We expect growth in the global economy to remain subdued out to 2026.

Insight

Friday’s BoJ announcements made a bigger initial impression on global bond markets than FX

Friday’s data/events summary:

Markets still haven’t decided quite what Friday’s main market news event – the BoJ’s decision to lift the hard cap on 10-year JGB yields from 0.5% to 1.0% – means; evidenced by the fact the USD/JPY exchange rate ended in New York on Friday at almost the exact same level it was trading prior to Thursday night’s Nikkei source report flagging a tweak to the YCC policy.

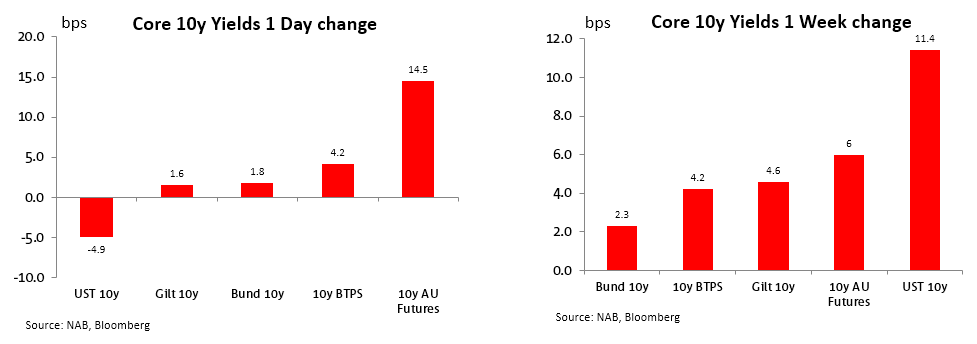

Bonds Friday & Weekly

The biggest global impact of Friday’s Japan news, during the APAC time zone at least, was felt in the Australia government bond market – on the view higher JGB yields would see less demand from Japanese investors – seeing 10-year futures-implied yields at one point Friday some 19.5bps higher than Thursday’s closing levels , though a decent offshore rally in both Eurozone and US Government bonds – aided by incoming EZ CPI and US ECI data – saw a 15bps fall back in yields from their post-BoJ highs to NY close. 10-year JGBs themselves closed Friday about 11bps up on Thursday’s close, at 0.556%.

Eurozone and US economic data made an impact across asset markets on Friday – as too did Friday’s much weaker than expected local retail sales data (-0.8% against expectations for flat). Weakness here was led by big falls for clothing (-2.2%) department stores (-5.0%) and ‘other’ retailing (-2.0%), data which saw expectations for another RBA hike on Tuesday further pared back beyond the impact of Wednesday’s softer than expected Q2 CPI report.

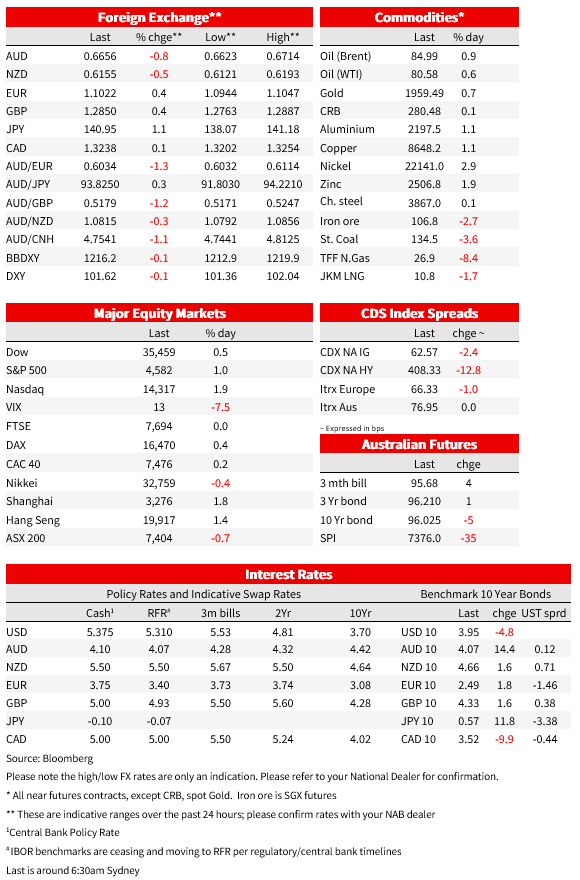

Friday’s offshore data showed 0.1% downside surprises for both French and German CPI (to 5.2% abd 6.5% respectively on the HICP measures) and in the US, the Q2 Employment Cost Index (ECI) up by 1.0% against 1.1% expected. The June core PCE deflator was also a tenth softer than expected at least on the year-on-year measure (4.1% from 4.4%) thanks to favourable rounding. Here, even though the monthly was 0.2% as expected, it was just 0.165% unrounded. Bonds in both the Eurozone and US rallied on the news, in the case of 10-year Treasuries meaning that the post-BoJ yield back-up was more than reversed by the end of the day (10s ending -5bps). Bunds, though ending the day 2bps up, were some 10bps off their opening/post BoJ highs. US equities liked the data, contributing to confidence that inflation can get back to target without necessitating the US falling into recession.

