Online retail sales growth slowed in May following a fairly strong April

Insight

The bond sell-off shows no signs of abating with a stronger than expected US ISM Manufacturing helping to drive the US 10yr yield up.

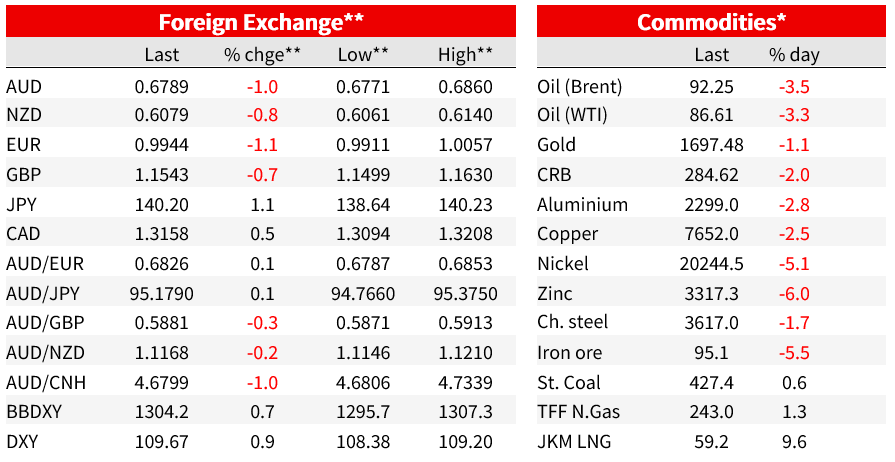

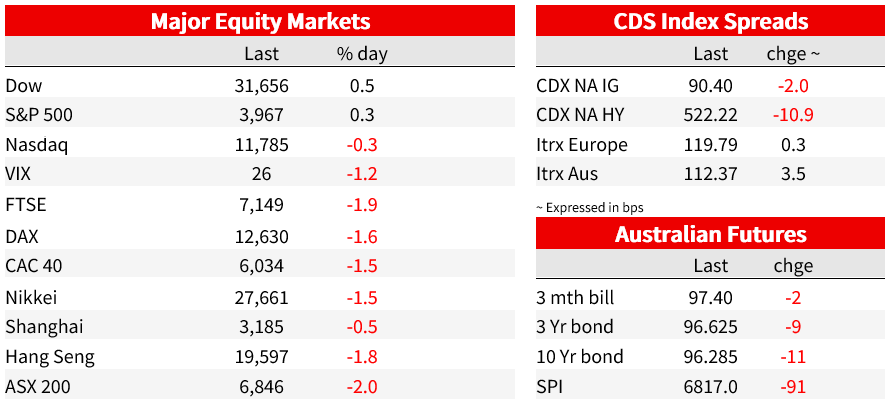

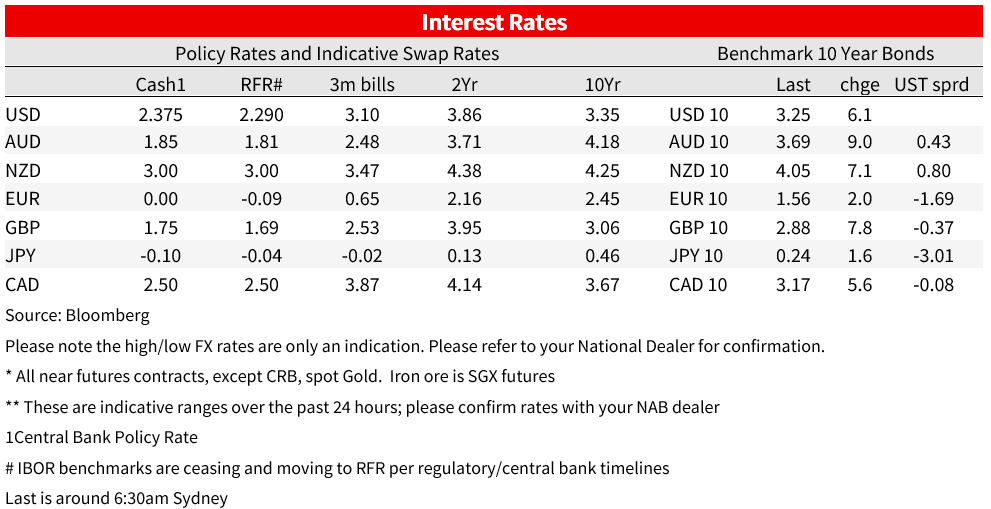

The bond sell-off shows no signs of abating with a stronger than expected US ISM Manufacturing (52.8 vs. 51.9) helping to drive the US 10yr yield up 6.1bps to 3.25% overnight. Big moves were also seen in FX with the USD (BBDXY) up 0.7% to be at an 18-year high. USD/JPY has broken through 140 and currently trades at 140.21 for the first time in 24 years, while EUR has broken back below parity to be at 0.9945. Equity markets were more mixed and the S&P500 has managed to close in the green +0.3% after a last hour of power dash which reversed initial losses of up to -1.3%. Data since Jackson Hole last Friday continues to underscore the “higher for longer” Fed rhetoric and the rise in real yields (5yr TIP yields are +50bps to 0.85% since Jackson Hole) will likely continue to test risk assets. All focus today is on Payrolls later tonight where the whisperer number is for a stronger than expected print, which would add to the argument for a 75bp hike in September. Another case of ‘good news is bad news’ for risk assets perhaps? Elsewhere news out of China remains dire with Chengdu in lockdown and weighing on commodities (Brent -3.6% to $92.16), while in geopolitics Taiwan shot down a Chinese civilian drone.

