RBA revisions, rates and risks ahead

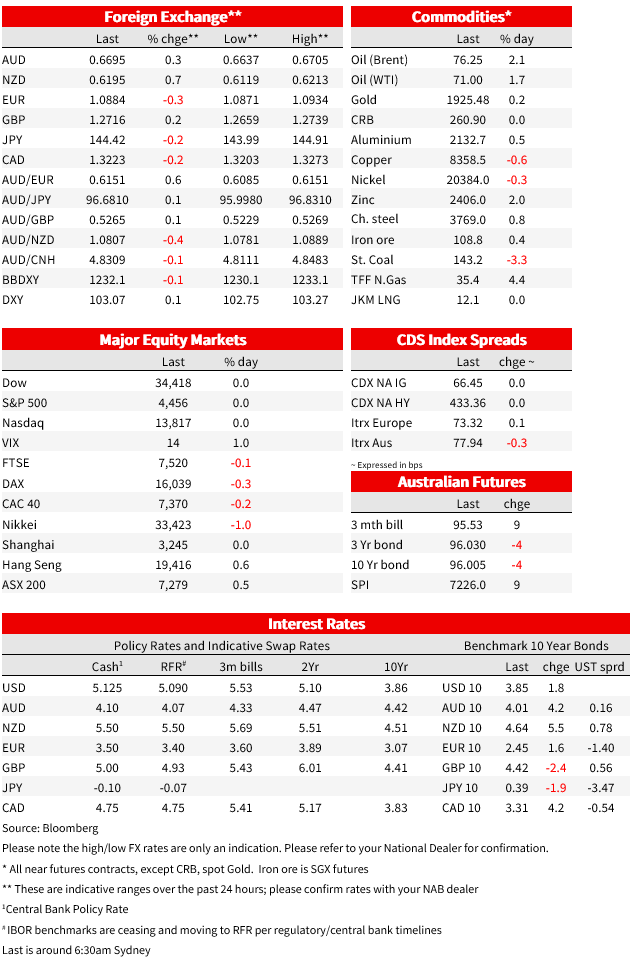

US yields were lower and the dollar stronger with the FOMC increasing rates by 25bp as expected and dropping the expectation for further hikes.

NZ: Employment change (y/y%), Q1: 2.5 vs. 1.8 exp.

NZ: Unemployment rate (%), Q1: 3.4 vs. 3.5 exp.

NZ: LCI pvt wages ex overtime (q/q%), Q1: 0.9 vs. 1.1 exp.

NZ: QES avg hrly earnings (q/q%), Q1: 2.1 vs. 0.9 exp.

AU: Retail sales (m/m%), Mar: 0.4 vs. 0.2 exp.

EA: Unemployment rate (%), Mar: 6.5 vs. 6.6 exp.

US: ADP employment change (k), Apr: 296 vs. 150 exp.

US: ISM services index, Apr: 51.9 vs. 51.8 exp.

US: Fed Funds rate (Upper bd%), May: 5.25 vs. 5.25 exp.

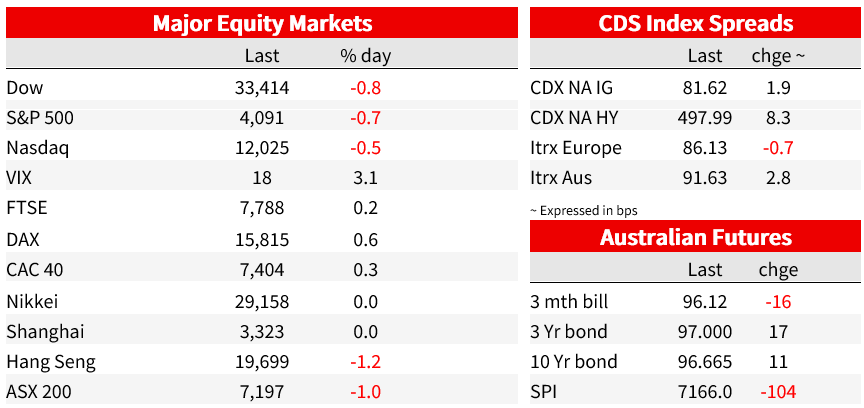

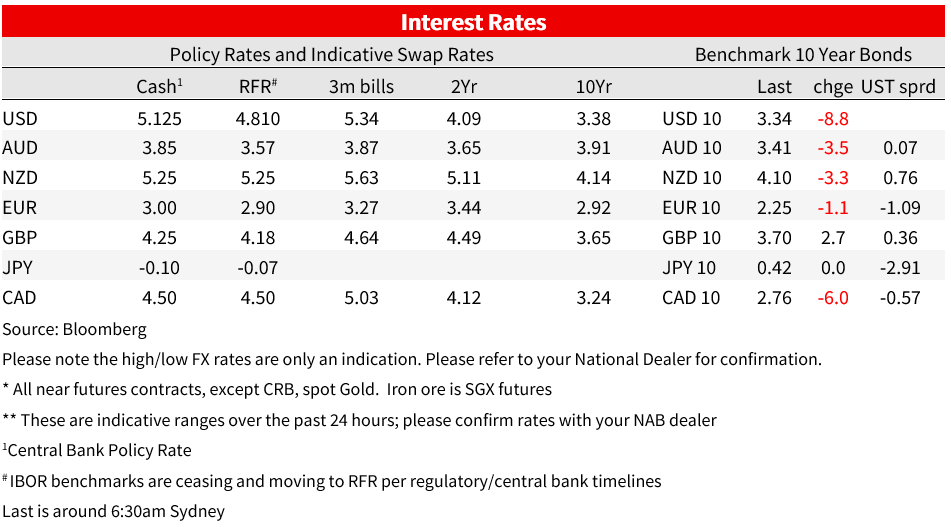

The FOMC delivered 25bp as widely expected and dropped the explicit expectation that additional tightening may be appropriate. The path forward from here will be a meeting by meeting proposition. US yields were lower, the 2yr down 16bp to 3.8% and falling through Powell’s press conference and taking another leg lower in the last hour or so after news PacWest was weighing options including a sale. The dollar was weaker, down 0.6% on the DXY, while equities sold off into the close, the S&P500 down 0.7% on the day even ahead of the re-emergence of regional banking fears on the PacWest headline.

