Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

Janari Tonoike, head of NAB Japan Securities Limited, National Australia Bank’s (NAB) new Tokyo-based, wholly-owned subsidiary, showcases the long-standing relationship between Japan and Australia, and explains how the new entity can help investors and borrowers in both markets and beyond connect better in a challenging global business environment.

At a time of global trade tensions, the relationship between Japan and Australia offers a valuable lesson in the many advantages and opportunities cross-border commerce presents, not least in coping with the slowing of the global economy.

Japan is Australia’s second-largest trading partner and accounts for nearly half of all Asian foreign direct investment (FDI) into the country.¹ And a steadily growing proportion of Japan’s pool of investible assets – the world’s third-largest – has shifted southbound over the past 15 years, with the value of Japanese investments in Australian securities now over AU$9 trillion.²

To better serve this growing investor base and in recognition of local investors’ commitment to the Australian market, NAB recently launched NAB Japan Securities Limited.

“As Japan continues to battle deflation with negative interest rates, from a Japanese investors’ point of view, Australia is an attractive destination, offering a positive interest rate environment and economic growth,” noted Janari Tonoike, Representative Director, NAB Japan Securities Limited. “It’s a great opportunity from the perspectives of Australia and New Zealand too, as Japan offers a deep pool of investible capital, especially for long-term infrastructure financing needs and the growing field of sustainable finance.”

As the largest corporate bank in Australia, with a significant footprint in New Zealand via Bank of New Zealand, and active in Japan for five decades, NAB is well placed to play a bigger role in facilitating and fostering investment flows between these markets.

According to Tonoike, the biggest advantage of being awarded the securities license is the ability to reach out to a broader set of investors in Japan with a greater variety of products and services, and connect them to borrowers in Australia and New Zealand. It also fulfils the critical regulatory objective of ensuring Japanese investors are served by an onshore entity.

While NAB Tokyo under its existing banking license will retain its strengths in foreign exchange and corporate and institutional banking to support borrowers, the new securities license will allow it to trade in bonds, derivatives, repurchase agreements and other securities products to support investors as well.

A key opportunity, according to Tonoike, lies in the corporate bond market as issuers in both Australia and New Zealand look to raise funds abroad, typically offering higher yields than are available in Japan. Semi-government bonds issued by local Australian governments to finance long-term infrastructure projects, many of which are rated as high as AA or AAA and offer better yields than government bonds, are another attractive offering.

“Because Australia is so big on project finance, there will be related lending opportunities for Japanese investors,” Tonoike said. “This would be very interesting for many investors with long-dated liabilities, namely the life insurance companies.”

A combination of factors are coming together to drive these trends. For one, the governments of both Australia and New Zealand are striving to tighten fiscal expenditure while continuing to fund the infrastructure projects required to serve a burgeoning population. At the same time, lending standards are tightening, prompting issuers to look overseas for alternative sources of funding.

Meanwhile, the sustainable finance market is gaining traction in Japan³ as the country seeks to ramp up participation in the global green bond market, opening up fresh investment avenues.4 This is also an area that NAB has played a pioneering role in, as the world’s first issuer of a Climate Bond Initiative-certified green bond in 2003.5

“As a leader in green bond issuances, NAB can help the Japanese market which is very focused on the UN Sustainable Development Goals right now, both as an issuer and arranger by providing our extensive experience and knowledge of sustainable investing,” Tonoike said.

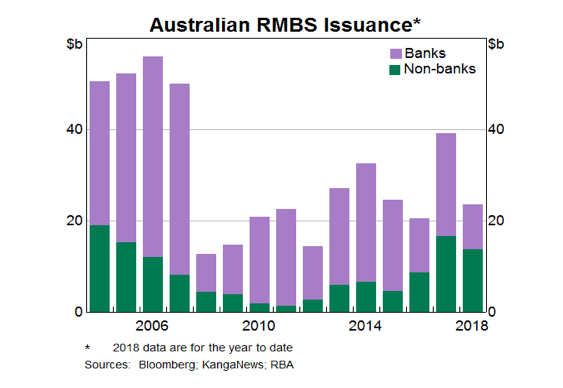

An example of this approach in action is NAB’s development of the world’s first green residential mortgage-backed securities (RMBS), an asset class now attracting interest from a growing number of Japanese investors.6

Recognising that there may be no escape from a low interest rate environment for the foreseeable future, financial institutions will have to become more creative in their product offerings to attract investors looking for higher-yielding assets, Tonoike noted.

NAB’s extensive experience in the global securitisation market – in assisting customers in raising funds from global investors, and arranging and lead-managing transactions worldwide – proves it can be relied upon in this regard. In 2018, NAB had a 26% share of Australia’s securitisation market, with 30 deals worth over AU$7 billion. 7

That expertise and experience, as well as a track record of innovation in areas like green finance, will now be available to a broader pool of Japanese investors through NAB Japan Securities, helping serve ambitions for both stability and healthy returns over the long term, and contributing to a thriving bilateral trade and investment partnership in the process.

Download a Japanese version of this article.

¹https://www.globalcapital.com/article/b1dpw0fvt8b1jg/japans-sri-bond-market-strength-in-numbers

² The opportunity for NAB, Appendix 1: Macro Trends slide

³https://www.globalcapital.com/article/b1dpw0fvt8b1jg/japans-sri-bond-market-strength-in-numbers

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.