We expect growth in the global economy to remain subdued out to 2026.

Insight

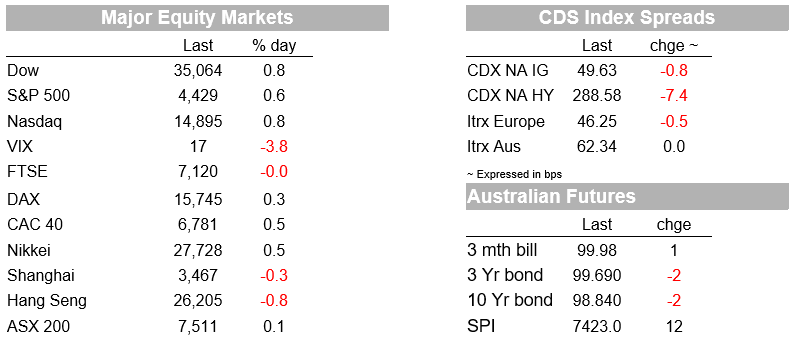

The S&P500 (+0.6%) hit another record high ahead of US Payrolls later tonight. Payrolls of course key to the Fed’s decision on the timing and pace of tapering (see Coming Up for details). Market moves elsewhere were more limited

https://soundcloud.com/user-291029717/watch-germany-go?in=user-291029717/sets/the-morning-call

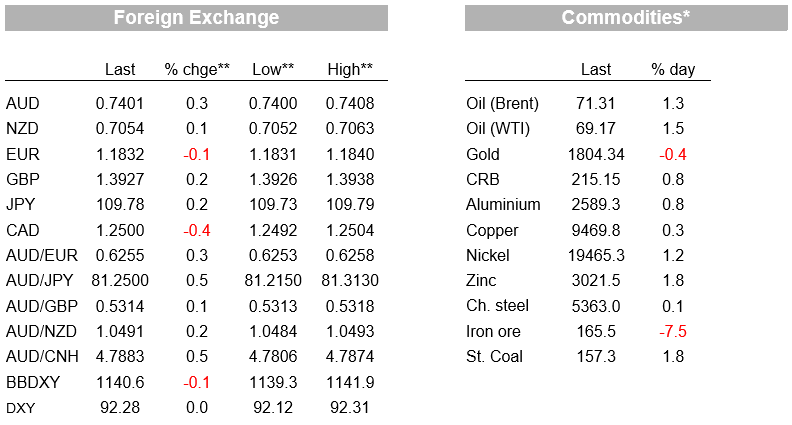

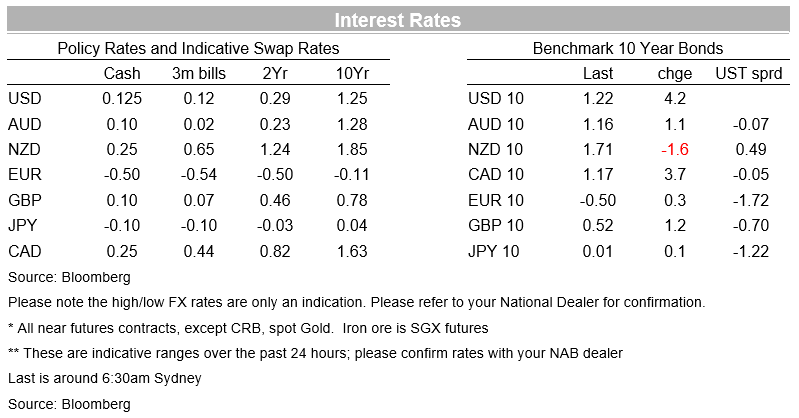

The S&P500 (+0.6%) hit another record high ahead of US Payrolls later tonight. Payrolls of course key to the Fed’s decision on the timing and pace of tapering (see Coming Up for details). Market moves elsewhere were more limited. Yields were up a little with the US 10yr +4.2bps to 1.22% and are well above the intra-day low of 1.12% on Wednesday that came in the wake of the much weaker than expected ADP Employment report. Key Democratic Senator Manchin also chimed in on the Fed saying he is concerned on inflation and that the Fed should begin “begin to taper your emergency response immediately ”. FX moves have been muted with the USD broadly flat (EUR -0.0%, GBP +0.2% and USD/Yen +0.2%). The AUD has outperformed marginally as have commodity currencies, up +0.3% to 0.7401. The BoE also met overnight and while rates were unchanged, guidance was a little more hawkish with the BoE noting “some modest tightening” over the next few years was likely to be necessary and that it would stop re-investing maturing QE holdings once the bank rate lifted to 0.5%