First to the Fed decision, where the FOMC delivered the widely expected quarter point hike to 5.0-5.25 on the fed finds rate target. The decision was unanimous, the more dovish Goolsbee joining the majority in voting in favour of the hike. Guidance in the statement on the path forward was pared well back. The committee will now take into account a number of factors “in determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time.” That contrasts March’s guidance “ the Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive.” The characterisation of the backdrop in the statement was similar to March, noting modest expansion on activity, robust job gains and elevated inflation. The extent that tighter credit conditions weigh on activity “remains uncertain”

In the press conference Powell noted “the US banking system is sound and resilient” and that conditions has ‘broadly improved’ since March. He noted some signs of a better balance in the labour market and that while inflation has moderated somewhat pressures continue to run high. Powell said that dropping the expectation of further tightening in the statement was ‘a meaningful change’ but that decisions would be made meeting by meeting and “a decision on a pause was not made today. ” Powell said ‘policy is tight’ and relative to a sufficiently restrictive level he said “we feel like we’re getting closer and maybe even there” but that it is an ongoing assessment. Ahead of the next meeting we’ll get two more employment and CPI reports.

Powell pushed back on market pricing for cuts, but only by noting that the FOMC views inflation as coming down ‘not so quickly’. On those inflation forecasts rate cuts would not be so forthcoming according to Powell, but the push back was conditional on that expectation for stubborn inflation. Powell expects the US to avoid a recession, in contrast to the March Staff forecasts.

In a preview of what to expect from the Senior Loan Officers Survey on May 8, Powell said the survey is “broadly consistent” with what policymakers have been saying about credit. Powell said lending had grown but the pace had slowed since the second half of 2022. He noted that it was difficult to assess the extent to which tighter credit offsets the need for hikes, including because it is uncertain how long credit will be tighter.

Coming ahead of the Fed meeting, US data didn’t move the market. The ISM services index was in line with expectations at 51.9, suggesting a modest pace of expansion for the services sector. The underlying series were mixed, with a broadly offsetting fall in business activity and a lift in new orders. The employment index slipped slightly to 50.8 and prices paid were little changed at 59.6. ADP private payrolls rose by 296k in April, close to double market expectations , though the figure has undershot the key non-farm payrolls figure for six of the past eight months, so the strong gain may simply just reflect some catch-up.

US 2yr yields initially dipped about 5bp to 3.88% on the announcement before rebounding, but renewed the move lower through Powell’s press conference, before another leg lower in the past hour or so. On the day, the 2yr is around 16bp lower at 3.80%. Although the explicit expectation of future hikes was dropped from the guidance, there was no decision to pause and certainly no appetite for imminent cuts absent some very large surprise. Despite that, markets currently price almost nothing for the June meeting with a cut fully priced by September. The futures-implied fed funds rate by year end is 4.27%, down 14bp from a day ago. 2yr yields had looked to stabilise around 3.87% around 6:30am Sydney time before falling another 7bp or so to be around 3.80%. That as regional banking worries resurfaced on the headline that PacWest was weighing strategic options, including a sale. PacWest shares fell more than 50% in after hours trading.

In currency markets, the dollar was lower ahead of the meeting and was 0.6% lower on the DXY on the day . The yen was the strongest G10 currency against the greenback, rising 1.3% alongside the fall in US yields. USDJPY fell to 134.74. The AUD managed only a small gain against the broadly weaker USD, up 0.1% to 0.6671. The AUD fell back from a brief intraday high of 0.6703 alongside a fall in equities as risk sentiment deteriorated. The CAD, unchanged against the dollar, was the weakest of the G10 alongside a fall on oil prices

US equities were up into Powell’s press conference, but fell alongside the renewed fall in yields to close around session lows. The S&P500 was 0.7% lower, while the Nasdaq lost 0.5%. Declines were led by energy stocks, the sector recording a 1.9% decline. Oil prices fell for a third straight day, with Brent dropping 4.4% and WTI dipping below $69 a barrel. An EIA report Wednesday showed a drop in US demand.

NZ labour market data yesterday morning were mixed. Strong employment growth and a stable unemployment rate at 3.4% painted a picture of a strong labour market that is absorbing the increased in labour supply from the rebound in net migration. Overall, our BNZ colleagues suggest it conveyed a stronger labour market than expected, but the key private sector labour cost index rose by “only” 0.9% q/q, two-tenths less than expected, still above where the RBNZ would need to see it to be confident of sustained 2% inflation. Pricing for the May MPS rose 5bps, taking it to 5.525%, implying a full 25bps, and some risk of another 50bp for the first time since the RBNZ’s shock 50bp in April.

In Australia yesterday, Retail sales rose 0.4% m/m, a little above consensus for a 0.2% gain. While durable goods spending continues to slow from still elevated levels, spending on cafés and restaurants remains strong increasing by +1.5% m/m. Overall, the level of nominal retail sales remains elevated and is running 16% above its pre-pandemic trend though growth has slowed with the level of sales is similar to 6 months ago.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.