We expect growth in the global economy to remain subdued out to 2026.

Insight

Early this morning and in line with market expectations the Fed lifted the funds rate by 0.5% to a range between 4.25% and 4.5%, a rates level not seen since 2007. The 50bps increase was a downshift following four consecutive hikes of 75bps.

Events Round-Up

NZ: Current account (%/GDP), Q3: -7.9 vs. -8 exp.

JN: Tankan large mfg index, Q4: vs. 6 exp.

UK: CPI (y/y%), Nov: 10.7 vs. 10.9 exp.

UK: Core CPI (y/y%), Nov: 6.3 vs. 6.5 exp.

EC: Industrial production (m/m%), Oct: -2 vs. -1.5 exp.

Early this morning and in line with market expectations the Fed lifted the funds rate by 0.5% to a range between 4.25% and 4.5%, a rates level not seen since 2007. The 50bps increase was a downshift following four consecutive hikes of 75bps.

The new dot plot revealed the majority of Fed officials now expect the Funds rate to end next year at 5.125% (5% to 5.25% range), 50bps higher relative to the median projection in September. The Statement was almost a carbon copy from it previous meeting, two words changed apart from the date and the actual target change levels with a reiteration of the key message that “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.”.

Looking at the economic projections there has been a notable downgrade to GDP in 2023, down to 0.5% from 1.2% in September while 2024 (1.6%) and 2025 (1.8%) projections were little changed. Unemployment ticks up to 4.6% in 2023, two tenths higher compared to the September estimates. No employment recovery is expected in 2024 (so still at 4.6%) with only a mild improvement to 4.5% in 2025 . Core PCE in 2023 is now seen higher at 3.5%, up from 3.1% in September, a shift to 2.5% is now seen in 2024 (2.3% prev.) and 2.1% in 2025 (same as before).

So, the uplifts in core PCE projections provides the justification for a higher rates track in 2023 compared to the September estimates. Against a backdrop of a higher funds rate, the economy is expected to slowdown materially next year with an uptick in the unemployment rate. No economic contraction is expected on a year over year basis, historically however the speed and magnitudes of this tightening cycle would be consistent with an economic recession.

The main take away from the new projections is a more hawkish Fed relative to the September projections. Importantly too, the decline in CPI readings over the past couple of months have not been strong enough to encourage the Fed to project a more meaningful decline in their inflation projections next year. Back in September the Core PCE was seen declining 1.4% to 3.1%, now the decline is from a higher level of 4.8% at the end of 2022 to 3.5% in 2023, so a 1.3% decline over the period.

Speaking at the press conference Fed Chair Powell reiterated the message that policy will need to remain tight for “some time” in order to restore price stability. Consistent with the projections the Chair also noted that FOMC participants expect the labour market to come into better balance “over time.”, currently the market is out of balance with robust job gains and still-high vacancies, Powell said.

While at the start of the press conference Powell reiterating yet again that “We still have some ways to go” in order to get back to price stability, he then added that we are “getting close to sufficiently restrictive rates level”, but that policy will have to be held at a restrictive level for a sustain period.

The Chair also reiterated that reducing inflation is likely to require a sustained period of below-trend growth and some softening of labour market conditions,”. Also adding that no rate cuts should be expected until the Fed is confident inflation is moving towards 2%.

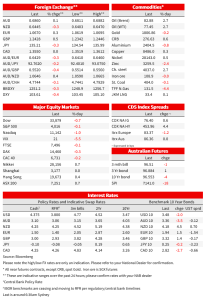

As it is often the case on FOMC day, price action overnight can be broken down in to a quiet pre FOMC session and a bit of fireworks post. After yesterday’s milder than expected US CPI print, price action ahead of the FOMC was essentially a consolidation of the previous day’s move. US rates drifted lower, led by the short end of the curve (US 2-year -4bps, US 10-year +1bp) as the lower CPI print emboldened the notion that US inflation has passed its peak. US equities edged higher with the S&P 500 up just over 0.5% before the FOMC announcement while in FX markets the USD traded with a softer tone. GBP and JPY let the charge against the USD, both up around 0.5% to 1.2427 and 134.95 respectively while the AUD and NZD consolidated gains from the previous day trading around 0.6870 and 0.6450.

JPY pre FOMC gains can be attributed to the decline in UST yields while the move up in sterling is less obvious, short covering seems to be one ongoing theme for the pound while overnight inflation news has eased (a little) the pressure on the BoE to hike aggressively over coming months. The UK November CPI fell to 10.7%yoy, from 11.1%yoy in October. The core reading also fell to 6.3%yoy from 6.5% previously, so the good news is that both readings decline 2 tenths in the month suggesting a peak in UK inflation is probably now behind us. The not so good news is that this does not necessarily mean that the BoE’s battle to bring inflation down back to target has been won, a peak in UK inflation also does not guarantee a steady decline should be expected from here. A core reading above 6% should still be an uncomfortable number for an inflation targeting central bank. The BoE is still expected to hike by 0.5% tonight, and at the margin the overnight reading favours the view the Bank will step down to 0.25% hikes next year (consistent with NAB’s view). The UK 2-year bond rate was 7bps lower overnight, at 3.39% and the market has pared back expectations of the terminal rate to around 4.55%, edging a bit closer to the BoE message.

CNY also deserves a line, the pair has consolidated around 6.95 over the past 24 hours, with the market prepared to look through the inevitable near-term disruption to Chinese economic activity as Covid spreads, instead focusing on the better economic outlook from next year once the country has become accustomed to living with the virus. However, this narrative remains “lively” with headlines on the BBC and other news outlets noting how the China is facing problems with stockpiling, running out of home medicine (ibuprofen, cold medicines and vitamin C for instance) and an increase in self-isolation. In addition, there are already signs that the health system is being quickly overwhelmed.

Reaction to the FOMC announcement and Powell’s press has so far seen a reversal of the risk positive moves seen earlier in the session. US equities are now down on the day with the S&P 500 currently – 0.38%, although the initial intraday decline was 2.15% post the FOMC. But in the past 20 minutes have seen a decent recovery. The NASDAQ now trades at -1.10% and the Dow is -0.19%. That said number are jumping around.

US rates have also moved higher with the 2y Note up around 5bps as I type to 4.22% while the 10y rate has swung around, initially jumping to 3.55%, but now is down to 3.47%, about 3bps lower pre FOMC levels.

Meanwhile FX moves have been more subdued. The USD initially gained on the FOMC news, but now is back to where it was preannouncement, so slightly lower on the day. The AUD and NZD are essentially unchanged at 0.6873 and 0.6458 respectively while the pre FOMC outperformers, GBP and JPY have retained their gains at 1.244 and 134.98 respectively.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.