We expect growth in the global economy to remain subdued out to 2026.

Insight

Fed, ECB, BoE heads reiterate hawkish views; BoJ reiterates dovish stance

The temptation to start the day with a Taylor Swift song was too much for your scribe given the efforts of 4m Swifties to secure tickets yesterday (for an interesting read see AFR: Swifties smash Ticketek records as Sydney and Melbourne shows sell out). What I wanted to start the day with though was with a definition of ‘headfaked ’ – which according to Urban Dictionary is being tricked by someone in such a way that in the end, you look very stupid. So it was with Australia’s Monthly CPI Indicator yesterday with a soft headline (5.6% y/y vs. 6.1% expected) triggering a sharp rally across the bond curve, with the majority of it retraced. The 3yr bond future initially rallied by 12bps, before mostly retracing, and overnight moved by 2bps to be broadly in line with US 2yr yields which are 3bps lower to 4.71%. Details in the CPI showed little change in inflationary pressure when looking at ‘excl. fuel, fruit/veg, and travel’ which fell only marginally to 6.4% y/y from 6.5%. Under the hood services inflation looks sticky (as it is offshore). Markets head into next week’s RBA meeting pricing a 34% chance of a 25bp move and a cumulative 22.3 bps for August. Peak RBA pricing is now 4.45% by December 2023, down from 4.50% by November just prior to the data.

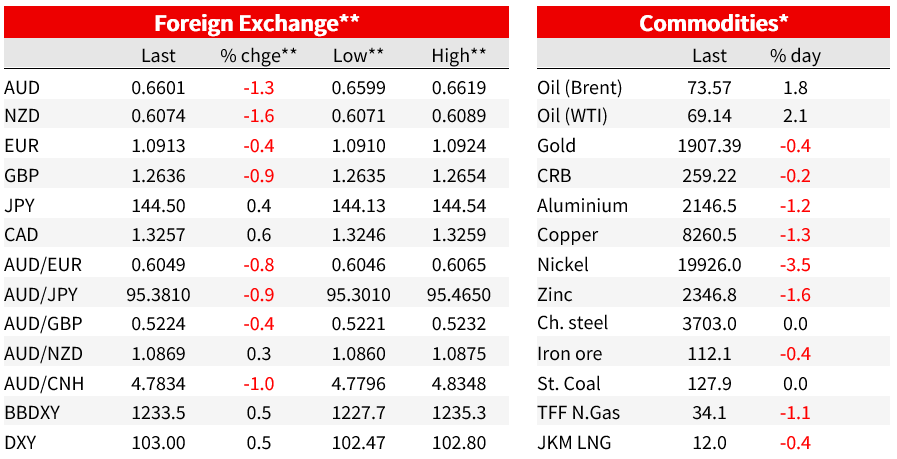

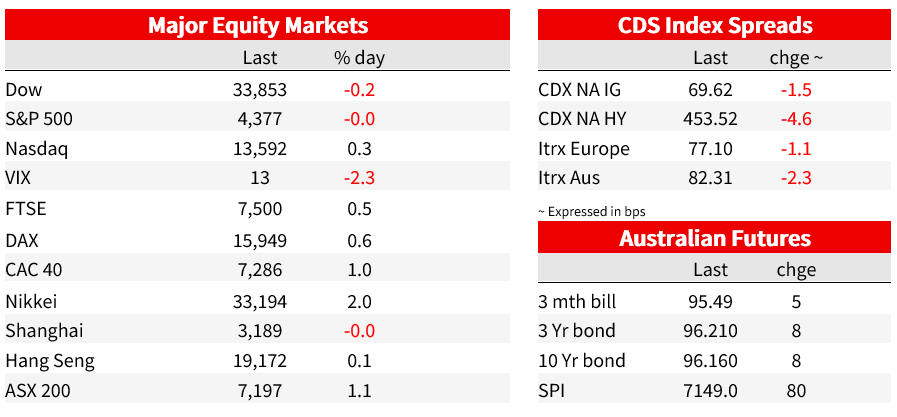

The exception to the reversal has been the AUD which was -1.3% to 0.6601, far exceeding USD strength (DXY +0.5%). Weak China data is also a contributing factor with the PboC choosing not to stem weakness in the CNY yesterday (USD/CNH +0.3% overnight and traded above 7.25 for the first time this year, currently 7.2452), while industrial profits were weak (-12.6% y/y), and there were headlines of the US contemplating further chip restrictions late Tuesday (see WSJ: U.S. Considers New Curbs on AI Chip Exports to China ). That headline weighed initially on US stocks, though the S&P500 did close flat at ‑0.0%, paring initial losses of ‑0.4%. The NZD also fell sharply by -1.6% to 0.6074 with one plausible explanation (alongside shadowing moves in the AUD) being retail flows from directed across the Tasman to Australia pay for Taylor Swift tickets and associated travel costs for the Australian leg of her tour. In any case the NZD is weak across all crosses. As for other FX moves, USD/Yen moved higher again by 0.4% to 144.50, but a lower global rates backdrop has limited moves in the face of BoJ’s dovish comments at Sintra (more on that below). Meanwhile EUR was -0.4% to 1.0913 and GBP -0.9% to 1.2636.

