Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

Bond yields continue to climb with risk assets now coming under pressures.

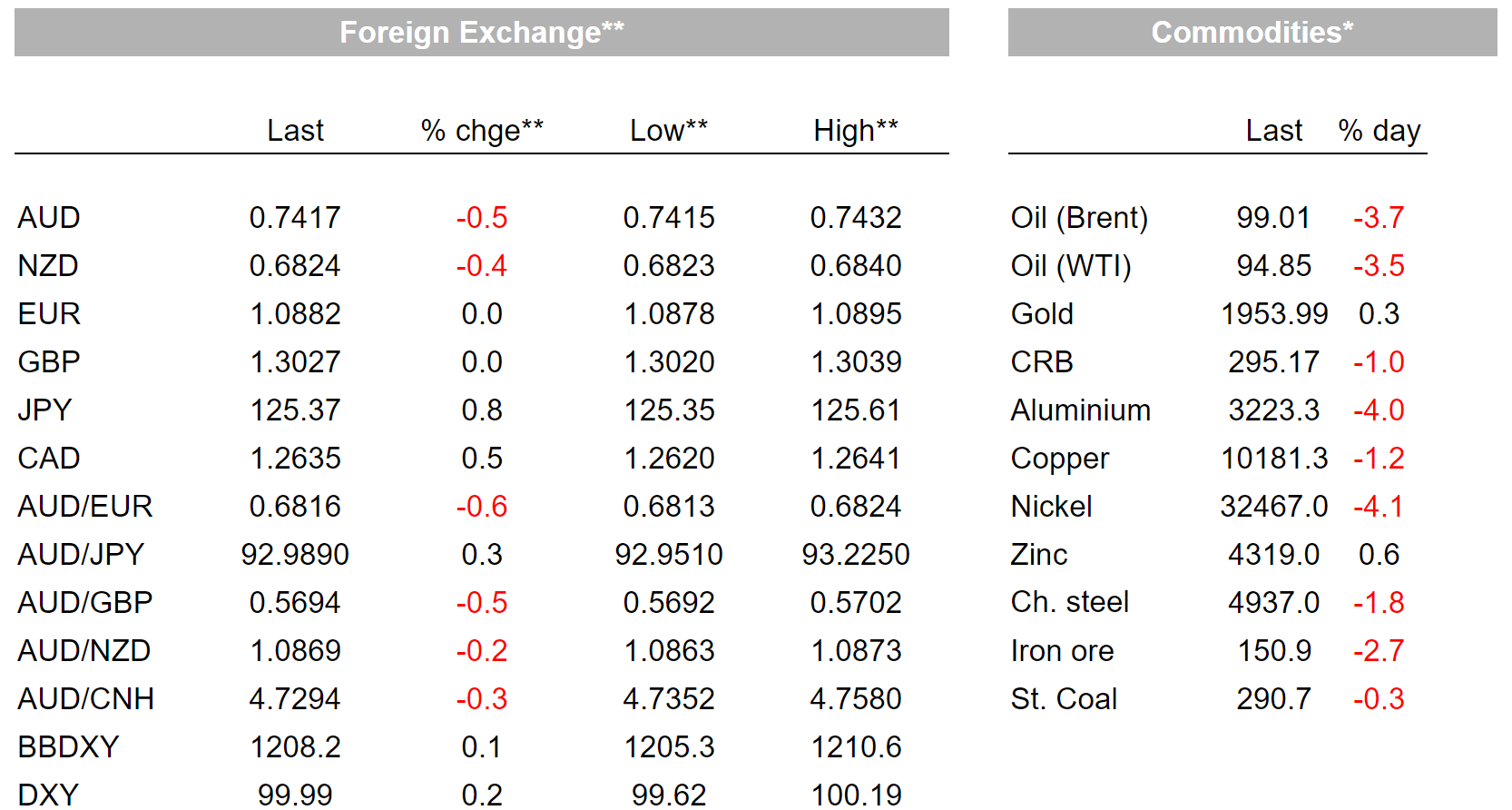

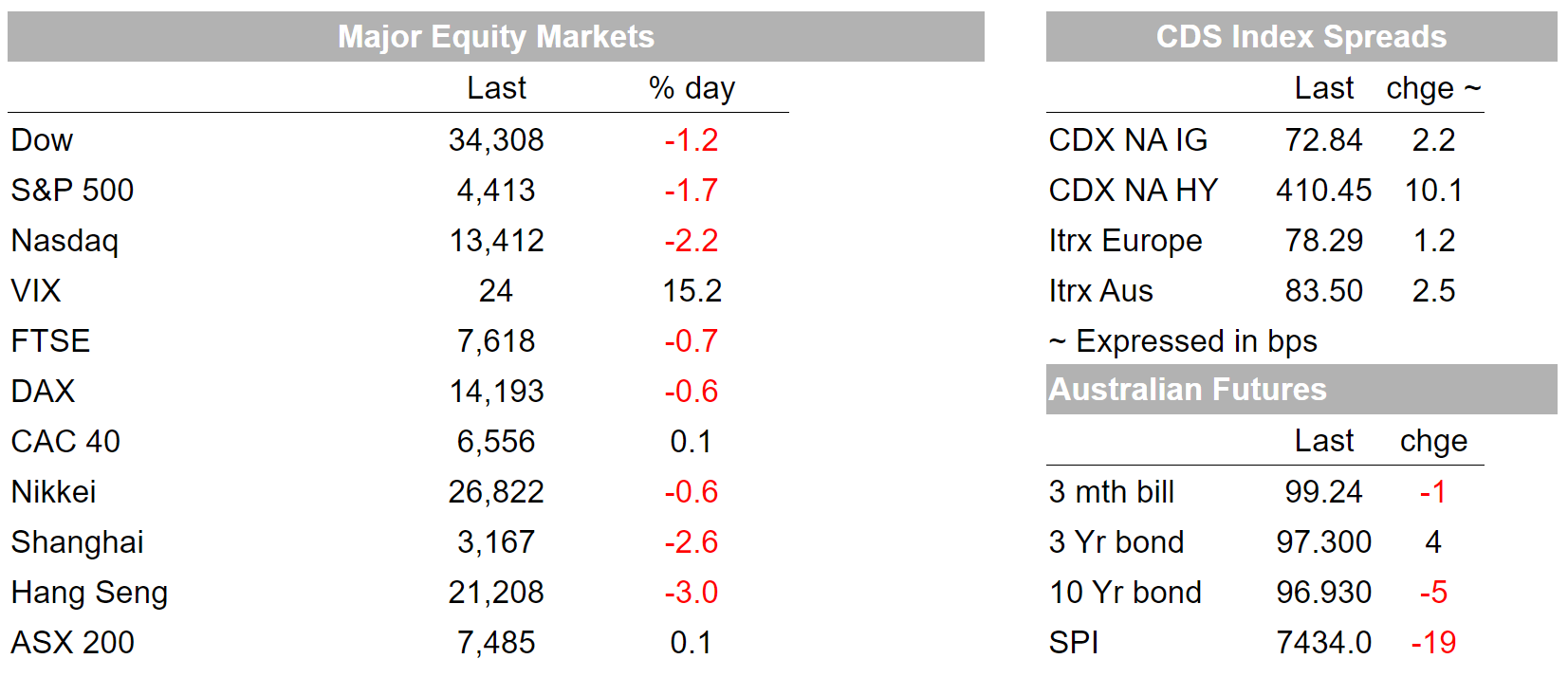

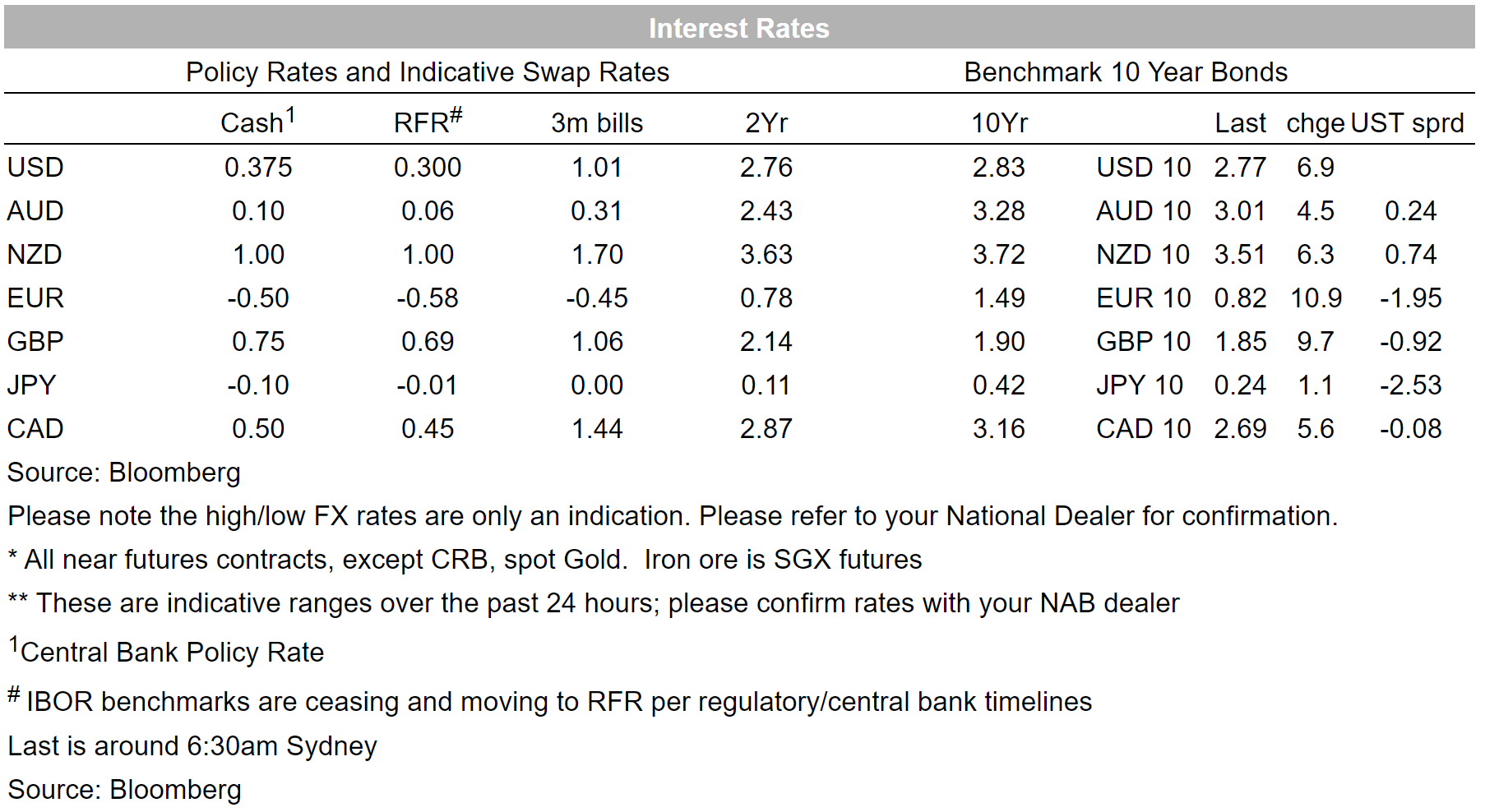

Risk assets are starting to respond to the relentless rise in yields with US equities falling sharply overnight as the US 10yr yield hit 2.79%, its highest in three years. The S&P500 closed -1.7% with all sectors in the red. Losses were led by tech with the NASDAQ -2.2%. Curves have steepened with the 2/10s curve now +26bps, adding 9bps overnight with 2 year yields down (-1.7bps to 2.50%) and 10yr yields up (+6.9bps to 2.78%). There was little data or news flow to drive moves, suggesting markets are still reacting to last week’s hawkish Fed commentary and the Fed’s QT plans. While near-term Fed Funds pricing has not shifted greatly, estimates of neutral have with 5Y1Y OIS FWD up 11bps to 2.53% and is now similar to the Fed’s long-run dot of 2.40%. Other factors possibly in the background include upcoming bond auctions and hedging related to upcoming corporate issuance (Amazon has flagged a $12.75bn bond issue; Amazon last tapped the debt markets in May). European yields which had lagged moves recently were also higher with the German 10yr up 10.9bp to 0.82%. As for what’s coming up today, all eyes will be on the US CPI with the Whitehouse prepared for a high print.

