We expect growth in the global economy to remain subdued out to 2026.

Insight

It was a quiet session overnight ahead of key risk events later in the week (US CPI is on Wednesday and bank earnings are on Friday, including Wells Fargo, Citigroup and JP Morgan).

It was a quiet session overnight ahead of key risk events later in the week (US CPI is on Wednesday and bank earnings are on Friday, including Wells Fargo, Citigroup and JP Morgan). There was plenty of news flow, but not overly market moving. The IMF downgraded global growth by a tenth to 2.8% for 2023 and warned risks were to the downside given recent financial turmoil. In the same vein the newest US Fed member Goolsbee (voter) from the Chicago Fed warned “at moments like this of financial stress, the right monetary approach calls for prudence and patience”.

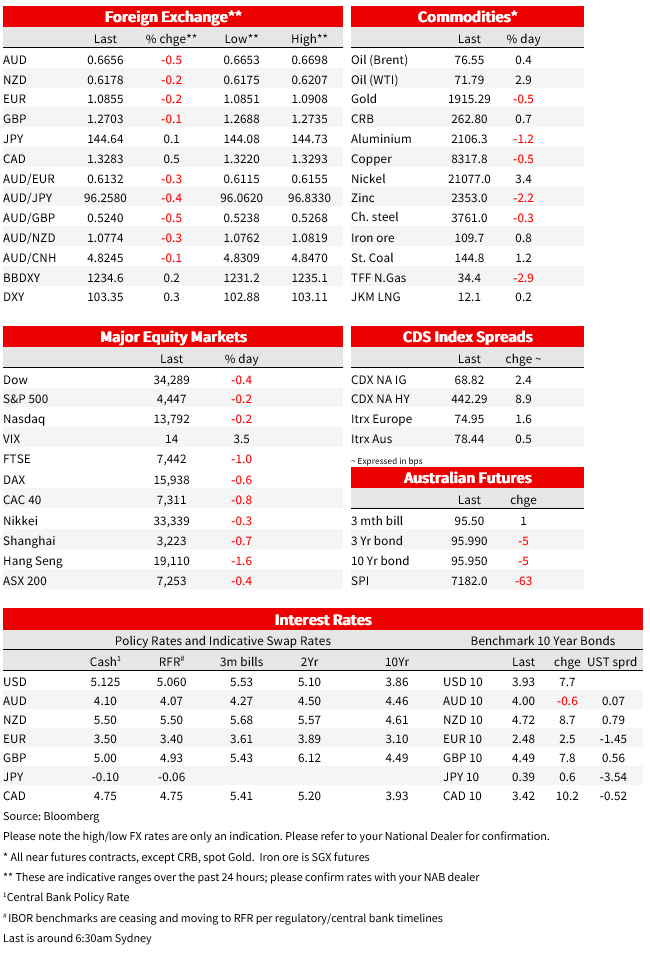

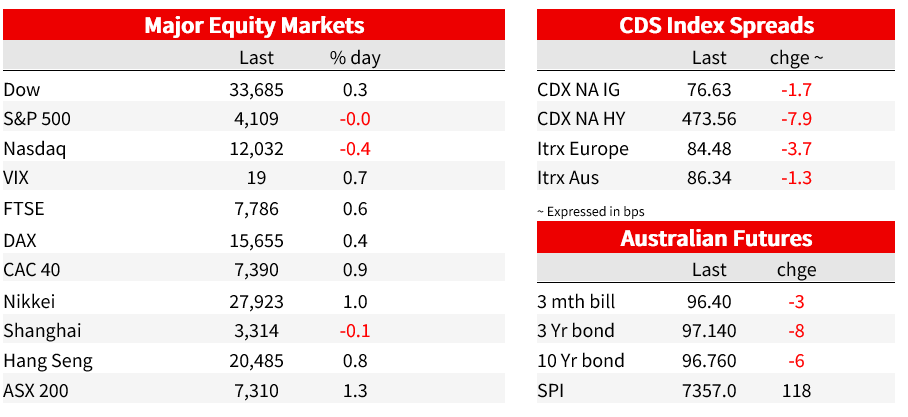

Despite those headlines yields are up modestly with the US 10yr +0.9bps to 3.43% and the 2yr +1.2bps to 4.02%. Fed Funds Pricing is little changed with a 72% chance of a May rate hike, followed by 63bps worth of cuts in H2 2023. Across the pond yields are up by more in catchup to US moves over the Easter break with the 10yr Bund yield +12.8bps to 2.31%. Equities were mixed with the S&P500 -0.0% and Eurotstoxx50 +0.6%. The USD is weaker with the DXY ‑0.4%, and modest gains were seen for EUR (+0.6%), GBP (+0.4%) and CAD (USD/CAD -0.4%). The AUD is also up +0.3% and got some support in APAC yesterday around headlines of China-Australia relations continuing to thaw with some talk of barley restrictions being reviewed (see AFR: Hopes rise for end to China trade bans after barley tariff deal). Meanwhile the NZD has underperformed -0.3%.

First to the new Chicago Fed President who sounded dovish and is a Fed voter this year. The speech was deliberately set up to explain why “at moments like this, of financial stress, the right monetary approach calls for prudence and patience”. Goolsbee’s main argument was that history shows moments of financial stress, even if they don’t escalate into crises, can mean tighter credit conditions which then have a material impact on the real economy. Citing private sector analysts, banking ructions so far might be equivalent to a 25-75bps worth of rate hikes. As a consequence the Fed should “ gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation”. On pre-emptive cuts to ward of financial stress, he wasn’t a fan, preferring to use supervisory tools first in order to avoid financial dominance over monetary policy concerns (see Goolsbee: Monetary Policy in Moments of Financial Uncertainty).