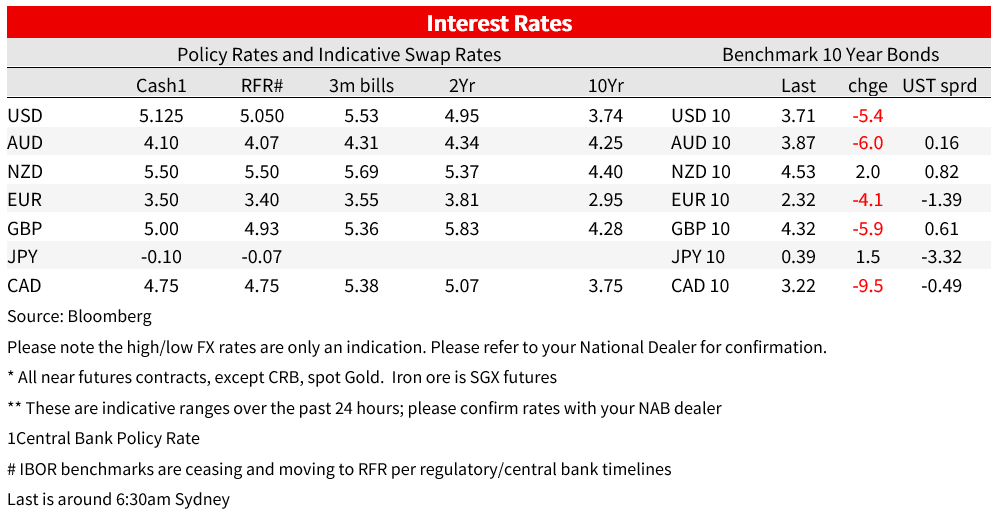

As for global yields, they were broadly lower. The US 10yr fell -5.6bps to 3.71%, with falls also seen in German 10yr yield of -4bps and UK 10yr of -6bps. Hawkish central speech by Powell at the ECB’s Sintra Conference did see US 2yr yields initially spike up to 4.78%, but the move wasn’t sustained and 2yr yields currently trade at 4.71%. Before the central bank headlines hit, the Italian CPI printed one tenth softer than expected at 6.7% y/y vs. 6.8% expected. That likely set the European tone for lower yields. Meanwhile at the ECB’s Sintra Conference, the heads of the Fed, ECB, BoE and BoJ all spoke, but no new views were expressed. All of them remained on message from recent policy updates with the first three reiterating the need for tight policy to bring inflation under control and the BoJ remaining dovish. Market pricing was little changed, for the Fed a July hike is 79% priced, up very slightly from 74% the day before yesterday, while 29.8bps of hikes are cumulative priced, whereas it was at 28bps previously.

Fed Chair Powell said that “although policy is restrictive, it many not be restrictive enough and it has not been restrictive for long enough”, keeping alive the chance of two more rate hikes this year. He wouldn’t rule out consecutive rate hikes, after keeping rates unchanged at the June meeting. The BoJ remained the outlier and Governor Ueda still claimed that underlying inflation was “still a bit lower than 2%” when the evidence patently suggests otherwise, with data last week showing the CPI ex fresh food and energy series continuing merrily along its path of a strong and steady increase to 4.3% y/y, its highest rate since 1981. One commentator we follow noted that the most fascinating moment of the whole session was when the moderator asked Ueda whether he worried that he would repeat the errors of his panel partners in treating the inflation rise as transitory. He seemed (and was) as stumped for an answer as if the question had been “how would you set policy for Mars?”.

There was little in the way of top-tier data. The US goods trade deficit narrowed to $91.1b in May, with imports falling 2.7% and exports down 0.6%. This follows the particularly large $97.1b deficit in April and even a flat June result would see net exports subtract about 1 percentage point off Q2 GDP.

Finally in Australia, the Monthly CPI Indicator showed still very strong inflation pressures despite the headline miss (5.6% y/y vs. 6.1% expected). The core measure the RBA looks at is the ‘excl. fuel, fruit and vegetables, and travel’ which fell only marginally to 6.4% y/y from 6.5%, and in seasonally adjusted terms was unchanged at 6.5%. While the Monthly Indicator is not the full CPI, what detail we do have shows services inflation looks sticky (as it has been offshore) and further demonstrates the risks the RBA has noted on shifting firm pricing behaviour and to their forecasts for 3% inflation by mid-2025. Insurance rose 5.3% over the 3 months to May (and was 14.2% y/y), a marked acceleration from already high recent outcomes. Other market services components also rose strongly: hairdressers rose 2.2% over the 3 months to May and 7.1% y/y; (while technically classified as a ‘good’) takeaway and fast food rose a faster 2.7% and 9.2% y/y; sports participation 1.7% and 4.6% y/y; rents accelerated further to 0.84% m/m and are now annualising above 10% with no relief in sight. In summary the RBA will need to do more and NAB still sees the RBA hiking rates to 4.60%, pencilling in July and August (see NAB’s full commentary: AUS: Don’t be head-faked – services inflation remains high despite fall in headline).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.