We hear from NAB’s new Chief Economist, as she unpacks the latest economic data with Deb Knight, Host of Money News – 2GB. Watch now.

Video

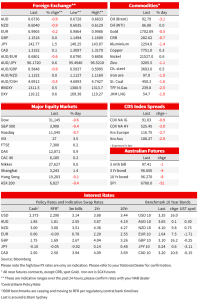

A broad rise in core global yields has been the big news overnight, fuelled by a better-than-expected US ISM report and news UK PM Truss is planning a huge debt-funded fiscal stimulus.

Events Round-Up

AU: RBA Cash Rate Target (%), Sep: 2.35 vs. 2.35 exp.

GE: Factory orders (m/m%), Jul: -1.1 vs. -0.7 exp.

US: ISM Services Index, Aug: 56.9 vs. 55.3 exp.

A broad rise in core global yields has been the big news overnight, fuelled by a better-than-expected US ISM report and news UK PM Truss is planning a huge debt-funded fiscal stimulus. Large US corporate issuance has also played a part, lifting 10y UST yields to 3.3349%. US equities struggle with the good ISM news amid increasing expectations for a 75bps Fed hike later in the month. JPY comes under renewed pressure as 10y UST yields head north, GBP surges on PM Truss news while the AUD succumbs to the stronger dollar, finding little support from yesterday’s RBA hike.

The US ISM Services index rose in August to a solid 56.9 reading against expectation for a small decline to 55.3 from 56.7. Details in the report were also very strong with business activity and new orders both recording to their strongest readings of the year. External demand was also solid, with export orders expanding at the fastest pace in nearly a year. Meanwhile the Prices Paid subindex remained elevated, at 71.5, indicating still-strong inflationary pressures in the services sector, albeit not as extreme as a few months back. Overall, the Survey paints a picture of solid activity in the services sector of the US economy supported by wages growth suggesting the Fed still has more work to do in order to cool the economy.

Core global bond yields were rising ahead of the ISM release following news during our time zone yesterday of a big (debt-funded) spending plan by new UK PM Truss, the ISM release then added more fuel to the (rising yield) fire. 10y UST yields have surged 15bps to 3.349% with the 2y rate lagging behind, up 11bps to 3.50%, steeping the 2y10y curve to -15bps. Meanwhile in the UK Gilts curve steepened with the 10y tenor up 16bps to 3.10% while the 2y eased 2bps to 3.14%. 10y Bunds closed 8bps higher at 1.63%.

Media outlets have reported newly anointed UK PM Truss plans to unveil a huge debt-funded fiscal stimulus package to ease the pressure on the cost of living from energy bills. Bloomberg reported that Truss was planning to cap the average household energy bill below £2,000 for 18 months while the FT reported that the price would be capped at around £2,500. On either option, Ofgem’s planned increase to the price cap for household energy prices from £1,971 to £3,549 in October would not go ahead.

If implemented the policy will be a significant relief to the imminent inflationary pressures that were set to come given the known price increases from Ofgem which had instigated warnings by several economist forecasting the UK inflation could breach 20% next year. The policy will also reduce near-term recession risks by lessening the squeeze on disposable incomes . But the policy comes at a huge cost, at an estimated £130b according to Bloomberg (~6.5%/GDP). Combined with Truss’s other proposed fiscal policies, including cancelling the planned increase to corporate tax and cutting national insurance, the overall cost might be in the region of 9% of GDP, an enormous fiscal stimulus at a time when the UK economy is already at full capacity and headline inflation is around 10%.

So, while the policy will likely ease near term inflationary pressures, the effective increase in disposal income and relief to business suggest they will be higher medium- term implication for inflation. This is also a fiscal stimulus that is untargeted that will not create a material increases in productivity, the UK government has relied on the generosity of strangers to fund itself and on the BoE QE, now the prospect of spending money without a guarantee of generating an improvement to the UK economy’s medium term growth potential is going to make it harder ( more expensive) with the BoE selling rather than buying UK government bonds making the outlook even more challenging.

Given this backdrop the steeping of the UK government curve makes sense while the pound has also performed, rising to an overnight high of 1.1609, before losing altitude after the USD regained its mojo following the stronger than expected ISM report ( now at 1.152). Looking further ahead if the UK economy does slowdown as expected, foreigners’ appetite to fund the UK government is going to be an important dynamic for GBP.

Europe is considering its own response to the energy crisis, with energy ministers set to meet on Friday night to debate a range of options. Unlike the UK’s debt-funded stimulus, the primary option in the EU appears to be a windfall tax on energy producers, with the proceeds recycled back to consumers to buffer them from rising energy costs. The FT reported the EU is likely to consider additional measures to cut demand, over and above the voluntary 15% reduction to gas usage previously agreed by EU countries, as well as assistance for energy companies struggling to meet margin calls on derivatives contracts. The EUR is marginally lower overnight and briefly touched a fresh 20-year low, but it is back to around 0.99. The immediate focus for the EUR is the ECB’s meeting on Thursday night, with the market expecting a 75bps hike.

The USD remains in the ascendency, reaching fresh 20-year highs on the DXY basis overnight. The continued strength in the USD reflects the relatively stronger state of the US economy (certainly compared to Europe and China), the continued march higher in Fed rate expectations, and still cautious risk appetite among investors, given the lingering risk of recession next year.

The standout currency mover over the past 24 hours has been USD/JPY, which has catapulted up to 143 (+1.7%), a fresh 24-year high. USD/JPY now has “technical room” to test its 1998 high of just above ¥147, but we think a much weaker JPY from here is likely to force the BoJ hand with a tweak to its YCC policy the more probable outcome. Speaking yesterday, former BoJ Okina said that “It’s hard to say that the weak yen at this level is positive on the whole,” adding that the BoJ should be careful not to invite too much depreciation by emphasizing that stance. Hard to disagree.

The AUD and NZD are both around 0.9% lower than this time yesterday, opening the new day at 0.6735 and 0.6039 respectively. Both antipodean currencies have succumbed to the stronger USD with the AUD showing little reaction to the RBA’s 50bps hike yesterday. The RBA signalled more hikes were likely in the coming months but, in a change to the last statement, omitted its reference to “normalising monetary conditions”, a possible nod to the cash rate approaching neutral. Our economists think the change in language potentially foreshadows a slowing in the future pace of hikes to 25bps increments, depending on how the data unfolds. RBA Governor Lowe is expected to provide more colour on the policy outlook in a speech tomorrow. The market is pricing around a 40% chance of another 50bps RBA hike next month and around a 30% chance of the same in November

The S&P 500 closed the day down 0.41% while the NASDAQ was -0.74%. The move up in yields and increase in Fed rate hike expectations weighing on sentiment. A classic case were good news is bad news, as the ISM reveals the services sector of the us economy is in rude health, implying the Fed still has more work to do to bring inflation under control.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.