “Recent Inflation and the Dual Mandate”, emphasising the Fed’s commitment to the inflation target: “changing the 2 percent inflation target would damage the central bank’s credibility. For these reasons, I am committed to lowering inflation to our 2 percent target.” Within the text of the lecture, Jefferson effectively echoed Powell’s Volcker 2.0:“… on the other hand there is a risk of policy being too restrictive and unnecessarily increasing the likelihood of recession. In the face of this latter risk, some economists argue that a higher inflation target is better than the Fed’s current 2 percent target rate…however, [this] would introduce an additional risk by calling into question the FOMC’s commitment to stabilizing inflation at any level because it might lead people to suspect that the target could be changed opportunistically in the future. If so, then these reputational costs will undermine the key benefits of well-anchored longer-run inflation expectations”.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.