Goolsbee’s remarks were somewhat in contrast to NY Fed President Williams on Monday, who said in an interview that the March outlook of one more interest rate hike this year is a “reasonable starting place”, though the path will depend on incoming economic data. While he acknowledged signs of inflation slowing, core services inflation excluding housing “hasn’t budged yet”. He noted that the economic impact of recent bank turmoil is uncertain but “right now we’re not seeing those effects. And actually the banking system has really stabilised”.

Playing to the view that a tightening of credit conditions may in fact be material, bank lending in the US has fallen sharply over the past few weeks, while the latest NFIB survey showed small businesses are facing tougher lending conditions, with a net 9% saying financing was harder to get, the highest in over a decade. There was also notable weakness regarding capital spending. Hiring plans which were published last week imply a sharp deceleration in payrolls growth, with this index tending to lead payrolls by two months. The headline NFIB index though was broadly as expected at 90.0 vs. 89.8 expected and 90.9 previously.

As for the IMF, they downgraded global growth forecasts made three months ago by 0.1% to 2.8% for 2023 and 3.0% for next year, following the 3.4% lift last year. These figures look optimistic so it’s no surprise that the IMF noted “the risks are weighted heavily to the downside, in part because of the financial turmoil of the last month and a half”. Interestingly the IMF also notes inflation’s return to target is unlikely before 2025 in most cases . In a separate Global Financial Stability report, the IMF noted the “perilous combination of vulnerabilities” that have been “lurking under the surface of the global financial system for years” and that stress in the banking sector will likely weigh on broader lending conditions and economic growth (see IMF WEO and IMF GFSR).

Positive economic news continues to come from China. Credit growth was stronger than expected in March, following the recent RRR cut and government encouragement to banks to support the post zero-COVID recovery, with aggregate financing of CNY 5380b in March consistent with a very rapid pace of credit expansion. China inflation data remained weak, being one of the few central banks around the world with inflation running well below target, with the CPI up 0.7% y/y, which can only encourage further easing in monetary policy.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.