First to the US ISM which sparked the session high in yields. The ISM Manufacturing was better than expected at 52.8 against the 51.9 consensus. Details were also positive with new orders up to 51.3 (from 48.0) and employment up to 54.2 (from 49.9). On the inflation front there were encouraging signs with the prices paid index falling sharply to 52.5 (from 60.0) to be at its lowest level since August 2020; supplier deliveries also held steady at 55.1 (from 55.2). Working against the numbers were customer anecdotes which paint a high degree of uncertainty over recent strength: “Orders are still strong through the end of the year, but there is a feeling that customers may start pulling back on orders, either cancelling them or pushing them into 2023” and “ demand from customers is still strong, but much of that is because there is still fear of not getting product due to constraints. They are stocking up. There will be a reckoning in the market when the music stops, and everyone’s inventories are bloated”) (see ISM Manufacturing). Jobless claims also came in lower than expected at 232k against the 248k consensus, while the prior week was revised down to 237k. Labour market thus still tight and resilient to the rate hikes so far. Meanwhile the Atlanta Fed upgraded its Q3 GDP Now tracker to 2.6% from 1.6% previously.

Yields were up across the board, with the stronger than expected US ISM sparking a lift to session highs. The curve flattened with the 2yr yield flat at 3.50% and remaining near their highest in 15 years, while the 10yr yield rose 6.1bps to 3.25%. The 2/10s curve currently stands at -25.4bps. More important for risk assets has been the sharp move higher in real yields since Jackson Hole. The 5yr TIP yield is up some 50bps since last Friday to 0.85%, while the 10yr TIP is up 39bps to 0.80%. The sharp increase in real yields is consistent with Fed Chair Powell’s speech from Jackson Hole, which signalled a desire to tighten financial conditions to get on top of inflation. As for Fed pricing, markets are pricing The market is pricing around a 70% chance of a 75bp hike at the September FOMC, while further lifting the peak for the Fed Funds rate to 3.95% in March 2023 from 3.79% prior to Powell on Friday, and there is 34bps worth of cuts still priced in 2023. Last night equities were mixed given this background with the S&P500 managing to close in the green at +0.3% after being down some -1.3% at one point. Since Powell on Friday, the S&P500 is down -5.5%. Interestingly Campbells and Hormel noted cost inflation was impacting margins.

Meanwhile news out of China continues to add to global growth fears. Chengdu (home to some 21m) is in lockdown, the first megacity in lockdown since Shanghai’s lockdown ended in late May. China’s zero-COVID policy the culprit amidst easily spread covid variants in what has been a very hot and dry time in Southern China. Lockdowns/mass testing continues to impede stimulus efforts to revie the economy, with announced stimulus to date unlikely to gain much traction if the zero-COVID policy continues. Given Chengdu is also a production hub for high tech manufacturing (cars, electronics), global supply chains are likely to be continued to be disrupted, while also adding motivation for companies to diversify supply chains. Yesterday saw the Caixin Manufacturing PMI slip back into contractionary territory, at 49.5, consistent with subdued growth in the Chinese economy. Commodity prices tumbled overnight on Chinese demand fears with Brent oil -3.5% to $92.25 and copper -2.5%. Geopolitical tensions were not enduring on markets – Taiwan shot down a Chinese civilian drone – with gold -1.1% amid the higher yield and higher US dollar environment.

In FX it has been a big night for moves. The USD BBDXY index has hit its highest level on record (the index has been in existence for 18 years) while the DXY, which has a large weighting to the euro, has reached a fresh 20-year high. The relentless rally in the USD over recent months has followed the sharp repricing in Fed rate expectations (which has flowed through to US real yields), a broad-based decline in risk appetite, and expectations that the Euro area is set for a deep recession as the energy crisis hits the region’s economy. USD/JPY has broken through the psychologically important 140 level for the first time in 24 years, up 1.1% from this time yesterday. EUR has fallen back below parity, -1.1% overnight, despite some relative stability in gas and electricity prices. The PBOC set the daily yuan fix at a stronger-than-expected level for the fifth day running, leaning against the pace of depreciation in the CNY. The PBOC’s action helped stabilise USD/CNY during the Asian session, although it now remains within sight of the psychologically important 7.0 level, at just above 6.90. The AUD and NZD meanwhile have come under downward pressure amidst the broad-based strength in the USD and the news that Chengdu would be locked down. AUD has broken below the 0.68 mark (-1.0% to 0.6789) and the NZD broken below 0.61 (-0.8% to 0.6079).

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.