There were two Fed speakers, though they mostly reiterated recent comments. The Fed’s Evens (one of the least hawkish) has seemingly cemented the probability of multiple 50bp moves, stating “Perhaps it’s highly likely, even ” and that he is open to getting to neutral by December (neutral pegged at 2.25-2.50%) which would require 3 x 50bps moves and 25bp moves at the other meetings (there are only six FOMC meetings left for 2022). Markets are well priced for this with back to back 50bp hikes in May and June now 88% priced, while there is 220bps of tightening priced for the rest of 2022. It is also clear recent long-end moves reflects ongoing reaction to proposed details around QT last week which at $95bn, is almost double the peak run down rate seen previously. The Fed’s George a few weeks back seemed to suggest accelerated QT was about steepening the yield curve: ” raising short-term rates while the balance sheet continues to depress longer-term yields will contribute to a flattening and inversion.” And that the Fed’s QE holdings have depressed 10-year yields by up to 1.5ppts.

Notwithstanding yield moves, concerns remain that the Fed may overdo the tightening cycle with the Fed’s Waller not playing down the risk: “When you have to use a brute-force tool, sometimes there’s some collateral damage that happens,” “We’re trying to do this in a way that there’s not much of it, but we can’t tailor policy.” “ With housing — can we cool off demand for housing without tanking the construction industry? Can we cool down the labor demand without causing employment to fall? That’s the tricky road that we’re on,”. In this context a recent WSJ survey reports economists see a growing risk of a recession with the probability of the economy being in recession sometime in the next 12 months now at 28%, up from 18% in January. The latest recession probability is though slightly lower than the last expansion’s peak of 34.8% in September 2019, with that expansion ended because of the pandemic in 2020 (see WSJ: Recession Risk Is Rising, Economists Say).

In FX, the Yen is the biggest story and is approaching a two decade low. USD/Yen was +0.9% to 125.43. The EUR and GBP on the other were flat against the dollar alongside rising ECB hike expectations and reduced political risk with French President Macron securing 27.8% of the first round of voting against 23.1% for Le Pen. With Macron a firmer favourite to win re-election, 10Y French OAT spreads tightened ~4bp (as did BTPs). The second round of voting is on 24 April with Macron heavily favoured to win. The USD was slightly higher with the DXY +0.2%. Commodity currencies have fallen (AUD -0.5% and NZD -0.4%) with a very sizeable fall in oil prices. Brent crude was down 3.7% to $99 a barrel with the physical oil market weakening in response to China’s lockdown in Shanghai (and signs of COVID spreading to other areas), while there Russia is able to find buyers with almost 4m barrels shipped in the first full week of April, the highest level seen this year. It appears China and India are taking advantage of the heavy discounting of Russian oil.

Finally in China, news remains very mixed. Covid-19 lockdowns in Shanghai and supply-chain disruptions in the country continued to mount, but there are also signs of stimulus taps being opened that will be supportive once lockdowns end and China starts to pivot to living with Covid. China aggregate financing figures released last night were 4.65 trillion yuan, beating the consensus by more than a trillion. China CPI and PPI also printed a bit stronger than expected (CPI 1.5% from 0.9% and 1.3% expected, PPI 8.3% from 8.8% and 8.1% expected). For now though the near-term impact of lockdowns is clearly weighing with the CSI 300 falling 3.1%, while Hong Kong’s Hang Seng Index down 3%.

US CPI the biggest item on the calendar. Domestically the NAB Business Survey for March is out along with the ANZ/RoyMorgan Weekly Consumer Confidence report. Details below:

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.