Elsewhere delta concerns remain, though markets continue to view it more in the window of delay rather than derail given the high efficacy of vaccines. Booster shots are also being fast tracked in the US (following Israel) amid concerns that those aged over 65 years which were vaccinated first starting from December last year may need a booster shot as soon as this month given protection diminishes with time (see WSJ – FDA Covid-19 Vaccine Booster Plan Could Be Ready Within Weeks ). Nevertheless, a number of US companies have pushed back the date when they expect most workers to return to offices given the spread of delta – Amazon has pushed it back as far as January 2022 (see WSJ – Amazon Delays Return to Office to 2022 Amid Renewed Covid-19 Surge). Chinese authorities are also battling against their outbreaks with new restrictions in Beijing. Meanwhile in Australia, Victoria (for the 6th time) joined Sydney, Brisbane and Newcastle in lockdown.

The Bank of England also met overnight and while it kept its policy settings unchanged, there was again one dissent (Michael Saunaders) against its QE bond buying programme. There was also a slightly hawkish tilt with the Bank noting “should the economy evolve broadly in line with the central projections in the

August Monetary Policy Report, some modest tightening of monetary policy over the forecast period was likely

to be necessary”. The forecasts which assume a market policy path have inflation dipping back to the 2% target in 2023, effectively an endorsement of the market path. In addition, the BoE also has said it intends to reduce the stock of QE by ceasing to reinvest maturing assets once the Bank Rate has risen to 0.5% and if appropriate given the economic circumstances, which is significantly lower than the prior hurdle of 1.5%. That lower hurdle rate is an explicit acknowledgement that negative rate are now part of the BoE’s toolkit. A more active QE sell down could be considered when the Bank Rate has risen to at least 1.0%. Nevertheless, the steady state balance sheet is still likely to be “materially larger” than it was prior to the pandemic (see BoE – Monetary Policy Report p.13 for details). The 2-year UK government bond yield increased 3bps in response with the market bringing forward the expected timing of the first 25bp rate hike to late-2022.

Data overnight was fairly sparse with US Jobless Claims broadly as expected (385k v. 383e and 399 previously). The US trade deficit was a little larger than expected (-75.5bn v. 74.2e and 71.0 previously) and is sitting at a record high. Across the pond German Factory were very strong (+4.1% v. 2.0e and -3.2 previously) and showed a clear tilt to a domestic pickup with domestic orders at +9.6% vs +0.4% for foreign orders. The German data recently underscores the recovery underway in Germany and Europe more broadly and adds to the narrative that Europe is set to outperform the US over coming quarters. Currency moves have been reasonably limited ahead of payrolls, although the GBP has been one of the better performers (+0.2%) following the BoE meeting. Commodity currencies have been the other outperformers, with the CAD and AUD both up 0.3-0.4% while the NZD has lagged slightly, up a lesser 0.2%.

Australia’s trade balance is set to detract from Q2 GDP growth. NAB is still finalising its figures, but a rough mapping from trade prices suggests the trade balance could detract 1-1.5 percentage points from Q2 growth, larger than what NAB currently has pencilled in. If not made up elsewhere, then it is possible Q2 GDP is close to flat or even negative before the very sharp negative outcome for Q3 due to the lockdowns in many cities. We haven’t reached for the ‘r’ word given there haven’t been many pre-GDP partials as yet and we will firm up our Q2 and Q3 forecasts in our usual Forward View on Wednesday. Also worth noting yesterday were SEEK job ads for July which fell 4.1% m/m with a particularly large fall in hospitality & tourism. Ads in NSW were down -14.2% m/m (for details please see the NAB/SEEK Employment Report).

Domestic focus is on RBA Governor Lowe who speaks before a House Committee at 9.30am, ahead of the Statement on Monetary Policy at 11.30am. Lockdowns have intensified since the RBA met earlier in the week and surprised markets by not reversing their QE taper. Offshore focus will be squarely on US Payrolls and the implications this has for the Fed’s likelihood to taper and also for when rates lift off may occur. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.