Over the weekend, ECB President Lagarde told Le Figaro any pause at an upcoming ECB meeting could be followed by another increase in interest rates. At the next meeting in September, “there could be a further hike of the policy rate or perhaps a pause,” she told Le Figaro newspaper. “A pause, whenever it occurs, in September or later, would not necessarily be definitive.” Minneapolis Fed President Neel Kashkari meanwhile told ‘Face the Nation’ “If we need to raise rates further, we will, but we’re going to let the data guide us and not prejudge the outcome.”

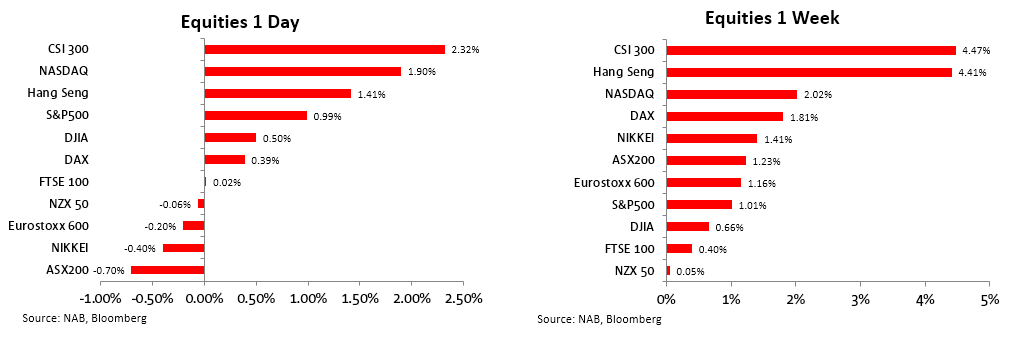

Equities Friday & Weekly

In trying to explain Friday’s BoJ action, Governor Ueda in his post-meeting press conference claimed that stable inflation with accompanying wages growth was not yet in sight and that the lifting of the hitherto hard 0.5% ceiling on 10-year JGB yields was aimed at enhancing the sustainability of the current policy settings amid ‘very high uncertainty’ about the outlook. Tellingly, the BoJ in its fresh forecast accompanying Friday’s announcement revised down its FY24 Core CPI forecast from 2.0% to 1.9% and for core core CPI left it unchanged at 1.7%. Plus, in the one page explainer of the YCC tweak, it included a chart of inflation expectations showing that while expectations have risen, surveys of households, economists and market participants still see inflation mired well below 2% (less than 1.5% in fact) even though firms now peg expectations at a shade above 2%.

Our read of the BoJ is that no formal changes to policy will be contemplated at least before the end-October meeting when forecasts will next be refreshed. Friday’s action might best be viewed as an attempt to head off a fresh wave of Yen-weakening carry trade activity, by at least ceasing to resist pressure for 10-year yields to rise above 0.5%, and so wider offshore-Japan yield spreads if offshore yields come under fresh upward pressure. Friday’s actions do though fail to provide a catalyst for a secular reversal of yen weakness.

FX Friday & Weekly

In FX it ended up being a good week for the big dollar, DXY up 0.9% and the broader BBDXY 0.6%, with across-the-board slippage in G10 currencies bar USD/JPY, up 1.2% on Friday so reversing the big drop that came late on Thursday following the Nikkei report flagging Friday’s YCC policy tweak. USD/JPY is marginally lower over the week as a whole though, by 0.4%. AUD/USD finished the week mid-pack, off 1% despite it being a positive week for US and APAC equities, the latter following positive signals out of the Politburo meeting vis-à-vis measures to support growth, including in the property sector, albeit so far lacking much detail.

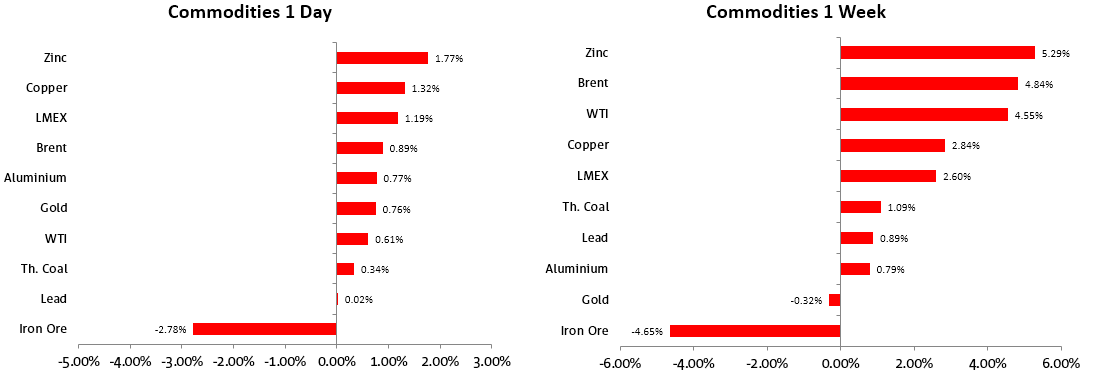

Commodities Friday & Weekly

he bulk of the AUD’s weekly loss occurred on Friday, following the poor retail sales data and pressure from AUD/JPY sales post the BoJ, the rest from Wednesday’s Q2 CPI data. Commodity prices were generally helpful to the AUD’s cause, with gains on the week for oil and all base metals, the exception being iron ore, off 2.8% Friday and down 4.7% on the week.

Coming Up

Market prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.